Blockchain

Roger Manuel Benites is a improvement director at The Blockchain Heart, a 503(c) non-profit group specializing within the schooling and adoption of blockchain, cryptocurrency, and digital asset applied sciences.

__________

I returned to Lima (Peru) within the 12 months 2013 once I was launched to Bitcoin by my brotherRoger Gabriel Benites. It was whereas residing in Argentina that Roger Gabriel was first uncovered to a digital forex often called Bitcoin and the inflated premium greenback, “greenback blue”. The Bitcoin forex community, backed by blockchain know-how, empowers the unbanked and the banked alike by liberating them from central banking and unstable nationwide currencies. In 2013, Bitcoin had grown in prominence as Argentina struggled with hyperinflation led to by monetary insurance policies and sophisticated authorities politics. It was clear to my brother and me that Bitcoin had the potential to alleviate lots of the financial points holding again creating economies round Latin America and the globe.

Expertise proved to me that financial improvement was solely doable when folks may belief their financial system and the rule of legislation. It was clear that Bitcoin as a forex and financial community, which was past the attain of difficult politics, may speed up creating economies.

No different group stood to profit extra from entry to the Bitcoin international financial system than the unbanked, who make up a major share of individuals in Latin America.

The one query was how finest to implement a know-how that in 2013 was nonetheless so new and experimental.

The first purpose of this know-how was to cut back the prices and burdens imposed by legacy techniques that management and oversee the remittance funds of the world’s underdeveloped economies. Bitcoin know-how had the potential to maneuver cash seamlessly, rising financial development in each nation that will undertake it and construct on prime of it. By having the technological prowess to switch the present outdated legacy monetary community often called SWIFT, our nations would save the folks of Latin America tens of millions yearly by enabling steady remittance funds and real-time forex exchanges. Remittance firms in Latin America that had been topic to hyperinflated currencies, outdated political techniques, and excessive prices had been ripe for disruption.

US blockchain Analysis and Improvement – The North and South of the Americas

I returned to the US, New York and Connecticut, to proceed my analysis in blockchain know-how in 2016 and was in a position to be a part of varied blockchain good contract pilot initiatives specializing in decentralized finance, actual property, medical, and authorities purposes. My group and I had been in a position to analysis and develop varied blockchain use circumstances and sensible purposes for real-world issues. A lot of this analysis was revealed as a part of a Blockchain schooling guide, titled “Blockchain for Accounting and Enterprise”, written by Saurav Dutta and distributed globally to educational and monetary establishments. In 2018, the chance arose in Miami to create a Bitcoin heart which later developed into The Blockchain Heart. The Blockchain Heart is a non-profit group developed to facilitate the mainstream adoption of blockchain and cryptocurrency know-how by political, monetary, and media influence initiatives at nationwide and worldwide ranges. The Bitcoin heart was based in 2014 by Bitcoin pioneer Nick Spanos below the title “The Bitcoin Heart”, and was featured within the Netflix documentary “Banking on Bitcoin”.

“The Blockchain Heart Miami was created as a way to type an financial and innovation hub in downtown Miami, attracting blockchain and tech firms from New York, San Francisco, and worldwide. We’ve had nice help from the native metropolis workplace because the starting and to today they’ve been a robust advocate of cryptocurrency and blockchain innovation.” – Nick Spanos

The preliminary purpose was for the town of Miami to turn into the “Silicon Valley of Latin America” to extend financial development, expertise improvement, and innovation. As the town continues to push cryptocurrency and blockchain applied sciences in its agenda, Miami is poised to turn into essentially the most disruptive metropolis in the case of decentralized authorities blockchain purposes akin to voting and public asset administration through good contracts. Miami is the middle for Latin America’s imports & exports, mobile/satellite tv for pc communications, and, most significantly, Latin American monetary establishments that maintain a majority of the continent’s wealth.

This positions Miami as the proper impartial zone for all of the international locations in Latin America and the start line for a Latin American union.

From experiencing firsthand the expansion of blockchain know-how supporters, it grew to become clear that Latin People imagine in a union that will flip our creating international locations into flourishing ones. This may be achieved by uniting and leapfrogging over inefficient techniques of presidency and cash.

A extra united Latin America

To raised perceive the present scenario of Latin American continental progress, there are at the moment three organizations which were developed to create a extra united Latin America, the Alianza del Pacifico, Mercado Comun del Sur (Mercosur), and Mercados Integrados Latino Americanos (MILA). These organizations had been designed to converge Latam international locations to supply financial prosperity by enacting monetary and financial insurance policies however are divided as a consequence of international pursuits associated to the US, China, and Russia. The west of Latam is supported by Alianza del Pacifico, whereas the east is supported by Mercosur. MILA is a corporation created to combine the monetary markets of Latin American international locations. At the moment, there are 4 international locations signed up: Peru, Colombia, Chile, and Mexico. The combination goals to strengthen capital markets to extend investor confidence within the provide of securities, and issuers, and enhance bigger sources of funding.

The primary milestone of the initiative is implementing a brand new group the place all Latin American international locations settle for and promote financial development and innovation utilizing decentralized monetary infrastructures and blockchain applied sciences, in addition to robust private and non-private partnerships for the general purpose of a robust united Latin America.

So as to construct the long run, we should perceive the previous

Within the Nineteen Twenties, the German authorities, below the Weimar Republic, was experiencing hyperinflation following World Struggle I. The nation desperately wanted to rebuild its economic system however lacked the required gold reserves. To beat this problem the Weimar Republic developed a brand new sort of forex often called the “Rentenmark”, which was redeemable for bonds of land and industrial vegetation as a way to stabilize the forex and produce again the boldness of international buyers. The Weimar Republic additionally launched new fiscal measures to insure the Rentenmarks stability. Credit score was not provided to the German trade to stop widespread hypothesis by leverage and subsequent inflation. With the forex in brief provide, banknotes that had been issued returned to acceptable ranges, and confidence was returned to the German economic system briefly. This initiative was profitable for a variety of causes however primarily because of the help of American bankers often called the Dawes Committee.

