Whereas the crypto market stays extremely risky amid the continuing armed battle between Russia and Ukraine, Terra (LUNA) swiftly moved towards the group and surged by greater than 70% over the previous seven days.

At press time, LUNA was buying and selling at $85.83, up 15.3% on the day, in keeping with CryptoSlate information. On the weekly chart, nonetheless, the coin’s worth surged by 71.9% since final Monday.

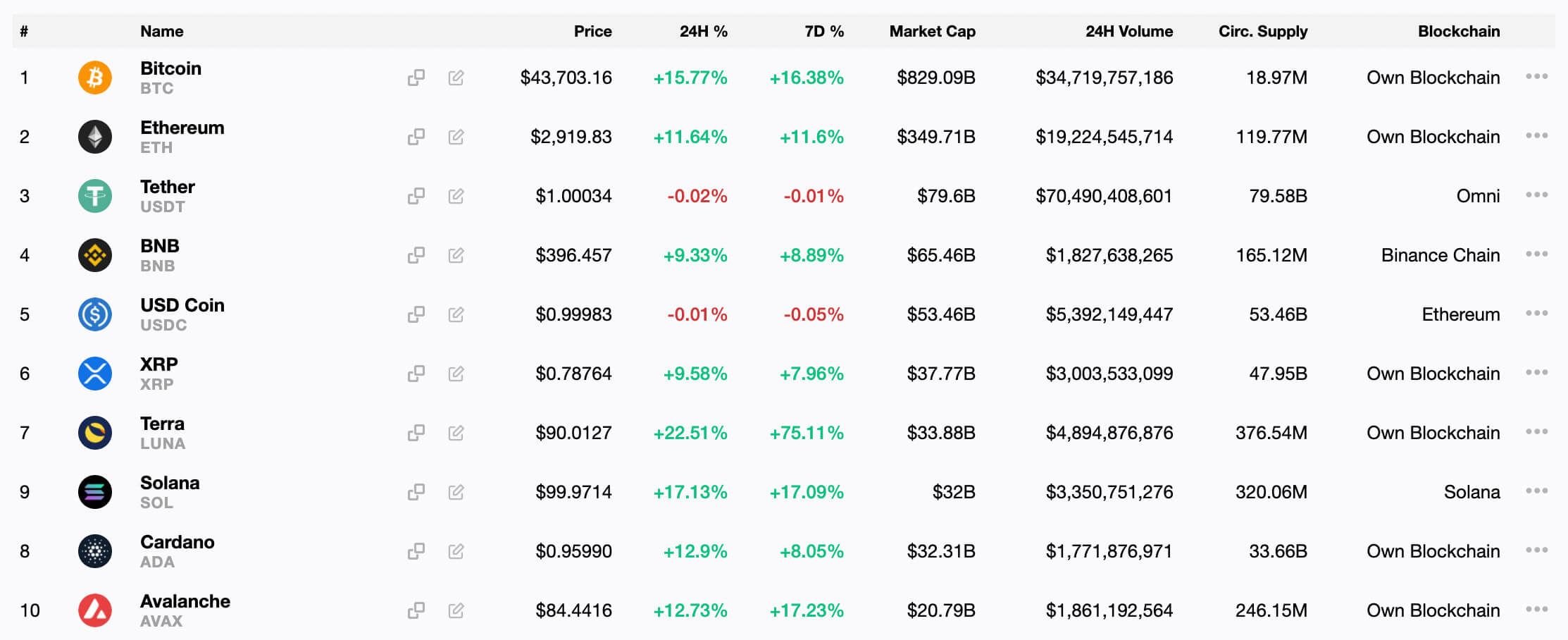

Consequently, the worth hike has boosted LUNA’s market capitalization (the mixed worth of all its tokens presently in circulation) to almost $32.1 billion, making it the seventh-largest crypto on the earth.

Notably, Terra has outpaced each Cardano (ADA) and Solana (SOL)—now ranked ninth and eighth, respectively—on its approach to the highest.

Nonetheless, each cash are additionally displaying optimistic outcomes. At press time, ADA was buying and selling at $0.9361, up 9.9% on the day. In its flip, SOL’s worth reached $98.27, gaining 15.1% over the previous 24 hours.

Crypto rebounds regardless of turmoil

As CryptoSlate reported, cryptocurrencies have just lately taken the highlight and are taking part in a big function in serving to to facilitate donations to beleaguered Ukraine.

For one, a brand new non-governmental group created to help the Ukrainian military has already received 192.4 Bitcoin (BTC) from compassionate customers—presently value over $8 million.

Why ought to he must pay a whole lot of 1000’s in cap good points if it takes two minutes for them to create an deal with?

— joelaustin.eth (@carolousue) February 27, 2022

Yesterday, Gavin Wooden, the founding father of Polkadot, even promised to single-handedly donate $5 million to Ukraine if the nation gives its DOT deal with.

Whereas the transfer confronted some criticism initially as some customers accused Wooden of “shilling” his mission amid a tragedy, much less vital commenters identified that Wooden could wish to keep away from capital good points taxes by paying in DOT tokens.

In his flip, Ukraine’s Deputy Prime Minister Mykhailo Fedorov, who is outwardly not happy with Russia’s SWIFT ban alone, known as for crypto exchanges to additionally block all Russian addresses.

Since then, main exchanges Binance and Kraken have formally refused to take action—until obliged legally. Maybe it wasn’t such an important thought to demand bans from the group centered on decentralization, transparency, and inclusion in any case.