- Synthetix’s buying and selling quantity went up significantly in the previous couple of weeks.

- Charges and income additionally elevated, however TVL plateaued.

Not too long ago, Synthetix [SNX] received into the highlight, because of its buying and selling quantity. Token Terminal revealed that SNX’s buying and selling quantity registered a substantial uptick over the previous couple of weeks.

The metric spiked through the second week of February when its value additionally pumped, reflecting robust buyers’ enthusiasm for SNX.

Buying and selling quantity on @synthetix_io trending ? pic.twitter.com/W6G32i2p9M

— Token Terminal (@tokenterminal) February 25, 2023

Furthermore, just lately, Syhthetix efficiently deployed its v3 on Ethereum and Optimism, which may end up in an extra enhance in buying and selling quantity within the coming days.

As per the official announcement, cross-chain performance and scaling will change into a spotlight of the core contributors in future upgrades of the V3 core system.

Furthermore, as there are presently no markets related to the V3 deployment, its most important operate might be to generate a collateralized debt place within the type of a stablecoin denominated in {dollars} for utilization in built-in markets.

The Street to Synthetix V3 has formally begun!

Be taught extra ?https://t.co/y1CLOG1TRF https://t.co/ZoJukjKQlR pic.twitter.com/6LrCanqZeQ

— Synthetix ⚔️ (@synthetix_io) February 22, 2023

Learn Synthetix’s [SNX] Value Prediction 2023-24

Income elevated, however DeFi’s progress stagnant

Curiously, as SNX’s buying and selling quantity elevated, DeFiLlama’s knowledge revealed that the community’s charges additionally went up. Aside from the charge, SNX’s income additionally elevated.

Supply: DeFiLlama

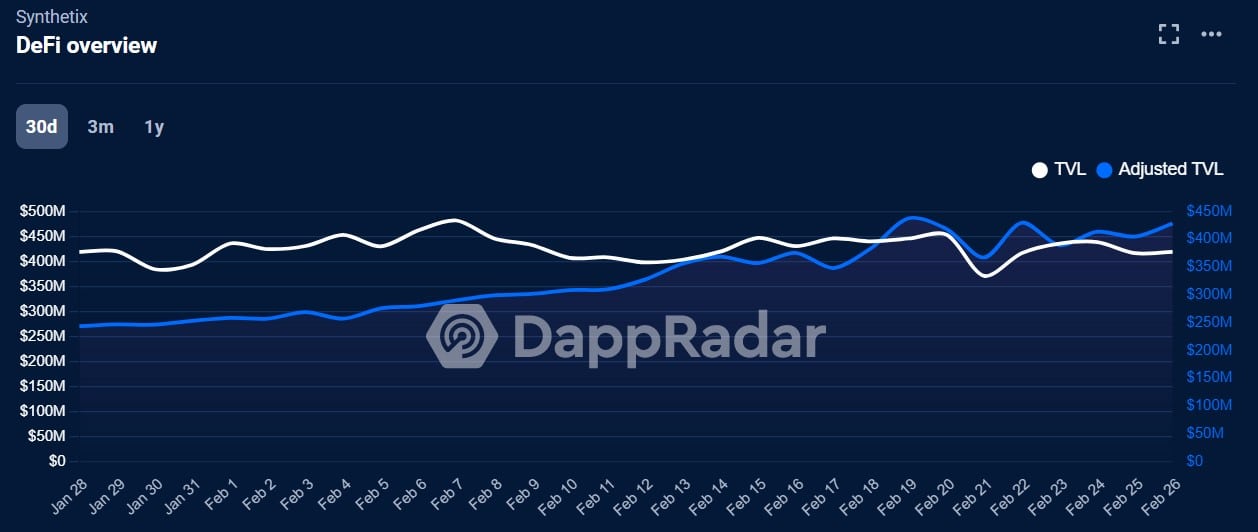

Nonetheless, whereas these areas flourished, Synthetix’s DeFi ecosystem appeared to have remained stagnant. Its Whole Worth Locked (TVL) plateaued over the previous few weeks, which recommended a halt in SNX’s DeFi progress.

