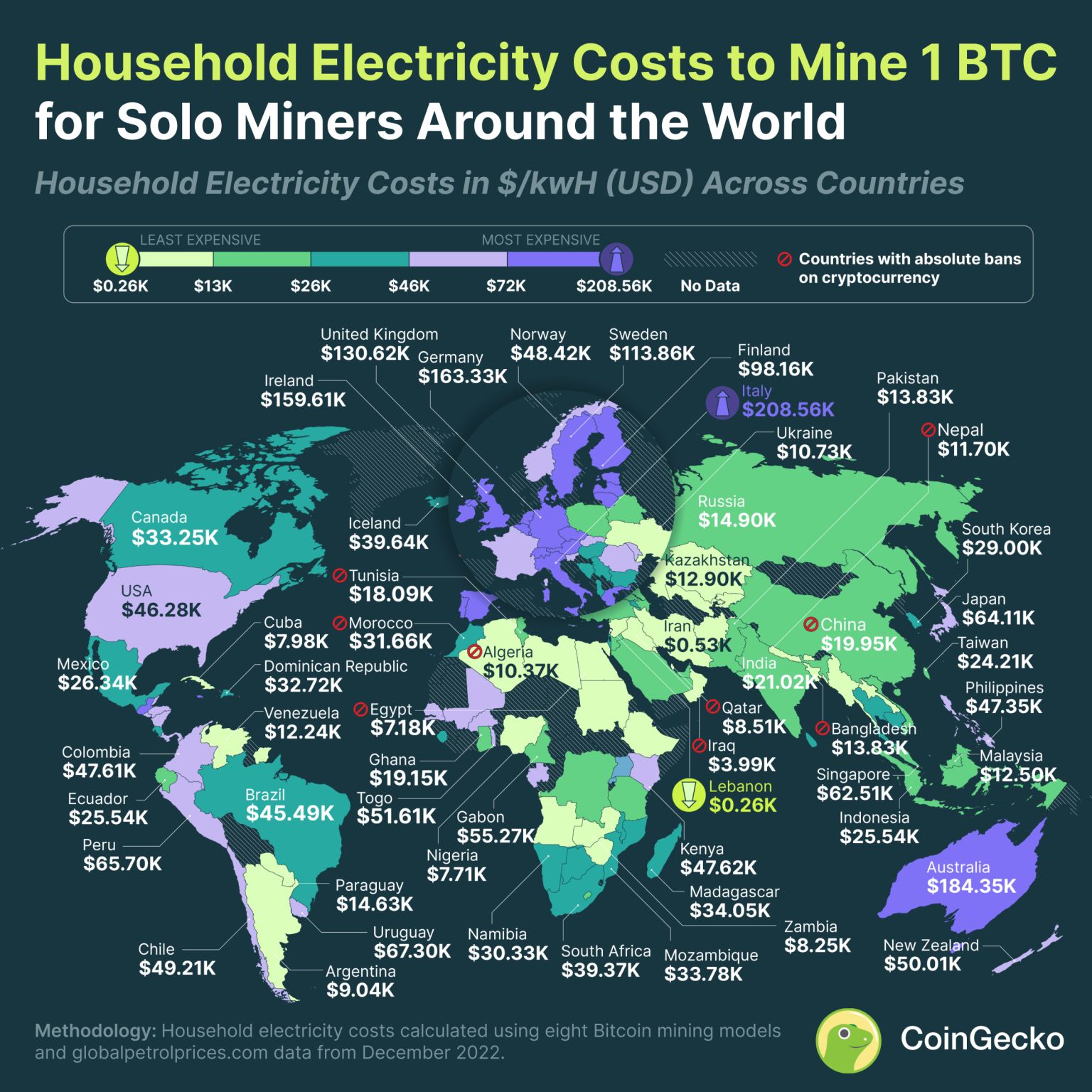

A current examine by Coingecko confirmed the value of power to be incurred to do Bitcoin mining in numerous nations world wide.

Italy ranks as the costliest nation because it takes over $200,000 to mine 1 BTC.

However, there are a number of locations the place training this exercise could be very low priced, though one has to face quite a lot of regulatory dangers and a low high quality of life.

Contemplating the price of {hardware} and the variability of power bills, is mining Bitcoin nonetheless a worthwhile exercise total?

European miners more and more perceive the significance of implementing renewable power methods with a purpose to get again into international competitiveness and keep away from having to close down.

All the main points beneath

Mining Bitcoin: mining 1 BTC in Italy has the very best power worth worldwide

Mining Bitcoin has all the time been an exercise whose outcomes are unsure and rely upon quite a lot of variables reminiscent of power and mining {hardware} prices, cryptocurrency worth, and community problem.

