After extreme growth and bust phases, how can we gauge the significance of blockchain-based belongings? Will they interface with each day life or stay on the margins of regulatory containment?

Above all else, one should discover that digital belongings symbolize the subsequent evolutionary step led to by the web. The World Broad Net decentralized info sharing, rendering gatekeepers into redundant friction factors.

By the identical token, blockchain know-how decentralized monetary belongings or is within the strategy of doing so.

Potential of Blockchain and Digital Belongings

From time immemorial, the core downside of finance centered round strategies to maintain an account of wealth. Both governments or banks have been answerable for sustaining the file of who owns what belongings and who transfers these belongings to whom.

This system grew to become entrenched within the absence of alternate options, being profitable the topic of manipulation, eroding the potential to save lots of, and forcing customers to search for various mechanisms to save lots of their buying energy. Considered one of these corrosive manifestations is setting the inflation goal at 2% with out being able to clarify the reasoning behind it coherently.

Wow. This clip is superb.

Powell is requested “why is 2% the inflation goal?”

His reply sounds prefer it was written by Kamala Harris.

— Chris Blec (@ChrisBlec) August 10, 2023

Bitcoin broke via this historic barrier as a product of a publicly distributed ledger – blockchain. The mix of a distributed ledger and a peer-to-peer verification/mining community made Bitcoin the vanguard of a very decentralized, permissionless monetary system.

All the pieces else that adopted was constructed on this idea. On the core, BTC token is a great contract, interfacing with different good contracts, their authenticity secured by the blockchain community. In flip, any present logic might be tokenized and secured on different blockchains utilizing related authentication methods:

- Lending and borrowing: Aave, Compound Finance, Maker, Solend

- Asset change: Uniswap, Sushiswap, Curve, dYdX

- Play-to-earn gaming: Axie Infinity, Splinterlands, Gods Unchained

- Non-fungible tokens (NFTs): from artworks, actual property and audio albums to ebooks

- Micro-insurance merchandise to the unbanked: Nexus Mutual, Solace, InsurAce

The frequent theme is that blockchain permits the expression of wealth in tokenized type to be accessed permissionlessly with out third-party interception. Alongside the inventory market, a permissionless crypto market emerged, with all its advantages and flaws. Within the transition between TradFi and DeFi, stablecoins have proved particularly in style.

Anchored to fiat forex worth, these tokens are poised to develop into a significant demand supply for US treasuries – monetized authorities debt. Already, the most important stablecoins, USD Coin (USDC) and Tether (USDT), again their tokens with billions in short-dated US treasuries. The most recent stablecoin newcomer, PayPal USD (PYUSD), does the identical.

The worth of tokenized wealth then turns into an extension of the present central banking system, as famous by Federal Reserve Chair Jerome Powell in June 2023:

“We do see cost stablecoins as a type of cash, and in all superior economies, the last word supply of credibility in cash is the central financial institution.”

Likewise, the testomony to the facility of good contracts is expressed via upcoming central financial institution digital currencies (CBDCs). The query just isn’t whether or not the blockchain revolution will fizzle out however what type it would take.

Because the discourse across the future trajectory of digital belongings deepens, many merchants discover it crucial to handle day buying and selling alongside full-time commitments to remain forward, highlighting the fast evolution and depth of right now’s monetary panorama.

Will decentralized and permissionless digital belongings be suppressed in favor of centralized and permissioned digital belongings? Will the casual taxation via inflation proceed unimpeded? Will good contracts in CBDC type transmogrify past mere cost instruments into one thing else?

That is the present powerplay panorama of world finance. Making the banking system redundant, each central and industrial, can’t go with out friction. The current Securities and Change Fee (SEC) Chair Gary Gensler finest exemplifies that friction.

SEC Chairman Gary Gensler’s Strategy

Following the blockchain (r)evolution, two varieties of frictions emerged:

- Digital asset flood

- TradFi counter-reaction

One friction rubbed towards the opposite, or extra exactly, fed into the opposite.

When one thing is of a digital nature, permissionless besides, it turns into easy to repeat. However that copying typically got here with a misleading, scammy tweak. Within the fog of 1000’s of altcoins and relentless crypto scams/exploits that adopted, a justified narrative emerged:

“This asset class is rife with fraud, scams and abuse in sure functions. We’d like extra congressional authorities to stop transactions, merchandise and platforms from falling between regulatory cracks.” – Gary Gensler, SEC Chair, in August 2021

Having been on the job for 3 months, this set the stage for DeFi’s interface with TradFi. On the Aspen Safety Discussion board that month, Gensler laid the groundwork for counteracting the brand new digital asset class. Apparently, he opened his speech by recognizing Satoshi Nakamoto’s historic contribution:

“However Nakamoto had solved two riddles that had dogged these cryptographers and different know-how specialists for a few a long time for the reason that daybreak of the web. First was methods to transfer one thing of worth on the web with out a central middleman…

…And transfer one thing of worth on the web with out a central middleman and relatedly, methods to stop what’s referred to as double spending of that precious digital token.”

