Bitcoin was rejected because it approached the excessive space round its present ranges. The primary crypto by market cap may return to earlier lows because it continues to commerce in a good vary.

Associated Studying | Bitcoin Retail Reaches Second-Highest Shopping for Charge In Historical past. Good Or Unhealthy?

The beginning of the Bitcoin Miami Convention 2022 may present the bulls with some assist. The occasion is normally full of optimistic bulletins with a direct affect on BTC’s worth.

Nonetheless, the macro-factors stopping Bitcoin and different risk-on belongings to reached new highs appear to be re-gaining relevance. The U.S. Federal Reserve (FED) started its tapering course of inside expectations however may flip extra aggressive as inflation persist.

On the time of writing, Bitcoin trades at $43,900 with a 5% loss within the final 24-hours and 7-days.

Within the quick time period, Bitcoin should maintain above $44,000 within the every day to stop additional losses. Information from Materials Indicators information little assist for BTC’s worth till round $42,000. Due to this fact, any short-term promoting stress may take BTC to revisit the low of its present ranges.

In the long run, Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone stated the benchmark crypto flashed a shopping for sign in its BI pattern sign. Used to measure momentum available in the market, the analyst stated that is the primary time since late 2021 that BTC turns bullish.

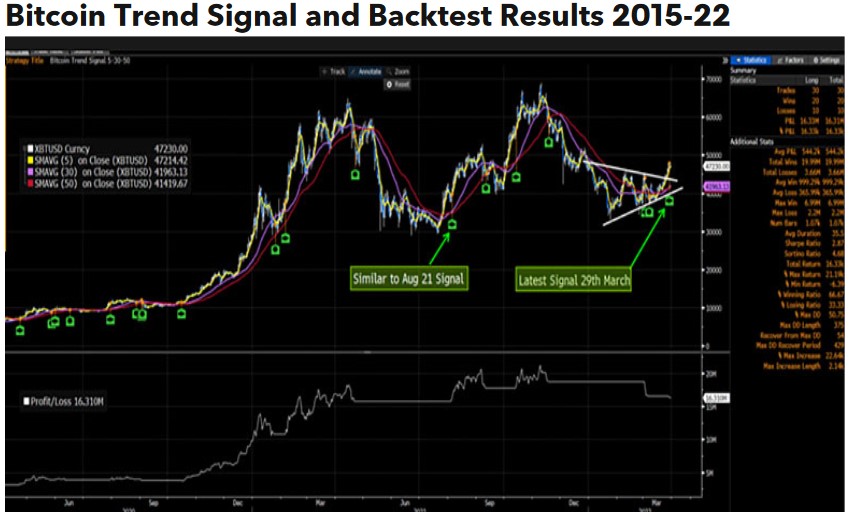

As seen under, the sign has proceeded with main rallies over the previous 7 years. McGlone added the next on the potential for BTC to reclaim greater ranges:

Previously seven years there have been 30 indicators, with a comparatively excessive 66% of them notionally worthwhile. Although macro elements stay unfavorable, and the broader sample continues to be a wide variety of $30,000-$70,000, the present rally might have legs just like the sign of August 2021, which preceded a rally of 65%.

A Robust Greenback May Play In opposition to Bitcoin

The rally within the U.S. greenback appears to be fueling the present draw back worth motion. Most likely associated to the battle between Russia and Ukraine and rising inflation in the US.

As seen under, the U.S. greenback has been on an uptrend for nearly a 12 months. In Might 2021, the forex touched its yearly low close to the 89 marked and has been signaling extra appreciation as uncertainty in international markets will increase and traders look to guard their wealth.

FTX Entry believes the crypto market faces a short-term hurdle with the upcoming FED Federal Open Market Committee (FOMC) assembly. As talked about, the monetary establishment may flip extra hawkish growing their rates of interest from 25bps to 50bps.

Associated Studying | Will Crypto Hit a Ceiling? Crypto Corporations Intention to Stop It

FTX Entry really helpful merchants to observe the FED steadiness sheet. This might present extra clues into the establishment’s strategy to the inflation subject and the aggressiveness of their financial coverage. FTX Entry stated:

It’s potential that this assembly was too quickly to get a QT plan agreed, however given how far they’re falling behind inflation it appears fairly possible that we do FOMC officers have guided us that the steadiness sheet unwind will probably be quicker than final time (which began at $10b/month).