The Dawes Committee created a novel answer for managing the funds raised from the sale of the Rentenmark. The method started with the German authorities elevating cash for battle reparations after which transferring mentioned funds right into a particular escrow account within the Reichsbank which might be managed and overseen by an American Agent-Basic. This new workplace would then determine how the funds ought to be put to make use of, both to pay again debt, purchase German items, or present credit score to native companies.

This ingenious mechanism ensured these property had been correctly distributed and invested.

One other case examine of how a nation or state can leverage its pure useful resource wealth might be seen within the Alaska Everlasting Fund. The Alaska Everlasting Fund was established by the State of Alaska by a constitutional modification in 1976 earlier than the trans-Alaska pipeline started manufacturing. The purpose of the fund was to monetize a portion of the state’s oil revenues for the wants of future generations of Alaskans. A couple of years later after induction, the Alaskan authorities shaped the Alaska Everlasting Fund Company (APFC) to handle investments of the Everlasting Fund exterior of the State Treasury. The investments had been then guided by a six-member board of trustees appointed by the Governor. The Fund makes use of oil royalties to make investments in bonds, shares, actual property, infrastructure, and personal entities. Yearly payouts of the fund are made to Alaskan residents that are used for school financial savings, retirement accounts, charities, and primary residing bills.

APFC efficiently injected tens of millions into the economic system (billions by 2023) within the early years of the fund’s creation and this previous 12 months alone injected 2.1 billion into the economic system.

Research have proven that it has decreased the state’s poverty fee since its approval by the Alaska Structure. In response to the Institute of Social and Financial Analysis from 2011-2015, the fund decreased the poverty fee in Alaska from 11.4% to 9.1%. The Everlasting Fund has been in a position to generate steady income for the State of Alaska and future generations of its folks.

The same mechanism could possibly be utilized to creating economies with huge untapped pure sources.

Ingenious mechanism, escrow accounts, and multi-party agreements?

These are recognized monetary banking phrases which were used and applied for ages, which asks the query: may blockchain and tokenization assist enhance transparency and effectivity and unlock the potential of illiquid property?

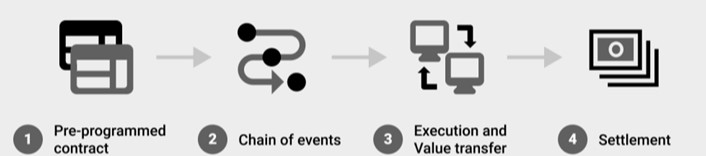

We are going to start by explaining what a blockchain good contract is, and in response to IBM, “Good contracts are merely applications saved on a blockchain that run when predetermined situations are met. They usually are used to automate the execution of an settlement so that each one contributors might be instantly sure of the result, with none middleman’s involvement or time loss. They’ll additionally automate a workflow, triggering the subsequent motion when situations are met”.

To simplify this, good contracts may help transactions between varied events be extra clear, environment friendly, and most of all honest, since each determination is ruled and verified by pc code and all events must agree as a way to transfer to the subsequent occasion.

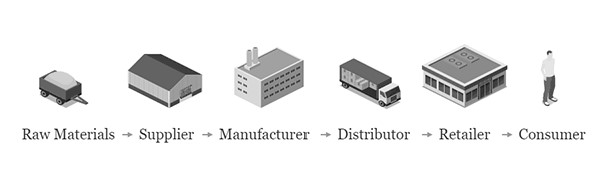

There are a number of steps within the provide chain of pure sources such because the mining of gold or the farming of soybeans. Many events are concerned on this course of and having the ability to confirm sure quantities of the availability are legitimate are key elements that blockchain good contracts may assist validate, in addition to present a extra exact real-time whole worth locked of property in a digital or bodily vault or higher but, phygital vaults. For instance, the Dawes Committee may have used good contracts when coping with the assorted events concerned for immediate settlement transactions and verification of property if the know-how was accessible on the time. The events within the good contract would encompass the German authorities, the Dawes committee, and the consumers of the Rentenmark. The Alaska Everlasting fund may use Blockchain good contracts to confirm the availability chain of the oil reserves from the Alaska pipeline, and even tokenize every barrel of oil based mostly on a person oil subject such because the Sourdough or Prudhoe streams for stock and logistics administration.

Latam Initiative: Bitcoin and DeFi: a vibrant future for underdeveloped economies

The Bitcoin blockchain’s decentralized and safe nature, in addition to its large acceptance by monetary establishments and enormous buying and selling quantity, make it a super basis for a brand new answer that goals to enhance the financial and authorities techniques in Latin America. By making use of Bitcoin’s community metrics to watch a rustic’s pure sources manufacturing fee and validate asset reserves, transparency and belief might be established within the community.

The proposed Nuevo Sol community goals to construct a community of trusted useful resource suppliers, together with personal firms and public organizations, that should meet a supply quota to take care of reliability and power.

By implementing a decentralized monetary community ruled by good contracts, the Nuevo Sol community can promote value stability, enhance liquidity, and drive financial development for all residents.

This new mechanism will permit creating Latin American nations with untapped potential to correctly worth every nation’s pure sources via tokenization. It will likely be in a position to present the folks with a steady technique of exchanging worth and supply financial equality to all its residents by offering entry to decentralized monetary applied sciences for the unbanked.