- stETH clinched an all-time excessive in its APR because the Merge

- Current market downturn attributable to FTX’s collapse has made it exhausting for its worth to see a lot positivity

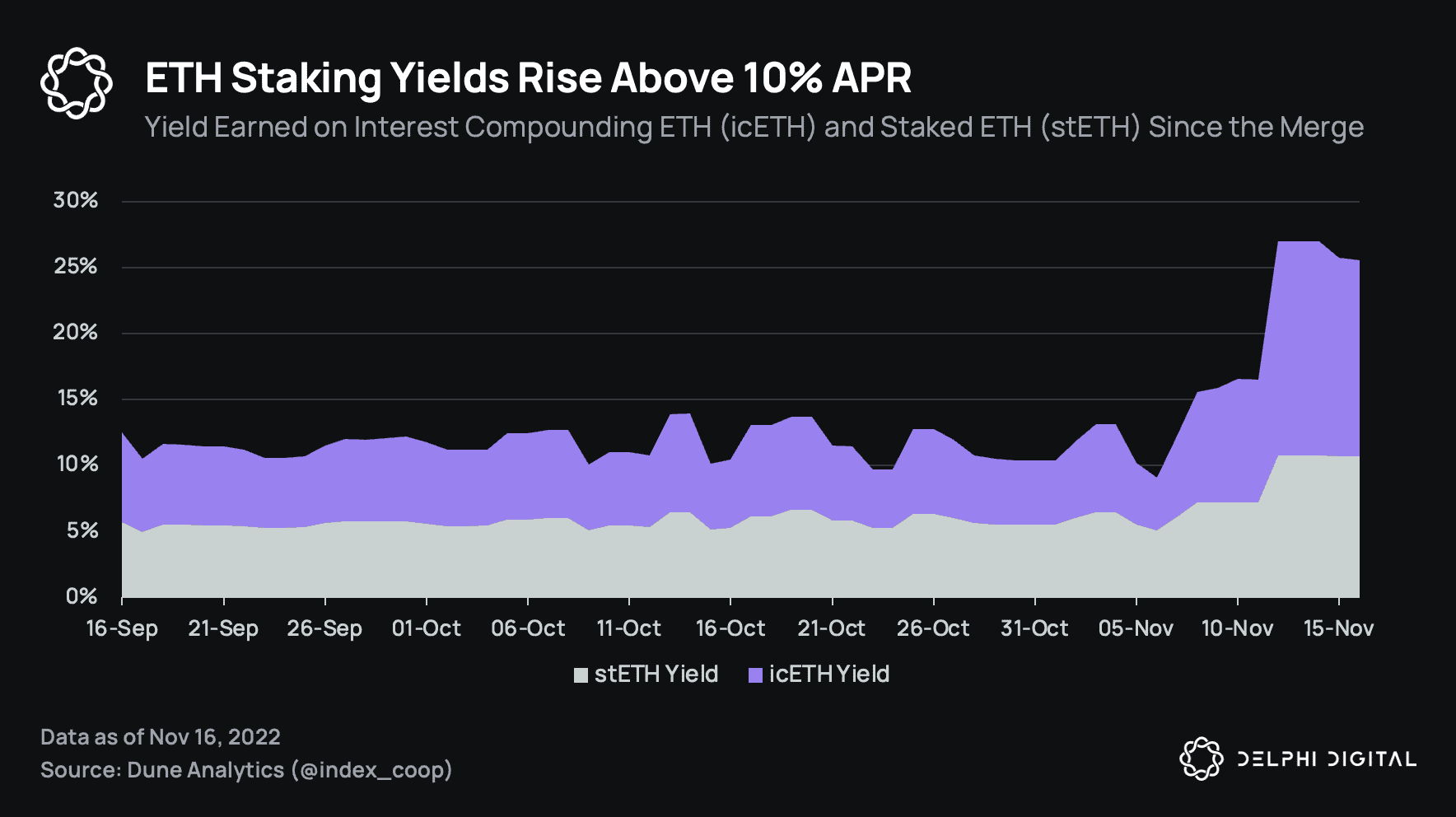

stETH, the tokenized type of staked Ether native to Lido Finance, noticed a leap in its annual share charge (APR) to an all-time excessive of 10.7% because the Merge. This, in response to knowledge shared by Delphi Digital.

