A macro analyst at a $3.3 trillion funding agency says the times of Bitcoin (BTC) skyrocketing over 1,000% after which crashing 80% are over.

In a brand new Twitter thread, Constancy government Jurrien Timmer tells his 107,700 followers that the wild value discoveries that BTC went by means of throughout its earlier bull markets are probably a factor of the previous as institutional traders undertake the main crypto asset.

“Till just lately, Bitcoin would usually overshoot its intrinsic worth to the upside throughout bull markets and to the draw back throughout bear markets. It was a momentum recreation with little to no resistance, till the development reached exhaustion.”

Timmer says that Bitcoin is now following a requirement curve based mostly on community progress or the rise within the variety of customers flocking into BTC.

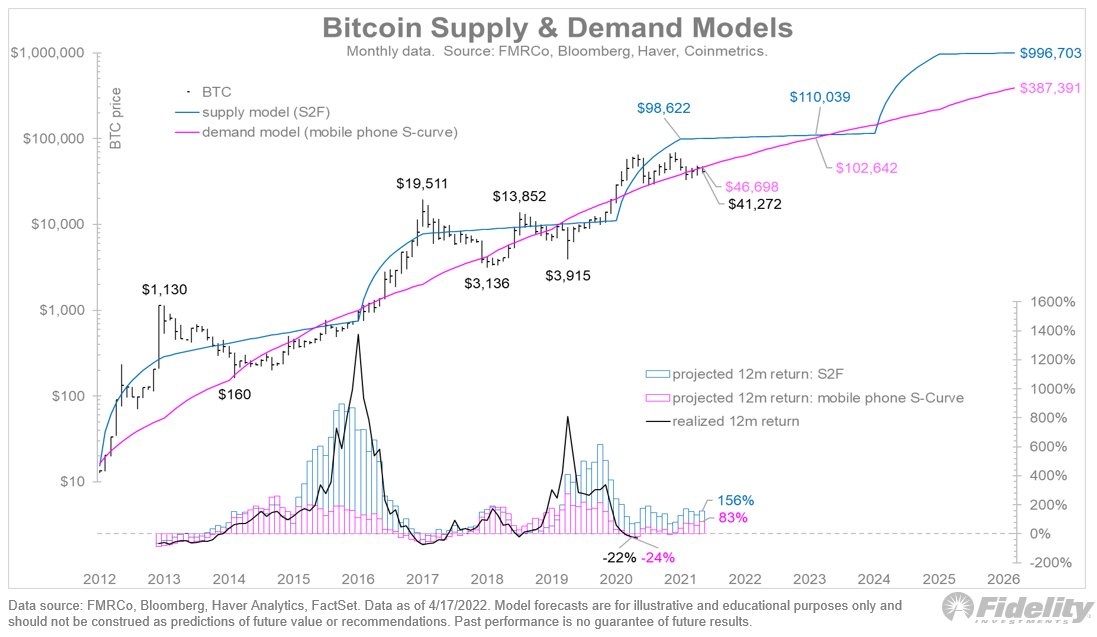

“Is the environment friendly market speculation changing the go-go value discovery of yesteryear? The chart [below] reveals Bitcoin’s fundamentals. The availability curve is dictated by the S2F mannequin (stock-to-flow), and the demand curve is pushed by community progress (Metcalfe’s Regulation)…

In latest months the value of Bitcoin has stopped monitoring the S2F mannequin and has as an alternative hugged the pink line (demand mannequin). That is smart to me.”

In accordance with Timmer, the demand mannequin makes Bitcoin an environment friendly two-way market the place traders accumulate BTC throughout value corrections and effectively unload BTC when the asset rallies.

“As Bitcoin’s worth turns into higher understood by increasingly traders, there might be extra environment friendly accumulation when Bitcoin swoons, and extra decided distribution when it moons. That’s what makes a two-way market.”

Timmer additionally says that the entry of larger traders will probably reshape the longer term value motion of Bitcoin.

“Keep in mind, value is what you pay, however worth is what you get. Within the early days, most traders solely knew the value. However as traders higher perceive valuation, Bitcoin is much less prone to resemble the early boom-bust days and will begin behaving like a conventional threat asset.”

Test Value Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/digitalart4k