Those that wish to achieve success on this observe, along with being aware of how the decentralized protocol works, have to pay attention to all of the fastened prices that must be incurred with a purpose to deal with lengthy months of bearish markets during which revenue could also be lower than bills.

Fairly often the extra structured mining firms select to transfer their machines to nations the place it’s cheaper by way of electrical energy costs, this being a figuring out think about being worthwhile.

Talking of electrical energy, in keeping with Coingecko’s newest examine, Italy is the nation the place mining 1 BTC by solo miners has the very best price on the earth at $208,560.

Which means for each Bitcoin earned it will price 8 simply in electrical energy, in keeping with present cryptocurrency costs.

Usually talking, the whole European continent has extraordinarily excessive power prices, averaging about $85,700, which is far larger than the market worth of the coin itself being mined.

In Germany, as an example, the value to be paid is $163,330, in Eire it’s $159,610, and in the UK it’s $130,620.

For European miners, creating options that implement renewable power sources is essential if they’re to pursue this enterprise efficiently.

Certainly, it’s well-known that in lots of northern European nations a number of entrepreneurs are lively in Bitcoin mining with out utilizing fossil fuels however counting on wind, photo voltaic, and hydropower.

International locations the place it’s cheaper to mine Bitcoin

In accordance with CoinGecko, there are additionally nations the place mining Bitcoin has a considerably diminished power worth that’s rather more inexpensive and sustainable.

Calculating the fee in {dollars} per kilowatt hour of various nations world wide (December 2022 information) and utilizing 8 totally different mining fashions, we are able to confirm that Lebanon is the nation the place it’s least expensive to mine Bitcoin.

Within the West Asian nation, mining 1 coin of digital gold prices a median of $260 in electrical energy, making the method 783 instances cheaper than in Italy.

FUN FACT: Mining one #Bitcoin in Lebanon is 783X cheaper than mining one #Bitcoin in Italy pic.twitter.com/mYbIAAojRq

— The Cardano Instances (@TheCardanoTimes) August 21, 2023

Nevertheless, a consideration have to be given to what are the regulatory and regulatory uncertainties in Lebanon, the place buying and selling cryptocurrencies is taken into account unlawful whereas there aren’t any restrictions relating to the observe of mining.

Furthermore, the standard of life within the Arab nation is considerably worse than in Europe: take into account that Lebanon’s GDP is about 100 instances decrease than that of Italy.

In any case, so far as Bitcoin mining is anxious completely, the Lebanese nation and the whole Asian continent on the whole are the locations the place the value of electrical energy is the bottom in the whole world.

On common, contemplating all Asian nations, the common power price is about $20,600 per Bitcoin mined.

The worldwide common, then again, is about $46,200, which is 35% above the costs of the primary cryptocurrency within the trade in July 2023.

In the USA, the present worth to be paid on this context is in step with the common for all nations on the earth.

Miners’ income: is mining digital gold nonetheless inexpensive?

Let’s begin from the premise that mining Bitcoin has all the time till now been a particularly worthwhile enterprise for many who have been capable of maintain their positions with out immediately dumping the whole mined provide into the market.

It is because the value of Bitcoin traditionally has risen larger and better through the years giving miners room to benefit from bull runs of the coin to reap rewards with larger boosts.

Nevertheless, past that, it must be stored in thoughts that leaving one’s machines operating for months with out monetizing in any approach may be very pricey by way of power consumption, all of the extra so if we’re in nations the place electrical energy prices rather a lot like in Italy.

Many giant mining firms have needed to cease their operations exactly as a result of they’d mistimed their market entry with {hardware} purchases at unprofitable instances and ongoing bills to be incurred.

On this regard, the costs of {hardware} such because the “antminer S19 professional” can go as much as round 4,000 euros in keeping with the present market, however they too fluctuate relying on the worth of BTC.

