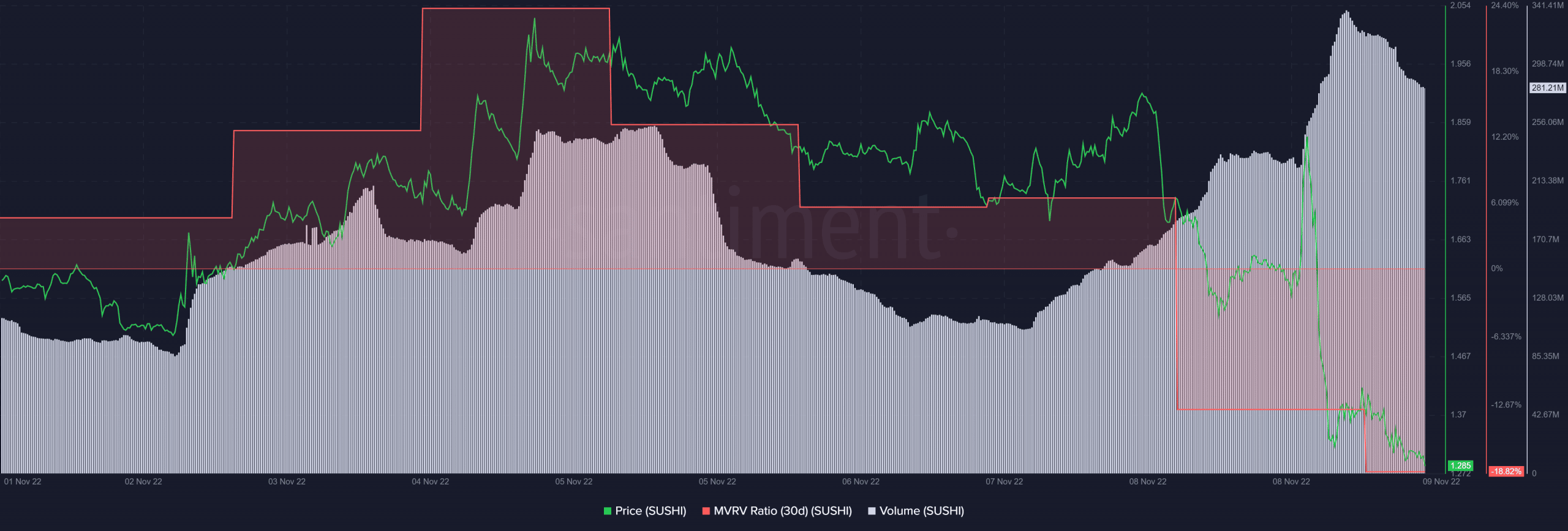

- A number of metrics together with MVRV Ratio and change reserves indicated an extra worth decline