But, to put the rising tokenization sector beneath the federal fold, Gensler framed it as a risk to nationwide safety. One which entails “cash laundering, tax compliance, sanction”. Gensler’s answer was to train the Funding Firm Act to designate almost all cryptocurrencies as securities retroactively.

“Properly, it’s principally an anticipation of earnings on the efforts of the sponsor or others and so forth. And that’s… It is determined by the info and circumstance, however that’s the story of plenty of these circumstances.”

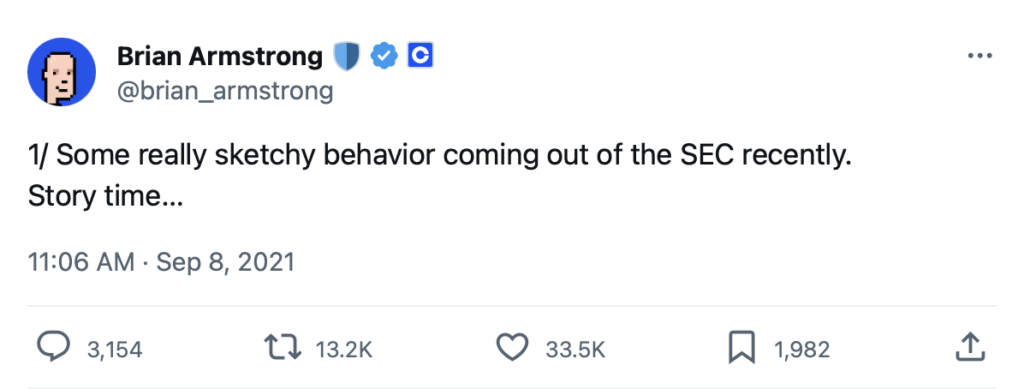

With none crypto laws, the SEC dominated by enforcement on that foundation. Gensler’s framework kicked off with Coinbase. A month after the Aspen speech, Coinbase CEO Brian Armstrong publicly put into query SEC conduct.

The gist is that the SEC’s mission to guard traders, beneath heightened transparency, became obfuscation and selective concentrating on to set pseudo-crypto legislation.

Authorized Pushback and Congress’ Function

The digital asset house underwent main contraction inside two years following Gensler’s pivotal Aspen be aware. The SEC sanctioned a number of crypto exchanges and digital asset protocols as unregistered securities brokers and clearing homes.

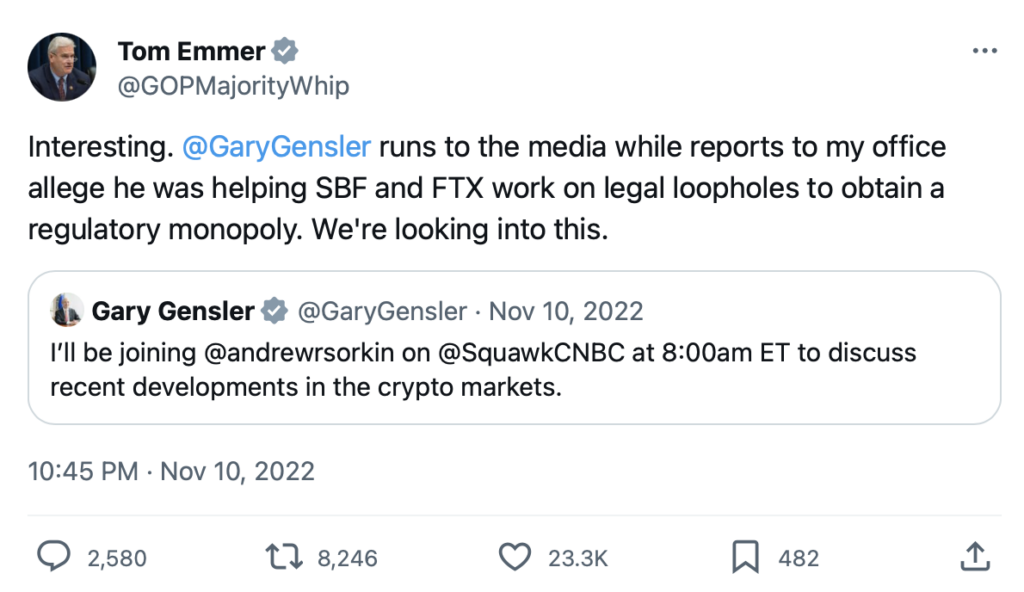

Throughout the interval, the SEC’s investor safety mission failed spectacularly, as evidenced by the multi-billion losses of funds in FTX and Celcius, to call a couple of. Some lawmakers had noticed this sample, referring to Gary Gensler, SEC Chair:

“This man in my thoughts, is a bad-faith regulator. He’s been blindly spraying the crypto group with enforcement actions whereas fully lacking the actually unhealthy actors.” – Congressman Tom Emmer, Home Majority Whip

Quickly after, along with Warren Davidson, Emmer launched the “SEC Stabilization Act” to be able to take away Gary Gensler following his “lengthy sequence of abuses”. Along with displacing Gensler, the act would restrict commissioners to solely three seats per political social gathering at any given time. Purportedly, this might stop the infusion of political agendas into SEC’s operations.

