Key Takeaways

- The Luna Basis Guard is constructing a $10 billion Bitcoin reserve fund.

- LUNA seems to have benefited from the announcement, hinting at a bullish breakout.

- If LUNA breaches the $97.50 resistance degree, it might hit $122.

Share this text

The Luna Basis Guard (LFG) not too long ago introduced plans to build up billions of {dollars} price of Bitcoin to stabilize UST. Terra’s LUNA now seems to be primed for brand new highs, nevertheless it should overcome a crucial resistance degree.

Terra’s LUNA Prepares to Break Out

Terra seems to be prefer it might quickly escape.

LUNA is at present buying and selling at $94.29 and has loved an increase in the course of the latest market surge. It’s up roughly 5.9% this week.

Terra has been within the crypto highlight for a number of weeks now, thanks partly to developments surrounding the Luna Basis Guard (LFG) and Terraforms Labs CEO Do Kwon. The Korean entrepreneur this week outlined plans to extend LFG’s Bitcoin reserves to $3 billion, with a long-term view to constructing a $10 billion fund.

“It’s not 10B immediately – as UST cash provide grows a portion of the seigniorage will go to construct BTC reserves bridged to the Terra chain. Now we have 3B funds able to seed this reserve, however technical infrastructure (bridges and so on) continues to be not prepared but,” Kwon tweeted, after saying that LFG’s Bitcoin reserve would “open a brand new financial period of the Bitcoin customary.”

$UST with $10B+ in $BTC reserves will open a brand new financial period of the Bitcoin customary.

P2P digital money that’s simpler to spend and extra enticing to carry #btc

— Do Kwon ? (@stablekwon) March 14, 2022

LFG has put in movement a plan to construct a reserve fund that can “present deep liquidity at a reduction when the UST peg is underneath stress.” The pool’s main purpose is to behave as a protection mechanism throughout a disaster and to stay programmable for brand new options to be added sooner or later.

UST is Terra’s flagship stablecoin. Terra makes use of a twin token mechanism to maintain UST pegged to the greenback. To mint UST, Terra customers should burn LUNA, and vice versa. As UST is an algorithmic stablecoin, it runs the danger of experiencing a “loss of life spiral” if it doesn’t have adequate collateral backing it (UST has briefly misplaced its peg when LUNA has crashed up to now). That’s why LFG has begun accumulating Bitcoin in its reserve fund.

So far, the nonprofit group has already raised $2.2 billion for its reserve. Roughly 45% of the funds have been collected through over-the-counter gross sales of LUNA and the remaining by promoting UST for Tether’s USDT.

Terra has confronted criticism for its algorithmic stablecoin design, significantly in latest weeks as LUNA has outperformed different tokens out there. Nonetheless, its detractors have performed little to quell Kwon’s confidence in Terra’s potential. He has such excessive conviction in his venture that he positioned two bets price $1 million and $10 million on Mar. 14 that LUNA would maintain above its present worth on a one-year timeframe. Kwon made the guess when LUNA traded at $88; it should must be commerce greater for him to win the guess when it closes on Mar. 14, 2023.

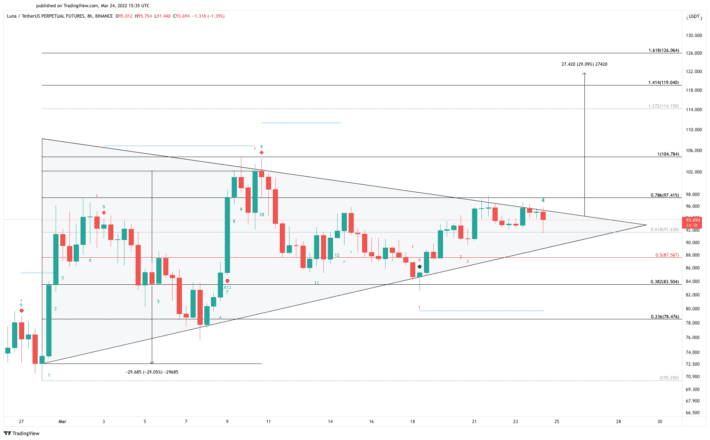

Though market contributors welcomed the latest developments surrounding Terra, LUNA continues to consolidate inside a decent worth vary. The token seems to be caught in a symmetrical triangle that has been forming on its eight-hour chart since late February. The consolidation sample estimates a candlestick shut above $97.50 might catapult costs towards a brand new all-time excessive of $122.

LUNA has discovered assist at $87.50. It should proceed to commerce above this degree to validate the optimistic outlook. Failing to take action might generate panic amongst buyers and encourage them to promote their holdings to keep away from additional losses. Elevated promoting stress might then push costs towards the subsequent crucial assist degree at $83.50 and even $78.50—which might be unhealthy information for Kwon if it fails to select up.

Disclosure: On the time of writing, the authors of this piece owned BTC and ETH.