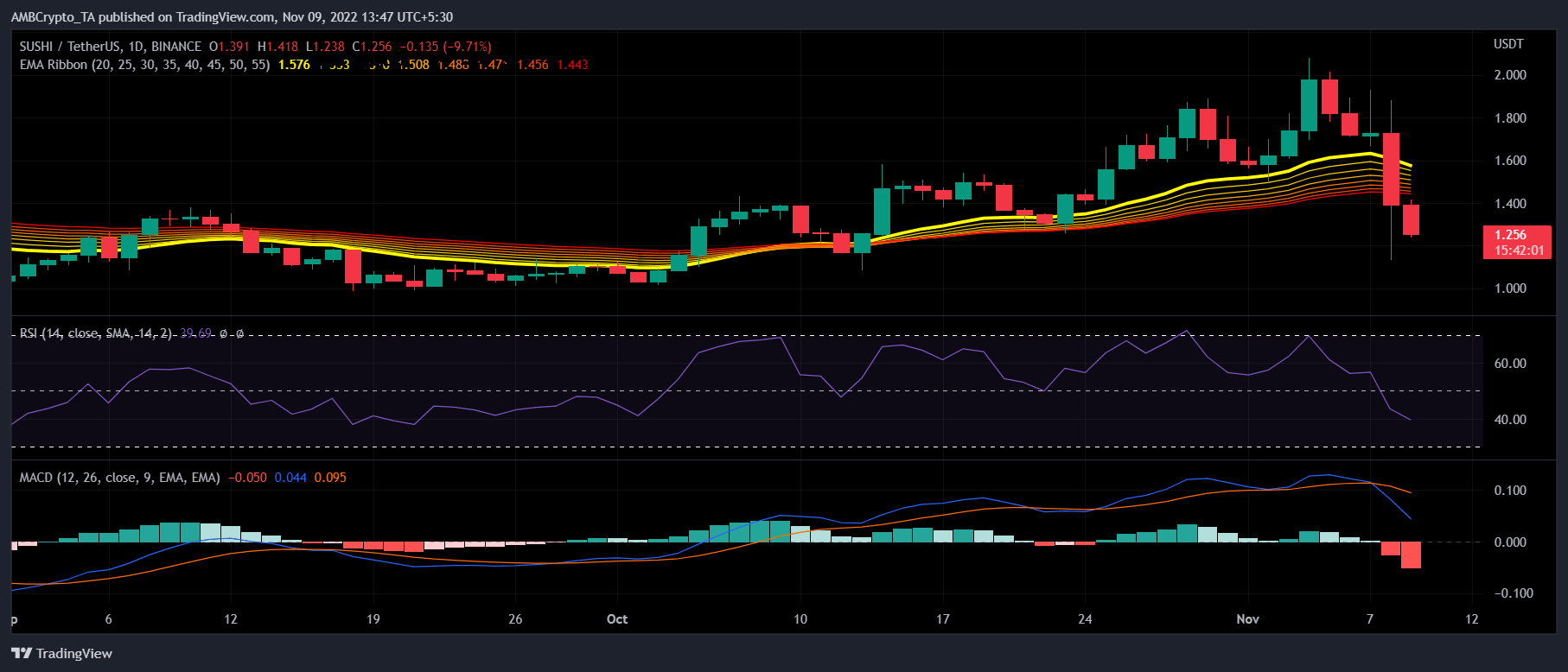

- The market indicators have been additionally not favoring SUSHI, which was regarding for the traders

SushiSwap [SUSHI] made it to the information once more because it was within the record of high Polygon initiatives when it comes to Altranking, which traders can contemplate a significant bullish sign.

Learn SushiSwap’s [SUSHI] Worth Prediction 2023-24

Prime @0xPolygon Tasks by Altrank

? $TEL @telcoin_team

? $BIFI @beefyfinance

? $QUICK @QuickswapDEX$SUSHI @SushiSwap$OM @MANTRAOMniverse$KASTA @kasta_app$INSUR @InsurAce_io$AXN @axion_network

$POLYDOGE @PolyDoge$IGG @IG_Galaxy@LunarCrush#POLYGON $MATIC pic.twitter.com/4gV9PtGa1R— Polygon Every day ? (@PolygonDaily) November 7, 2022

Not solely on Polygon, however SUSHI topped the record of probably the most influential initiatives on the Avalanche community too. This seemed fairly promising for the long run trajectory of the token.

Most Influential Challenge on Avalanche$SUSHI @SushiSwap$DYP @dypfinance$FITFI @StepApp_$BIFI @beefyfinance$FXS @fraxfinance$CRA @PlayCrabada$JOE @traderjoe_xyz$TIME @wonderland_fi$XAVA @AvalaunchApp$PNG @pangolindex#AVAX $AVAX pic.twitter.com/8cdvvBua2t

— AVAX Every day ? (@AVAXDaily) November 7, 2022

Nevertheless, none of those truly mirrored on SUSHI’s chart, because it was largely painted purple. CoinMarketCap’s data revealed a distinct story, as SUSHI was down by 20% and 16% within the final 24 hours and the previous week, respectively.

On the time of writing, SUSHI was buying and selling at $1.29, with a market capitalization of greater than $163 million. A have a look at SUSHI’s on-chain metrics revealed the opportunity of an extra downtrend, which could give traders nightmares.

Hassle is across the nook

CryptoQuant’s data revealed that SushiSwap’s change reserves have been rising, which is a bearish sign because it signifies larger promoting strain.

Actually, SUSHI’s MVRV Ratio was additionally significantly decrease, additional rising the probabilities of a worth decline. Furthermore, whereas SUSHI’s worth witnessed a downfall, the quantity stored rising, legitimizing the downtrend.

