Blockchain

An Overview of Layer 2 Roll-ups

Over the previous few years, Layer 2 (L2) rollup options have come to the forefront as exercise on the Ethereum community has grown. Exercise and engagement with non-fungible tokens (NFTs) and Decentralized Finance (DeFi) has brought about a surge in Layer 1 (L1) blockchain exercise.

In flip, the demand for blockspace, represented by fuel prices, has elevated. And the time for transaction finality has risen as a result of elevated community load.

While the Ethereum Merge set the groundwork for future fuel payment optimisations; it didn’t straight scale back transaction fuel charges.

Within the yr between the summer time of 2020 and the height demand in the summertime of 2021 fuel price in Gwei on the Ethereum community elevated by as much as 1300%. The necessity to make transactions quick and inexpensive spurred the creation of two major types of rollup: Optimistic and Zero-Information (ZK).

Rollups assist take away the computational calls for on the Ethereum community by transferring transaction processing off-chain, changing them right into a single piece of knowledge after which submitting again on Ethereum as a batch to scale back the related price and time.

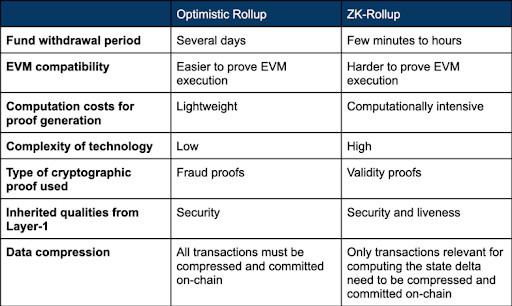

The large distinction between the 2 is that Optimistic roll-ups utilise fraud proofs, whereas ZK-rollups depend on zero-knowledge proofs to confirm adjustments to the primary chain.

Optimistic and ZK-rollups: Fraud Proofs vs Validity Proofs

Fraud proofs bundle transactions off-chain after which repost them to the L1. After a bundle has been submitted on the L1 there’s a problem interval, throughout which anybody can problem the results of the rollup by computing a fraud proof.

Equally, zero-knowledge proofs batch transactions off-chain and submit them as a single transaction. The place they differ is somewhat than assuming the transactions are right initially, they use a validity proof to immediately show whether or not the transactions are legitimate. As soon as the transactions have been confirmed as legitimate they’re then submitted to the L1.

That is how they derive their respective names – fraud proofs are the place the transactions are checked retrospectively to see if there are any fraudulent transactions, whereas validity proofs are accomplished earlier than the transactions are submitted to the L1.

While there are outstanding initiatives for each, they every include their very own respective advantages and downsides. Optimistic roll-ups have the benefit that fraud proofs are solely required when there is a matter.

This implies they require much less computational sources and are in a position to scale effectively. The difficulty lies with the problem interval. An extended problem interval will increase the probability that any fraudulent transactions are recognized, nevertheless it additionally implies that customers have to attend longer to withdraw their funds.

For main optimistic rollup options, reminiscent of Arbitrum and Optimism, this ready interval can last as long as every week. Alternatively, ZK-rollups have the benefit of at all times reflecting an accurate L2 state. Their disadvantage is that proofs are required for all state transitions, somewhat than solely when they’re contested, which limits scalability. That is additional compounded by the complicated nature and early stage of the know-how.

Regardless of their respective challenges, ZK-rollups are being heralded as the longer term for roll-ups. That is primarily as a result of computerized era of validity proofs rising the safety of the protocol, the considerably decreased time to withdraw because of there being no problem interval, and that ZK-rollups boast higher information compression.

For these causes we are going to hone in on the present state of the ZK-rollup area, the newest improvements and what lies forward sooner or later.

The ZK-Rollup House

As we’ve mentioned, ZK-rollups are predominantly in the focus with gamers like zkSync, Starknet, Polygon zkEVM, and Scroll all elevating giant quantities of capital to develop their options regardless of solely StarkNet having launched on mainnet ($780MM in complete).

Every of those initiatives have taken their very own angle, differing primarily throughout their rollups information availability technique and their proving algorithm. The information availability technique determines the place the state information of a roll-up is saved, on-chain storage has elevated safety however it makes use of up block area on the Ethereum community which reduces transaction throughput.

The proving algorithm is the technique of producing a validity proof, which may both be STARK or SNARK.

