Mining

The speedy progress of the Bitcoin mining business in Kazakhstan led to unexpected penalties that strained the nation’s power infrastructure. Miners have wanted assist discovering a stability with the native rules.

Kazakhstan’s speedy ascent within the international Bitcoin mining business was fueled by its plentiful power sources and favorable regulatory setting. The nation shortly rose to turn into the second-largest producer of Bitcoin on this planet in 2021, trailing solely China.

Nonetheless, this speedy progress additionally led to some surprising penalties. The nation’s power infrastructure wanted to be geared up to deal with the huge surge in demand from Bitcoin miners. Consequently, the nation started to expertise frequent energy outages and electrical energy rationing. The state of affairs reached a vital level in early 2022 when the Kazakh authorities imposed a nationwide energy rationing program. The federal government stated the measure was obligatory to forestall the nation’s power infrastructure from collapsing.

Bitcoin Mining in Kazakhstan

Bitcoin mining is an energy-intensive course of that requires huge quantities of electrical energy to energy the computer systems that carry out advanced calculations to generate new bitcoins. In Kazakhstan, Bitcoin miners have been drawn to the nation’s plentiful pure sources, together with coal and pure fuel, which might be used to generate low cost electrical energy.

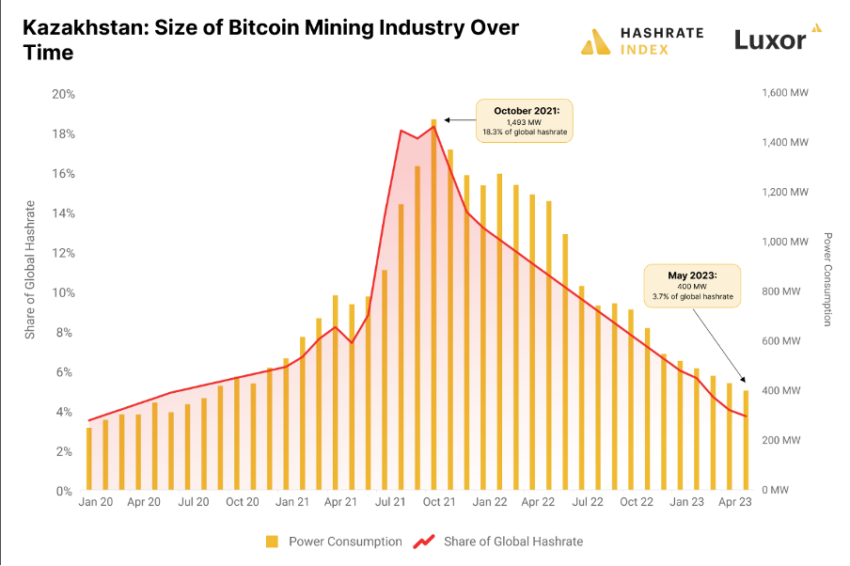

In reality, simply in 2021, Bitcoin mining capability exploded from 500 MW in January to a peak of 1,500 MW in October. Its share of the worldwide hashrate surged from 6% to 18%. “Kazakhstan had all of a sudden turn into a Bitcoin mining superpower,” a Could 2 report from Hashrate Index added.

Highs and Lows of Bitcoin mining capability in Kazakhstan. Supply: Hashrate Index

Nonetheless, the sudden inflow of Bitcoin mining operations strained the nation’s power grid. Many operations have been positioned in distant areas not related to the first energy grid. These operations relied on their mills to energy their mining rigs, which positioned much more pressure on the nation’s power sources.

Consequently, the nation’s share of the worldwide hashrate plummeted from a peak of 18% in October 2021 to solely 4% in Could 2023. In the meantime, the mining capability stood at 400MW, depicting a 73.33% drop, as proven within the graph above.

The federal government tried assuaging the power grid’s pressure by taxing Bitcoin mining operations. Nonetheless, this transfer met with resistance from the business, which argued that the tax would make it troublesome for them to compete with different international locations.

Understanding the Rise

Kazakhstan’s booming Bitcoin mining business in 2020-2021 was fueled by a number of elements that created an ideal storm for the business to thrive.

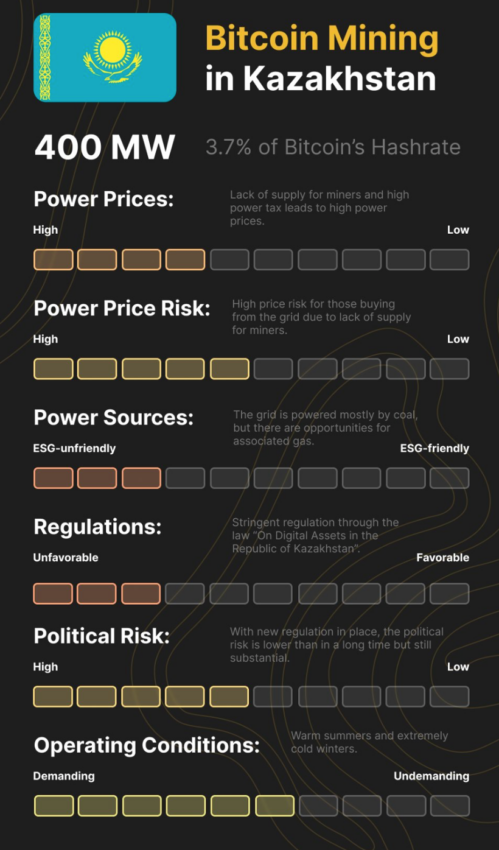

Kazakhstan was one of many main nations for Bitcoin mining. Supply: Hashrate Index

Firstly, Kazakhstan has plentiful pure sources, together with coal and pure fuel, which can be utilized to generate low cost electrical energy. This was a serious draw for miners, as mining Bitcoin is an energy-intensive course of that requires huge quantities of electrical energy.