Supply: Santiment

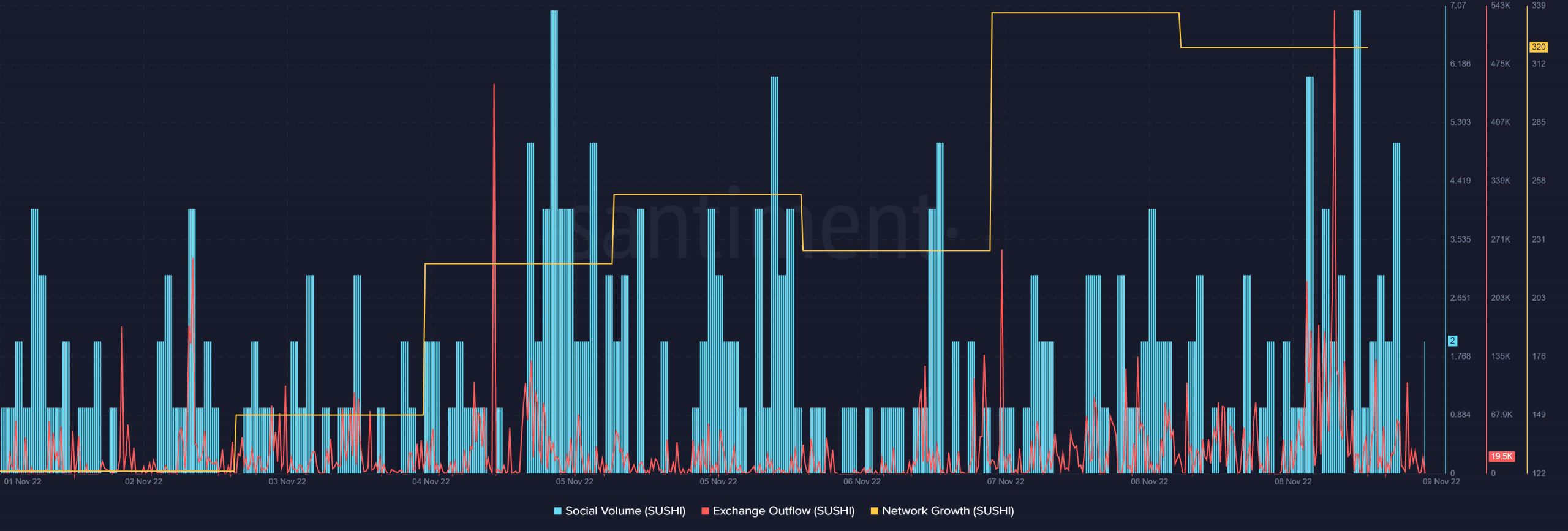

Nonetheless, just a few of the metrics offered some reduction as they indicated that issues would possibly get higher. For example, regardless of the value decline, SUSHI’s community progress went northward.

Not solely that, however SUSHI’s change outflow additionally registered a pointy spike on 9 November, which is a bullish sign. The token’s social quantity was constantly excessive during the last week. Thus, indicating the recognition of the token within the crypto neighborhood.

Supply: Santiment

Curiously, in response to GitHub’s current knowledge, SushiSwap was on the record of probably the most energetic cryptos within the final 12 months. This growth seemed fairly promising because it mirrored the efforts of the builders.

THE MOST ACTIVE CRYPTOS BASED ON THE #GITHUB DATA FOR 12 MONTHS$ICP $MINA $SOL $XCH $SUSHI $BTC $FEI $GRS $MASK $PART pic.twitter.com/23Y3vT3WjR

— PHOENIX ?? (@pnxgrp) November 6, 2022

Wanting ahead

That being mentioned, SushiSwap’s each day chart gave a bearish notion concerning the forex market, as many of the market indicators favored a worth decline.

For example, the Relative Energy Index (RSI) selected to go southward and was resting manner under the impartial mark, which is a regarding issue for holders who’re planning to go lengthy.

The MACD’s studying displayed a bearish crossover, additional rising the probabilities of a worth plummet. Although the 20-day Exponential Transferring Common (EMA) was above the 55-day EMA, the hole between them was lowering, at press time, which is one more bearish sign.

Supply: TradingView