Mining

Bitcoin (BTC) miner Core Scientific’s inventory has soared almost 200% previously 4 days, following the constructive reception for a Dec. 14 financing proposal from a present creditor who’s hoping the agency can keep away from chapter.

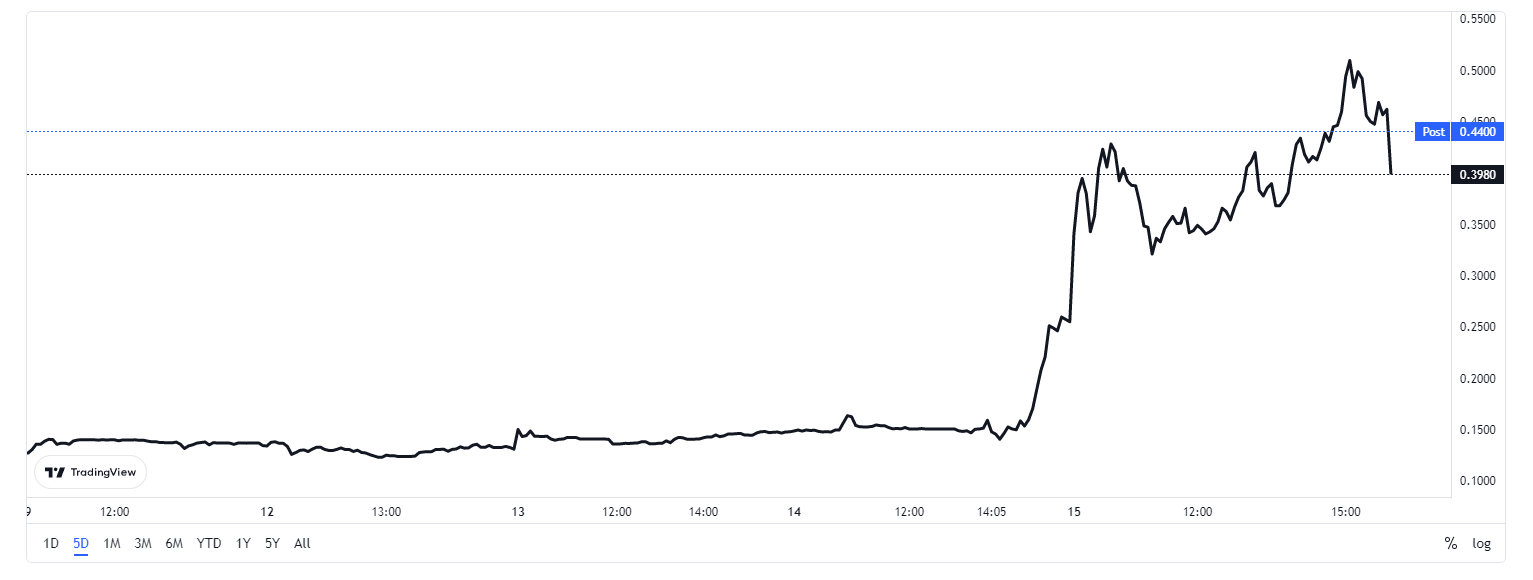

Shares for the embattled miner had been sitting simply over 13 cents on Dec. 12, earlier than climbing to almost 40 cents because the market closed on Dec. 15 — representing a acquire of 198%.

A five-day chart displaying Core Scientific’s share value on Nasdaq. Supply: TradingView

In keeping with monetary media agency Marketbeat, merchants acquired 6,572 name choices on Dec. 15, 136% greater than the typical quantity of two,780, which signifies that many are bullish on the inventory and are betting that the worth will proceed rising.

Some members of the Bitcoin group had been additionally buying shares, within the hope that scooping up shares at present costs might ship an enormous return if the financing plan goes via and the agency can survive via the bear market.

Purchased a slug of $CORZ on the shut. If the financing goes via they usually can survive via the bear market, this commerce might develop into an absolute MONSTER. DYOR. To your reference: pic.twitter.com/eHF4NXjcvH

— CR (@CashRocket) December 14, 2022

The rally might be the beginning of a turnaround, or only a lifeless cat bounce. Core Scientific was hit with a run of unhealthy information all through 2022 and regardless of current positive aspects the worth remains to be 95% decrease than it was at the beginning of the yr.

On Dec. 14 monetary providers platform B. Riley wrote a letter to Core’s shareholders and lenders, outlining a $72 million financing plan which it believes is adequate to forestall the miner from being pressured to file for chapter 11 chapter.

Ought to the deal be accepted, the primary $40 million can be funded “instantly, with zero contingencies,” whereas the remainder of the funds can be issued if Core agrees to droop funds to gear lenders till the worth of Bitcoin is again above $18,500 — a value the main cryptocurrency has been beneath since Nov. 9.

B. Riley suggests the financing will present Core with two years of working money, and notes that based mostly on the forecasts of their analyst the miner can generate annual earnings of roughly $165 million at a Bitcoin value of $18,000, with an additional $20 million for every $1,000 value improve.

Core was hit onerous by the broader market downturn and filed a report on Oct. 26 which cited a low BTC value, excessive electrical energy charges and a refusal from bankrupt crypto lender Celsius to repay a $2.1 million mortgage as the explanation why it’d default on a few of its money owed.

The unhealthy information continued on Nov. 22, when the miner admitted in a quarterly report that its money reserves could also be depleted by the top of 2022 and it didn’t consider it might be capable of increase funds via financing or capital markets given the present market circumstances.