Learn stETH Value Prediction 2022-2023

As per knowledge from Dune Analytics, the expansion in APR represented a 159% increment because the transition of the Ethereum community to a proof-of-stake consensus mechanism.

Supply: Delphi Digital

As to why there was a big surge in stETH APR over the previous few days, Lido Finance explained that it noticed a hike in cumulative Lido MEV rewards, with a quantum of it being re-staked by validators on the platform.

MEV rewards going up and getting restaked by validators. Extra context right here: https://t.co/Ujk50QrCFa

— Lido (@LidoFinance) November 14, 2022

stETH on the chain

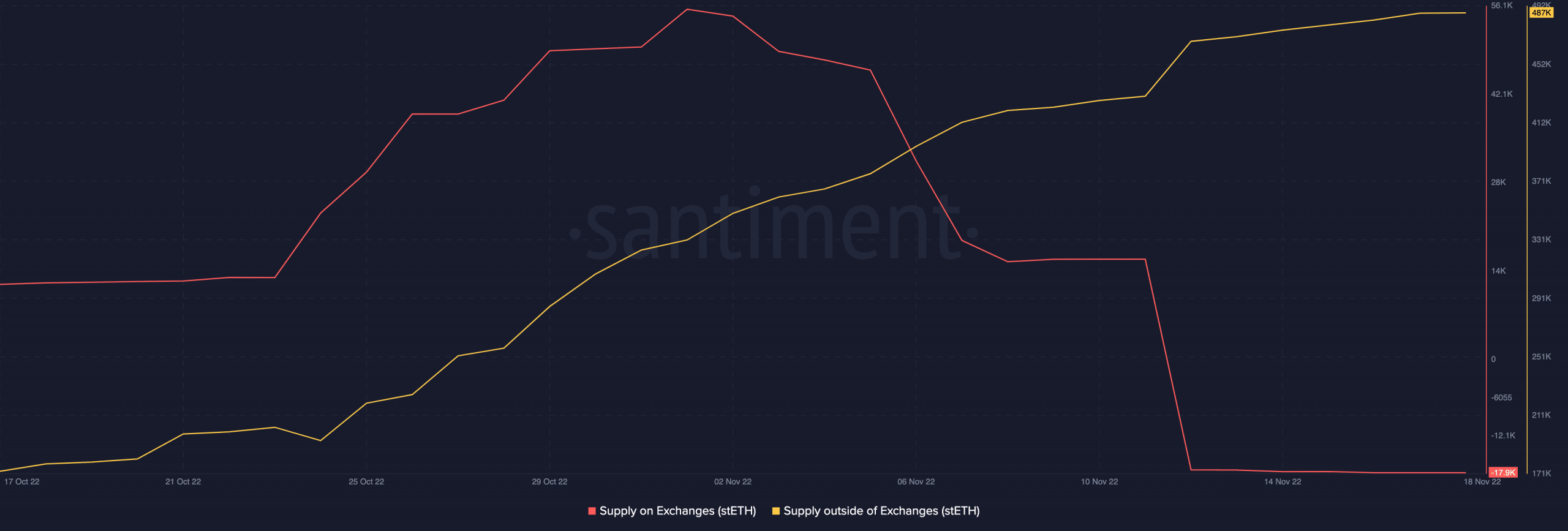

Regardless of the rigmarole of FTX’s collapse and the consequential downturn within the wider cryptocurrency market, stETH has recorded decrease sell-offs and elevated accumulation because the starting of the month. A take a look at the token’s alternate exercise on Santiment revealed the identical.

