- BAYC’s royalties and treasury have been saved on the FTX US alternate

- Ground worth and quantity dropped considerably over the week

The NFT market felt the affect of falling costs as crypto charges plunged over the previous few days. In reality, even Ethereum [ETH] blue-chip collections like Bored Ape Yacht Membership [BAYC] couldn’t financial institution on their reputation to counter the antagonistic impact of the FTX collapse that left the market in turbulence.

Apparently, there was a brand new twist to the impact FTX had on the NFT assortment. This was because of the revelation by NFTGo that BAYC’s ground worth decreased about 10% within the final seven days. A fast overview of the gathering’s floor price confirmed that it was 60.79 ETH, a 2% lower from yesterday.

What’s the connection between the 2, you ask?

As reported by Wu Blockchian, Yuga Labs, the workforce behind the gathering improvement, saved 18 ETH in royalties on FTX.

In keeping with NFTGO, up to now 7 days, the ground worth of BAYC has dropped by practically 10%, and the full market worth of CryptoPunks has surpassed BAYC. The principle purpose is that the BAYC treasury and royalties of greater than 18k ETH are saved in Blockfolio acquired by FTX.

— Wu Blockchain (@WuBlockchain) November 13, 2022

Leaving BAYC in shambles

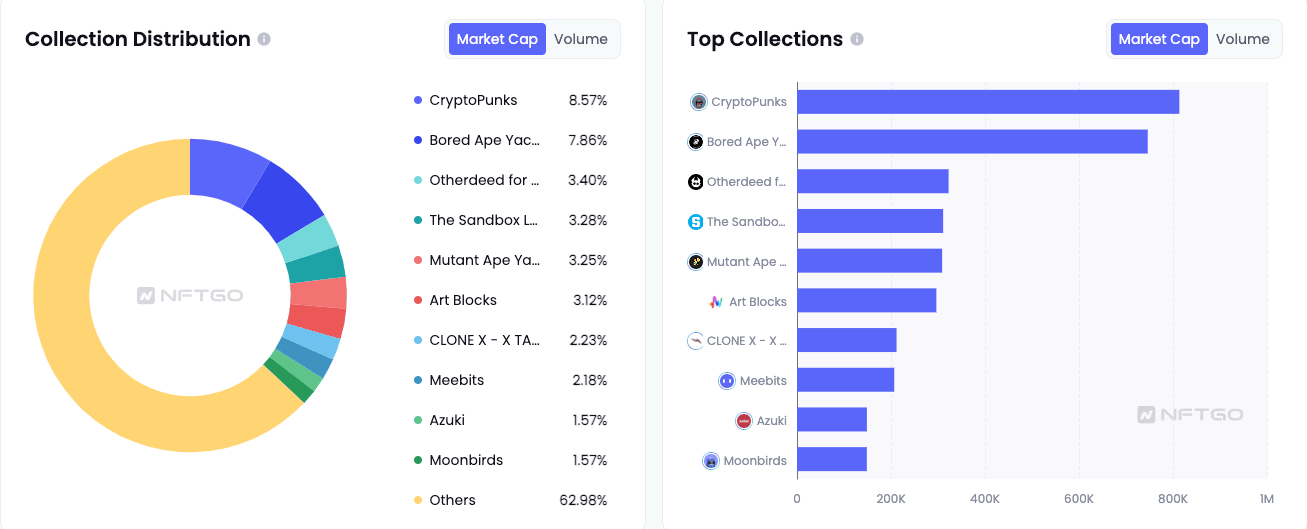

As a consequence of this, BAYC misplaced its high place within the NFT market. In keeping with NFTGo, Crypto Punks surpassed the gathering when it comes to market capitalization. As of this writing, the NFT information tracker revealed that Crypto Punks shared 8.57% of the full market worth, and BAYC got here second with 7.86%.

Therefore, the FTX-Blockfolio hyperlink depreciated the asset worth. Equally, merchants may need additionally shifted focus to proudly owning the Punks slightly than the Apes.

Supply: NFTGo

However, BAYC appeared to have held the road per gross sales quantity. At press time, information from CryptoSlam confirmed that the gathering was on the crest of gross sales within the final 24 hours. Nonetheless, its keep on the pinnacle didn’t replicate a rise in transaction or buying and selling quantity.

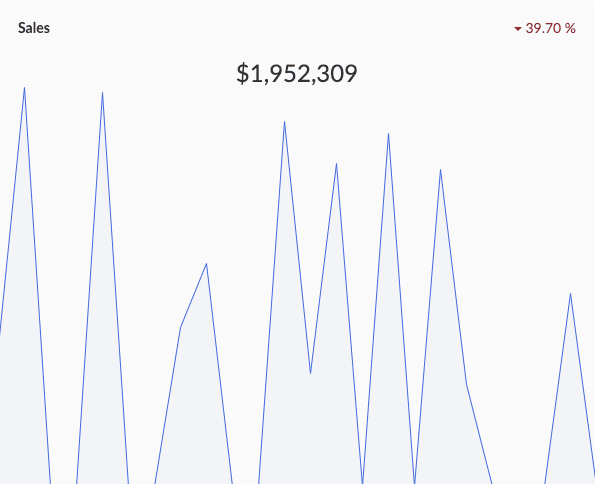

In keeping with the NFT collections aggregator, BAYC’s quantity inside the aforementioned interval was $1.95 million. This quantity represented a 39.70% drop. It was additionally noteworthy to say that the transaction occurred between 23 patrons and 20 sellers.

This involvement of merchants additionally signified a major decline. Thus, it implied that not solely did the FTX collapse have an effect on merchants, however they have been much less curious about grabbing collections in such market circumstances.

Supply: CryptoSlam

All due to this saving grace

On the broader NFT market, CryptoSlam disclosed that ETH NFT gross sales have been down 34.39%. This drop led to the general gross sales quantity remaining at $7.97 million. Thus, it was not solely blue-chip that had misplaced the numbers, however the broader market sentiment was principally detrimental as nicely.

Nonetheless, fears about BAYC being unable to reclaim its treasury and royalty had been resolved. This was as a result of Yuga Labs famous that it was in a position to salvage the state of affairs by transferring the property to Coinbase.

Yuga Labs stated the ETH asset was held in FTX US, and earlier this week moved the whole asset to Coinbase Custody. Regardless of FTX being a seed investor, Yuga has by no means used FTX and was not affected by the FTX/Alamade crash.

— Wu Blockchain (@WuBlockchain) November 13, 2022