Each of those algorithms assist builders to relocate computation and storage off-chain, in flip rising scalability. They’re additionally in a position to confirm whether or not a consumer has adequate funds and the proper personal key with out having to entry the data itself, thus enhancing the safety.

You may learn extra concerning the technical variations right here. STARKs have the benefit of providing extra scalability, safety and transparency in comparison with SNARKs.

However the disadvantage STARKS have is a bigger proof dimension, which takes longer to confirm, and that SNARKs comparatively solely use 24% of the fuel. Therein for each SNARKS and STARKS we now have the tradeoff between velocity and value vs. scalability, safety and transparency.

While many various strategies are being explored there’s not but a definitive reply as to one of the best ways to arrange a ZK-rollup. Every configuration brings respective advantages and lots of builders are nonetheless exploring the optimum selection or mixture for his or her rollup designs.

The Hurdles To Overcome

As we’ve mentioned, ZK-rollups are nonetheless in growth and there are numerous challenges that should be overcome earlier than blockchain customers are in a position to reap their full advantages.

Language compatibility is one such problem; translating EVM-friendly programming languages, reminiscent of Solidity, right into a custom-built language particularly optimised for ZKP can assist increase their effectivity, however it brings with it adoption challenges for builders.

For instance, StarkNet is trying to resolve this with Warp, a Solidity to Cairo (the language of StarkNet’s ZKP) language compiler that appears to mechanically convert Solidity into Cairo. Utilizing Warp removes the necessity for builders to rewrite their code in Cairo, making it a a lot smoother course of.

Different challenges embrace the secretive nature of initiatives, with many going towards the open supply ethos of crypto because of issues over first-mover benefit and capturing a sticky userbase. Most ZK-rollups had been first launched this yr, highlighting the quantity of labor that’s but to be completed within the area.

Lastly, while rollups (each optimistic and zero-knowledge) have the advantages of improved velocity and value, it tends to be on the expense of decentralisation.

That is as a result of inherent want for sequencers, the actors batching transactions and committing proofs to the L1.

All rollups at present want a centralised sequencer and use upgradeable sensible contracts which are managed by a single entity. As a result of the area remains to be so early, a central point of interest is usually required for fast fixes to bugs within the code. Add to that the initiatives aren’t open sourced, creating one other hurdle for neighborhood members to behave as sequencers.

Many initiatives have indicated that they plan to decentralize their sequencer features sooner or later, however it will undoubtedly take further sources and time.

Decentralization Plans

Launching a token and open-sourcing code would be the subsequent steps for lots of the initiatives searching for decentralisation. Tokenisation of those providers to generate exercise and decentralise the product is one other space the place we count on to see a myriad of various options cropping up as initiatives look to create essentially the most scalable, decentralised and lively L2 in the marketplace.

StarkWare and zkSync are each planning to launch a token and Polygon may probably use MATIC to assist Polygon’s zkEVM initiative. Token engineering on ZK-rollups is an much more nascent area than the optimistic rollup know-how and discovering an efficient and sustainable mannequin can differentiate and increase adoption.

The Future

zkEVMs are nonetheless of their very early levels and the race is on to launch on mainnet. StarkNet has the primary mover benefit however nonetheless has challenges on the subject of supporting Solidity options because of the usage of Cairo, leaving room for rivals to make enhancements.

The initiatives which are in a position to amass vital consumer bases will appeal to dapp builders, in flip bringing extra dApps to their platform and rising the characteristic set. ConsenSys’ zkEVM is at present transferring to testnet and are focussing particularly on dapp builders because of this, leveraging instruments like MetaMask, Infura and Truffle in order that they will deploy and handle functions as in the event that they had been straight utilizing Ethereum.

And while we now have mentioned the present gamers within the zkEVM market, different predominant rollup options like Polygon, Optimism and Arbitrum nonetheless command a big market share.

As zkEVM options mature, we might even see these initiatives look to transition to validity proofs or hybrid options, leveraging their present consumer bases to draw dapp growth and preserve their market dominance. In the long run, the numerous rollup options (and the elevated competitors between them) will proceed to enhance the web3 consumer expertise and introduce platforms for functions to onboard the subsequent era of customers.

Given these threats, we’re not stunned on the secrecy of initiatives within the area, however we imagine the true winner will be capable of leverage the effectivity of ZK-rollups and mix it with a seamless developer and consumer expertise to return out on prime.