A couple of years in the past, many publicly traded firms considerably remodeled their enterprise to capitalize on the rising recognition of cryptocurrency mining. Now, because the profitability of those operations turns into decidedly smaller, they’re in search of alternate options and transferring in the direction of a brand new increase. Because of this, extra miners are starting to supply entry to substantial computing energy from their information facilities to firms within the quickly rising synthetic intelligence (AI) sector.

In accordance with the most recent report by JPMorgan printed final week, the biggest mining firms are now not proscribing themselves to mining Bitcoin (BTC) and different cryptocurrencies. Moreover, they provide high-performance computing (HPC) providers within the AI business. This business is growing dynamically and has an rising demand for computing energy.

Common manufacturers within the Bitcoin mining business, equivalent to Riot Blockchain (RIOT) and Hive Blockchain Applied sciences (HIVE), have even modified their names to emphasise the diversification of their enterprise. RIOT is now Riot Platform, and HIVE is Hive Digital Applied sciences. Cryptocurrencies mined and held as reserves have served them in current quarters to hold out new investments and adapt to a market more and more pushed by the AI craze.

Ethereum (ETH) miners who used graphics processing models (GPUs) to mine this cryptocurrency will even profit. These rigs turned ineffective after the Ethereum community replace and the shift from the energy-consuming mining mannequin to the staking mannequin. Nonetheless, now they might discover a second life.

“With the speedy progress of AI, the elevated demand for high-performance computing is now opening a brand new and maybe extra worthwhile avenue for using GPUs beforehand used for ether mining,” JPMorgan commented within the analysis.

In June, one other digital asset miner, Iris Vitality, introduced plans to maneuver in the direction of AI. The shift to AI looks like a pure evolution, particularly after a weak 2022. Final 12 months, the worldwide mining business generated $6 billion much less income than within the record-setting 2021.

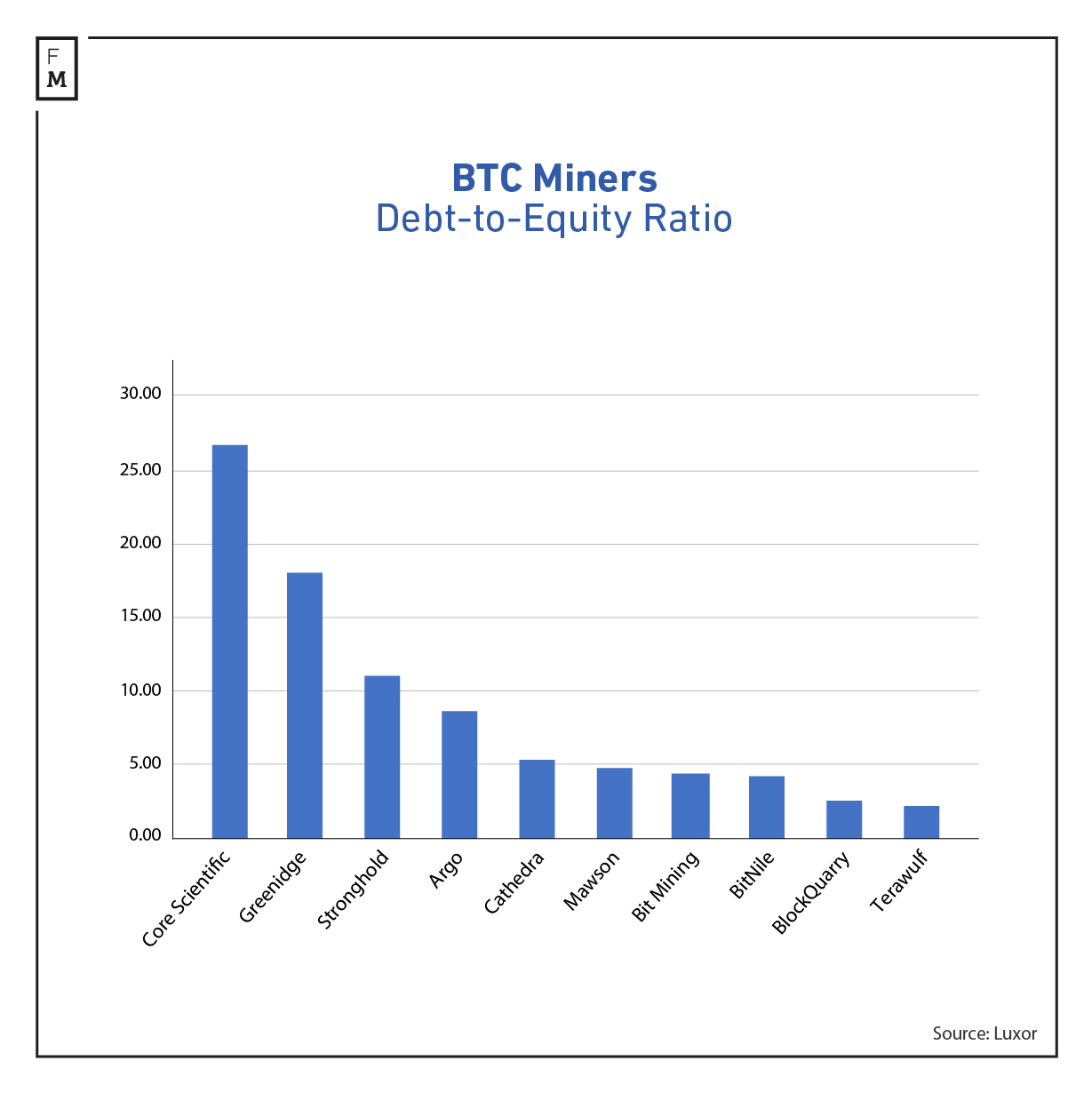

BTC Miners Dept-to-Fairness Rartio

HPC Extra Worthwhile than Crypto Mining

Considerably, the JPMorgan report means that if the outcomes from the beta exams are confirmed in actuality on a bigger scale, offering HPC providers to the AI business might be far more worthwhile than mining Bitcoins.

“If the profitability reported in beta exams is ready to be repeated on a big scale, it would overshadow the revenues coming from Bitcoin mining in the intervening time,” the report added.

Miners are more and more switching from Bitcoin to HPC and altering areas for service provision. Russia is turning into more and more in style, having important vitality surpluses since its aggression in the direction of Ukraine started. At the moment, the Russian Federation presents among the least expensive vitality for firms within the digital asset mining sector.

For publicly listed mining firms, it may be an opportunity to enhance outcomes, which haven’t been optimistic not too long ago. Riot Platforms Inc. and Galaxy Digital Holdings Ltd. reported destructive monetary outcomes for the final quarter. Furthermore, the mining firms’ shares have misplaced closely from their 2021 peaks by means of low Bitcoin costs and a rising variety of hacks.