Notably, the Kazakh authorities caps electrical energy costs at between $0.02 and $0.03 per kWh. These worth caps gave Kazakh miners entry to globally aggressive electrical energy costs.

Secondly, there was an enormous demand for internet hosting companies from Bitcoin mining firms because the business grew globally. Kazakhstan had a good geographic location, with its proximity to China and Europe making it a gorgeous website for internet hosting. Subsequently, the area witnessed an enormous capital influx from Western miners. Primarily on the lookout for fast and low cost machine deployments throughout a bull market.

China Ban Performs a Half

Thirdly, entry to low cost Chinese language mining machines additionally performed a job within the progress of the business in Kazakhstan. China has been a dominant participant within the international Bitcoin mining business.

Nonetheless, the ban ended such operations as miners’ exodus started to different areas. Lots of the machines utilized in Kazakhstan have been imported from China at a decrease price than different international locations. As well as, unable to promote to the Chinese language market anymore, the massive rig producers, significantly Canaan, began focusing on the Kazakh market extra aggressively.

Fourthly, Kazakhstan had a comparatively unfastened regulatory setting and tax breaks for the business, which made it a gorgeous location for Bitcoin miners. The federal government was eager to draw funding and create new jobs, and the bitcoin mining business was seen as a option to obtain these objectives.

These elements mixed create the right breeding floor for the business. Nonetheless, the business’s speedy progress additionally led to unexpected penalties.

From Highs to Large Lows

The state of affairs in Kazakhstan highlights the challenges that come up when a rustic turns into too depending on a single business. On this case, the speedy progress of the Bitcoin mining business led to an over-reliance on power sources and a failure to adequately spend money on the nation’s power infrastructure.

Consequently, Kazakhstan’s Soviet-era electrical energy system had difficulties accommodating the sudden 1.5 GW demand progress from miners. As a result of sheer load, southern elements of the area suffered blackouts.

Moreover, regulatory tussles with the federal government led to hiccups within the operation. Kazakh grid operator KEGOC began reducing the availability of electrical energy to Bitcoin miners within the southern a part of the nation. Issues went from dangerous to worse amid the ability rationing program imposed by the federal government. This had a big impact on the mining business. Many operations have been pressured to close down or scale back their output. All of it led to a drop within the nation’s international rating for Bitcoin manufacturing.

Furthermore, the federal government carried out a algorithm and rules to centralize or management the operations. In 2019, the federal government introduced that Bitcoin miners can be topic to a tax on their earnings, calculated primarily based on the quantity of electrical energy used to mine bitcoin.

Lately, the federal government introduced plans to introduce new crypto rules to curb tax fraud and illegal enterprise operations. Kazakh President Kassym-Jomart Tokayev signed into legislation a draft invoice that permits miners to faucet into the nationwide grid solely when there’s a surplus. The nation will distribute this surplus primarily based on a bidding course of, however solely to licensed miners. This legislation got here into impact on April 1, 2023.

The place Do Issues Stand?

To cut back the potential for tax evasion, crypto miners in Kazakhstan will likely be pressured to promote no less than 75% of their income by way of registered crypto exchanges. This rule, which goals to gather “data on the revenue of digital miners and digital mining swimming pools for tax functions,” will likely be efficient from January 1, 2024, to January 1, 2025.

The Kazakh Bitcoin mining business is at a crossroads following the most recent regulation. Both the legislation will present the secure regulatory setting wanted for the business to develop sustainably, or its stringent guidelines will euthanize what’s left of the business.

Bitcoin mining ongoing state of affairs. Supply: Twitter

What is for certain is that Kazakhstan has an influence scarcity that should be solved earlier than the nation’s Bitcoin mining business can return to its former gigawatt glory.

Jaran Mellerud, a number one researcher at Hashrate Index, opines:

“The one approach I see the Bitcoin mining business in Kazakhstan considerably rising within the coming years is that if miners develop their very own technology capability. This may be from varied sources, however the largest potential is in related fuel, wind, and photo voltaic.”

Takeaways

The expertise of Kazakhstan ought to function a cautionary story for different international locations contemplating getting into the Bitcoin mining business. Whereas the potential rewards may be nice, extreme dangers are additionally concerned. Governments should weigh the advantages and dangers of permitting Bitcoin mining of their international locations and guarantee they’ve the infrastructure to deal with the business’s calls for.

Along with the nation’s power grid pressure, Bitcoin mining has environmental implications. The method of producing new bitcoins requires huge quantities of power, which contributes to local weather change. This has led some international locations, corresponding to China, to crack down on Bitcoin mining operations to scale back their carbon footprint.

In response to the ability rationing program in Kazakhstan, some Bitcoin mining operations have began to discover various power sources. For instance, some mining operations use solar energy to generate electrical energy. Nonetheless, this shift to renewable power sources remains to be in its early phases and isn’t widespread.