Based on Santiment, stETH’s provide on exchanges was 17,987 stETH at press time. Because the month started, it has fallen by 68%. The constant fall within the asset’s provide on exchanges indicated a decline in its distribution because the begin of the month.

Conversely, its provide outdoors of exchanges has since hiked. With 487,390 stETH outdoors of exchanges at press time, this depend has risen by 47% during the last seventeen days.

Supply: Santiment

Nevertheless, this did not translate into any optimistic worth appreciation for the asset. Whereas stETH tried a worth rally between 1 November and 6 November, the unlucky occasions that trailed the overall cryptocurrency market because of FTX’s fallout led its worth to drop considerably. Between 6 November and press time, stETH dropped by over 25% on the charts.

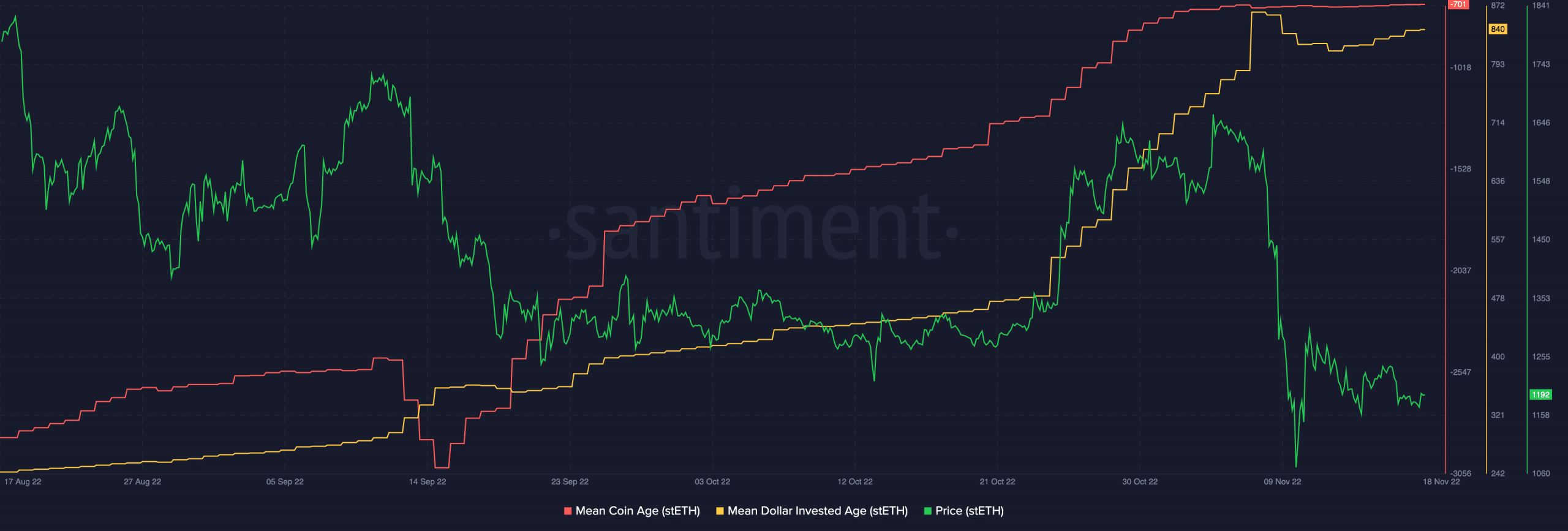

Other than the statistically vital optimistic correlation that stETH shares with Bitcoin [BTC], on-chain knowledge from Santiment revealed dormancy on the chain.

Based on Santiment, the token’s Imply Coin Age and Imply Greenback Invested Age had been noticed to be on 3-month-long uptrends. This confirmed that stETH investments remained dormant in wallets and didn’t change palms. This was an indication that there was stagnancy on stETH’s community, which usually makes it exhausting for the value of an asset to hike.

Supply: Santiment