Supply: DappRadar

How a lot are 1,10,100 SNXs price right now?

Was SNX affected?

As buying and selling quantity elevated and TVL flattened, let’s take a look at SNX’s on-chain efficiency to seek out out whether or not these updates had any influence on the community.

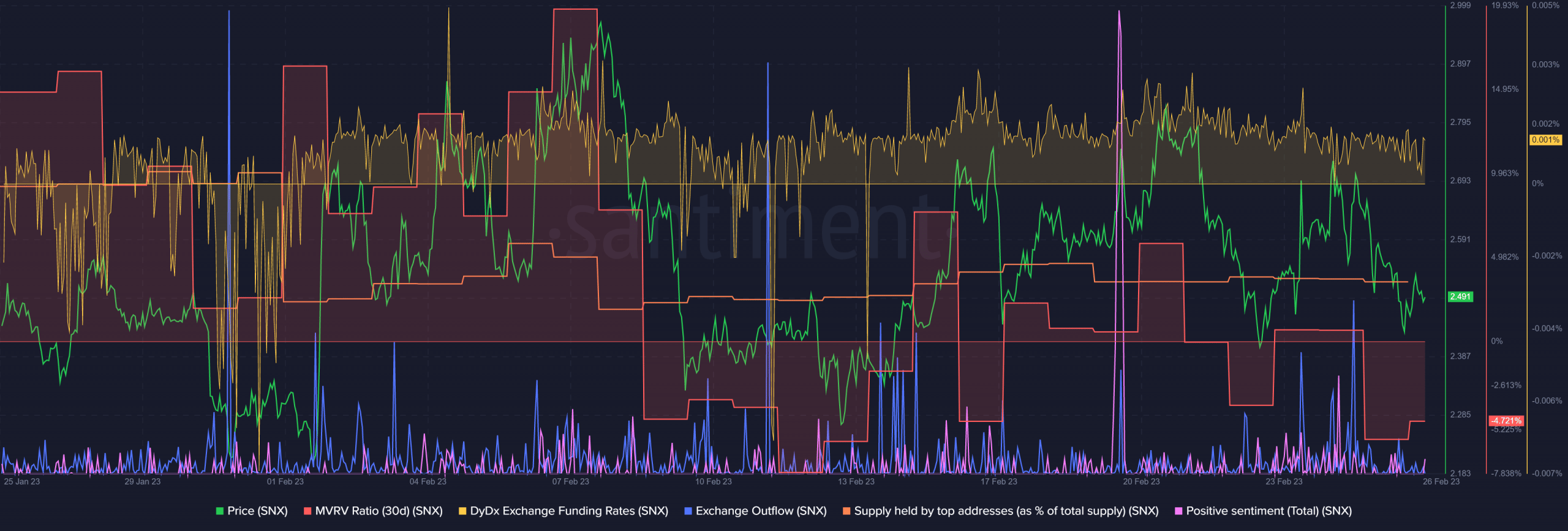

Santiment’s chart revealed that SNX’s metrics have been constructive and supported the community’s additional progress within the coming days.

As an illustration, SNX’s DyDx funding charge remained constantly excessive, which signified its demand within the futures market. Not solely that, however constructive sentiments round SNX additionally spiked, reflecting buyers’ confidence within the community.

One other constructive metric was SNX’s trade outflow, which elevated in the previous couple of days.

Supply: Santiment

Nonetheless, regardless of these constructive updates, Synthetix’s provide held by high addresses registered a slight decline.

SNX’s latest value motion favored the bears, which prompted a decline in its MVRV Ratio. In line with CoinMarketCap, its value declined by practically 3% within the final 24 hours, and on the time of writing, it was buying and selling at $2.49 with a market capitalization of over $640 million.