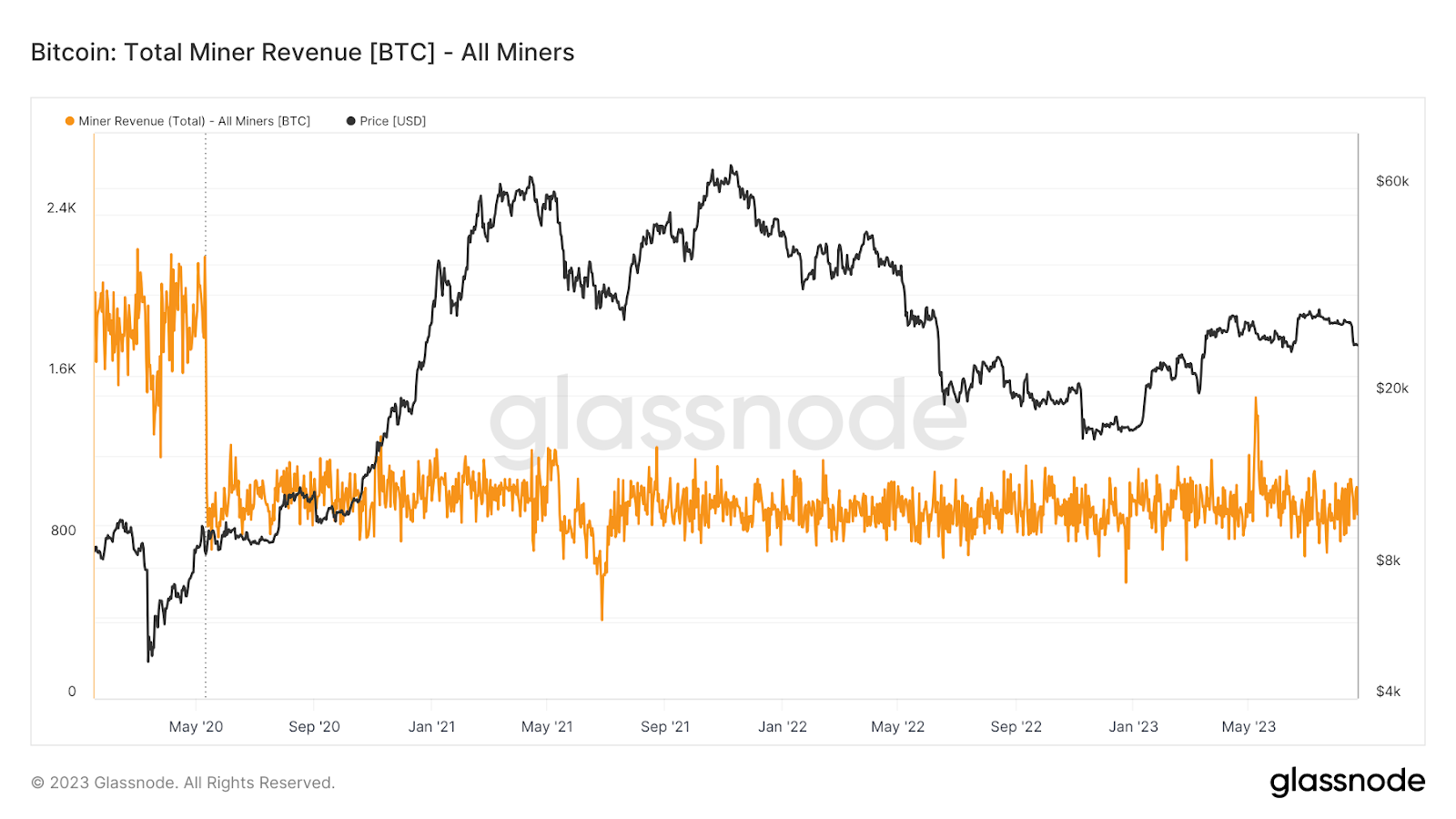

Complicating the image of miners’ entrepreneurial exercise much more is the speak of protocol revenues: more often than not the revenues per block validated within the community fluctuate inside a slender vary and don’t give room for durations when it’s rather more handy to go away mining units on/off (with out contemplating the volatility of BTC worth).

As a sign, on daily basis miners world wide have to separate a income starting from 700 to 1200 BTC complete of block reward and transaction charges.

It was solely with the appearance of Ordinals and BRC-20 tokens that we noticed a disproportionate enhance in community charges that led miners to gather 1400-1500 BTC per day, although this pattern was very short-lived.

Furthermore, let’s not overlook that each 4 years the block validation rewards are halved in keeping with the halving mechanism: certainly, in 2024 the block reward will lower from the present 6.25 to three.125 BTC.

Preserving in thoughts all these issues, which embody a hard and fast {hardware} price plus a roughly predictable estimated income additionally in view of the issue adjustment, we are able to deduce that the profitability of Bitcoin mining actions is especially associated to the value motion of the asset itself and particularly to the ability issue.

We will conclude by saying that for many who discover themselves not paying for electrical energy as a result of they’re able to benefit from renewable sources or for many who are in Lebanon and luxuriate in very low prices, the profitability on this exercise is there!

Clearly this may be roughly enticing throughout bull or bear market durations however there may be all the time a foundation on which to be comfy.

For individuals who are involved about exponential will increase in problem, there may be the consideration that even within the face of disproportionate will increase in competitors, some (those that have no idea the right way to optimize their power sources) will abandon operations to make room for larger earnings for different miners.

In essence, within the modest opinion of the creator of this text, so long as the Bitcoin community continues to course of transactions correctly and continues to function because it has executed thus far, miners who undertake inexperienced options on the expense of fossil-burning power sources (or the Lebanese) will all the time deliver house good outcomes.

The important thing to the way forward for miners lies within the inherent sources that our beloved globe affords us without spending a dime.