Within the meantime, because the SEC crammed the legislative void, the watchdog company suffered severe authorized pushback. The most recent authorized defeat comes from the federal choose denying SEC’s attraction within the landmark Ripple Labs case that affirmed XRP as not a security.

If the case had gone into the opposite course, the SEC would’ve drastically expanded its leeway to curtail the digital asset class. Furthermore, the company misplaced the case towards Grayscale Investments relating to the refusal to convert Grayscale Bitcoin Belief (GBTC) into an ETF.

The SEC’s refusal to approve a single Bitcoin ETF has been one other sign of bad-faith performing. It has been speculated that legitimizing Bitcoin on this method would open capital floodgates an excessive amount of earlier than the digital class area is beneath firmer federal oversight.

One other such sign got here from the historic FTX crypto fraud involving Sam Bankman-Fried (SBF). The incarcerated ex CEO met with Gensler on a number of events, but failed to note any purple flags. Congressman Tom Emmer recommended that this may occasionally have been a ploy to put FTX because the designated dominant market maker within the crypto house.

The connection there’s circumstantial in the interim, primarily based on Gary Gensler serving as MIT lecturer beneath the division of Glenn Ellison. He’s the daddy of Caroline Ellison, SBF’s ex associate and Alameda Analysis CEO.

Alameda served as a slush fund for FTX to funnel buyer belongings. Caroline Ellison had pleaded responsible to seven counts of fraud in December 2022. It’s speculated that her cooperation will safe SBF’s conviction within the upcoming trial.

The Bipartisan Consensus Nonetheless to Materialize

No matter how one perceives SEC’s habits up to now, the company acted with none crypto laws, optimistic or destructive. Due to this fact, to stabilize the crypto market long run with clear guidelines of engagement, bipartisan effort must happen.

This comes from the Bipartisan Blockchain Innovation Mission (BBIP). The non-profit group is co-chaired by Congressman Tom Emmer (R-MN) and Congressman Darren Soto (D-FL).

BBIP goals to each educate lawmakers and to craft a legislative framework that helps the expansion of the blockchain business in america. BBIP’s work has resulted in a number of invoice proposals:

- The Token Taxonomy Act (H.R. 7081)

- The Blockchain Analysis and Growth Act (H.R. 5437)

- The Blockchain Regulatory Certainty Act (H.R. 4337)

- The Digital Asset Regulatory Transparency Act (H.R. 4214)

- The Monetary CHOICE Act (H.R. 10)

Nonetheless, as not one of the payments have handed as legal guidelines, it’s unclear if training is the deciding think about crypto laws, or is it a matter of timing and politics.

Penalties of Over-Regulation

It’s secure to say that US lawmakers have been dragging their ft on the subject of setting the foundations for the digital asset ecosystem. Because the SEC took the steering wheel, long-standing FinTech hubs, from Singapore and Hong Kong to Abu Dhabi, have taken benefit of this.

That is finest exemplified with the US-based stablecoin (USDC) issuer Circle. After the SEC charged Binance for a number of violations in June, together with for buying and selling Binance USD (BUSD) stablecoin, Circle CEO Jeremy Allaire argued that stablecoins needs to be exempt from “almost every little thing is a safety” SEC onslaught:

“The SEC’s declare that Binance supplied and bought its competing stablecoin as an unregistered safety raises severe authorized questions affecting digital forex and the U.S. financial system extra broadly.” – Circle’s amicus temporary to the SEC

As tokenized {dollars}, stablecoins are the preferred digital asset for each day world transactions. But, the off-shore Tether issuer of USDT enjoys the most important capitalization at $83.4 billion, out of which $72.5 billion is backed by US treasuries. That is greater than total nations maintain, from Mexico and Australia to Spain and UAE.

For comparability, the US-based Circle stablecoin issuer of USDC has a modest $25.2 billion market cap.

In different phrases, an offshore firm makes use of the very forex the SEC is not directly defending because the arm of the central banking system. Due to this fact, the SEC created such restrictive situations that going absolutely offshore is a greater guess than having fun with the SEC’s safety of capital markets.

If this continues, the US is poised to oust the digital asset market by way of the lethal combo of legislative inaction and regulatory over-action.

Conclusion

Blockchain hype birthed numerous scams, but the muse stands on agency legs. That is evidenced by blockchain/good contract utility within the central banking system itself – upcoming CBDCs.

As a result of blockchain (r)evolution got here from the personal sector, spearheaded by Bitcoin, it took TradFi off guard. As soon as it grew to become clear that digital belongings are solely poised for development, regulatory mechanisms sprung into motion.

They usually had cause to take action, amid common crypto scams. However there’s little proof for useful regulatory safety to be discovered. If something, regulatory overreach seems to have designated the US market as too burdensome and dangerous, additional pushing digital belongings into the grey zone.

For now, the digital US market is operating on fumes of its depth, however how lengthy can this final till benefit is completely misplaced?