Bitcoin mining shares actually gained prominence in 2021. As a result of improve within the value of the digital asset, mining profitability shot up, and traders used this as a option to acquire publicity to the market. Because the market has retraced, although, the mining shares have struggled. Nonetheless, they proceed to be in operation, and information exhibits that a few of these bitcoin mining shares stay largely undervalued.

The Most Undervalued Firms

Some bitcoin mining firms haven’t been within the public eye in comparison with others. Primarily, these have been within the shadows on account of not having as excessive a valuation as others and their shares not performing fairly as effectively, however this doesn’t imply that these firms will not be good in any method.

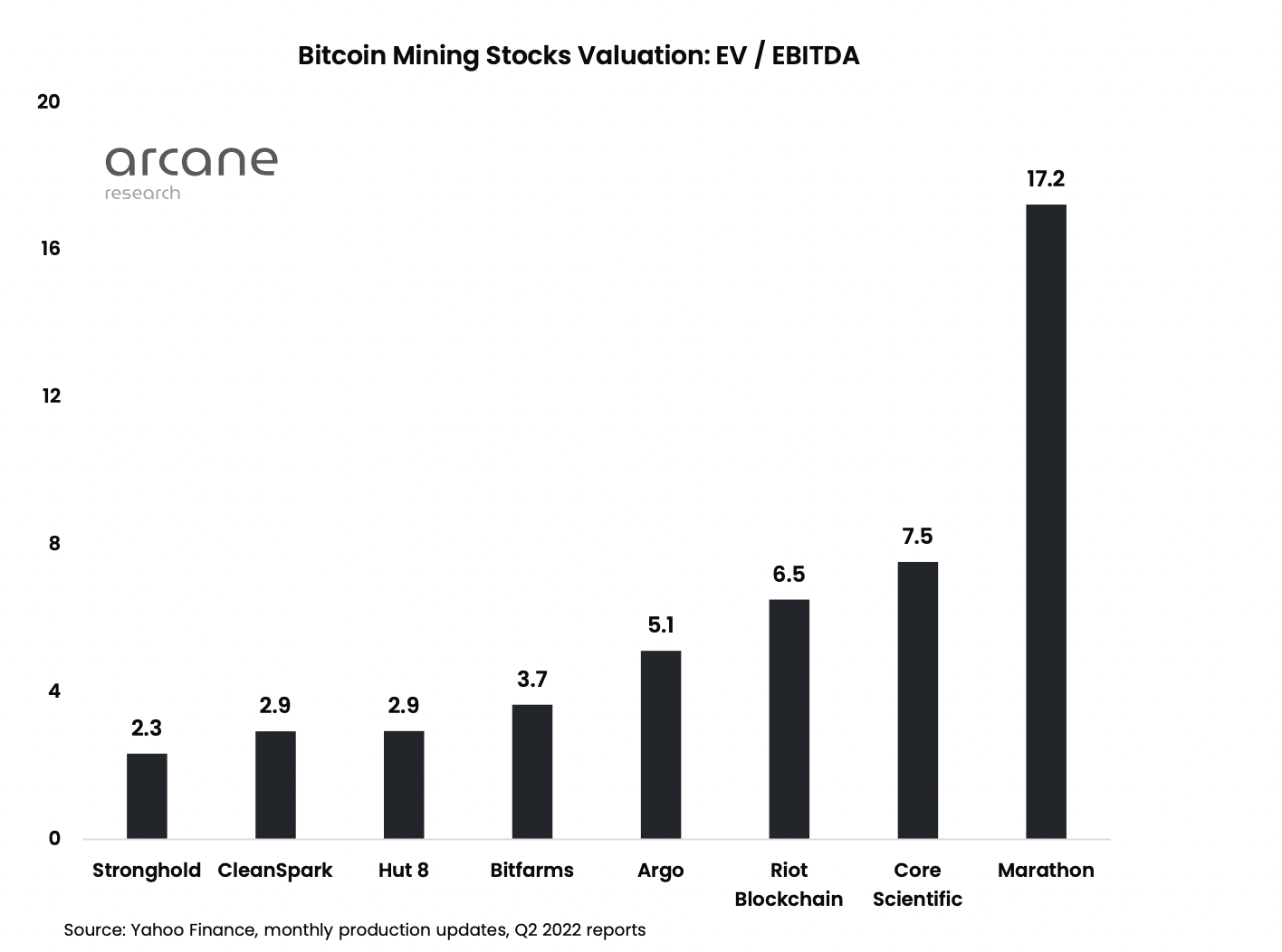

An instance of an organization like this has been Stronghold. The bitcoin mining firm has been working within the shadows whereas its valuation stays undervalued. Utilizing the EV/EBITDA metric versus the EV/ASIC worth, Stronghold exhibits one of the vital promise by way of its undervaluation.

You will need to be aware that firms who rating lower than 10 on the EV/EBITDA metric are thought of to be undervalued, and Stronghold has one of many lowest of all bitcoin mining firms with a rating of two.3. One other is CleanSpark which is sitting at 2.9, in addition to Hut 8 with a rating of two.9. These firms have the bottom valuations despite the fact that they maintain lots of promise.

Mining shares largely undervalued | Supply: Arcane Analysis

Bitfarms can be in the identical class with a rating of three.7. These mining firms are a mark for greater returns. Nonetheless, it also needs to be famous that these firms additionally produce other issues weighing them down, resembling debt, which will increase their probabilities of going bankrupt.

Bitcoin Miners With Increased Valuations

Not all bitcoin miners have been undervalued in these instances. Some have acquired excessive valuations even via the bear market. The most important bitcoin minger in keeping with valuation is Marathon Digital which has acquired a 17.2 EV/EBITDA rating. Because of this the corporate is working at a traditional valuation and has extra probabilities of sustaining a extra secure worth over time.

BTC recovers above $21,000 | Supply: BTCUSD on TradingView.com

Others have additionally acquired a excessive valuation however haven’t crossed the ten mark but. Core Scientific has acquired the second-highest rating after Marathon Digital. The general public miner is at the moment sitting at a rating of seven.5 on the EV/EBITDA scale, making it barely undervalued.

Subsequent is Riot Blockchain, with a rating of 6.5, with Argo following proper behind with a rating of 5.1. Nonetheless, one factor that separates these two has been the standard of the businesses, making a play on such undervalued firms fairly helpful over time.

Featured picture from GoBanking Charges, charts from Arcane Analysis and TradingView.com