Because the crypto market crumbled beneath the $900 billion market worth, Stellar Lumens [XLM] accompanied it to achieve its lowest worth in two years.

In keeping with CoinMarketCap, XLM hit $0.0828 within the early hours of 11 November. This worth was the bottom it had reached for the reason that token exchanged palms at $0.0806 on 13 November 2020.

Learn AMBCrypto’s worth prediction for XLM 2023-2024

Whereas this may not be an sudden bombshell, not many buyers may need professed it hitting such lows. On the similar time, it may very well be described as XLM following within the footsteps of its friends after current occasions. Aside from the worth, it appeared that different components of XLM have been additionally affected.

Fall out season

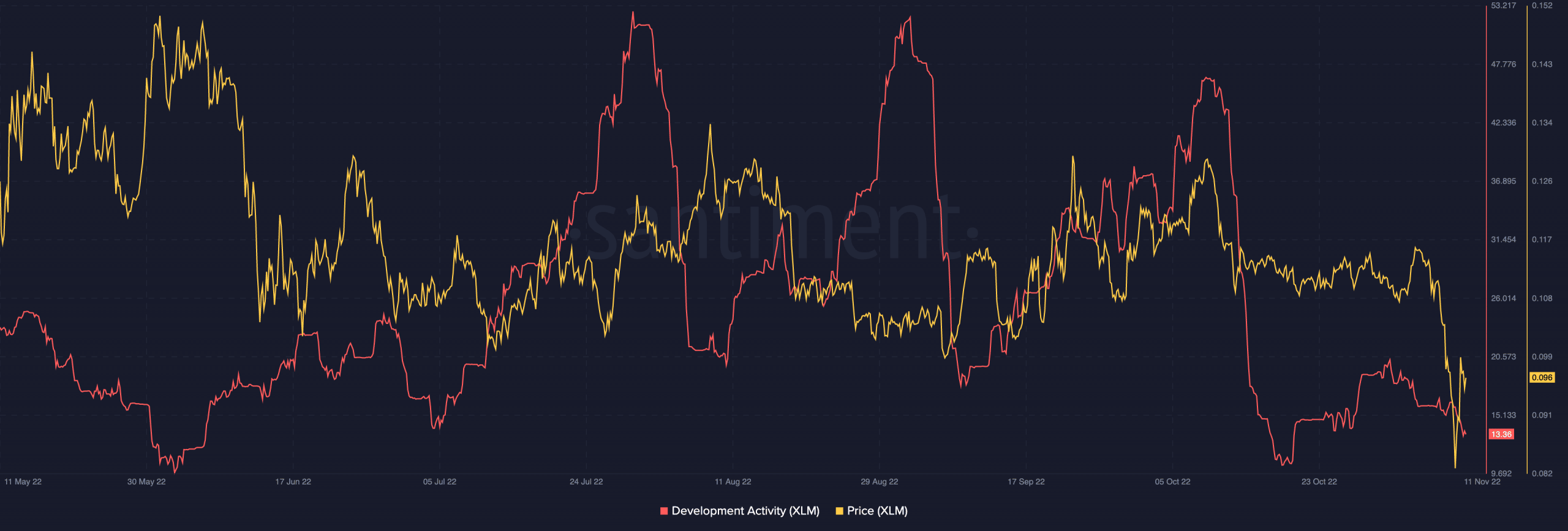

Per Santiment knowledge, Stellar’s growth exercise had significantly declined. As of this writing, the event exercise had plunged from 20.35 on 1 November to 13.29.

Because of this, it was clear that there had been a lot fewer upgrades within the XLM ecosystem. Equally, the current fall off of the market may not have been in a position to forestall a shrink even when there was a major community enhance.

Supply: Santiment

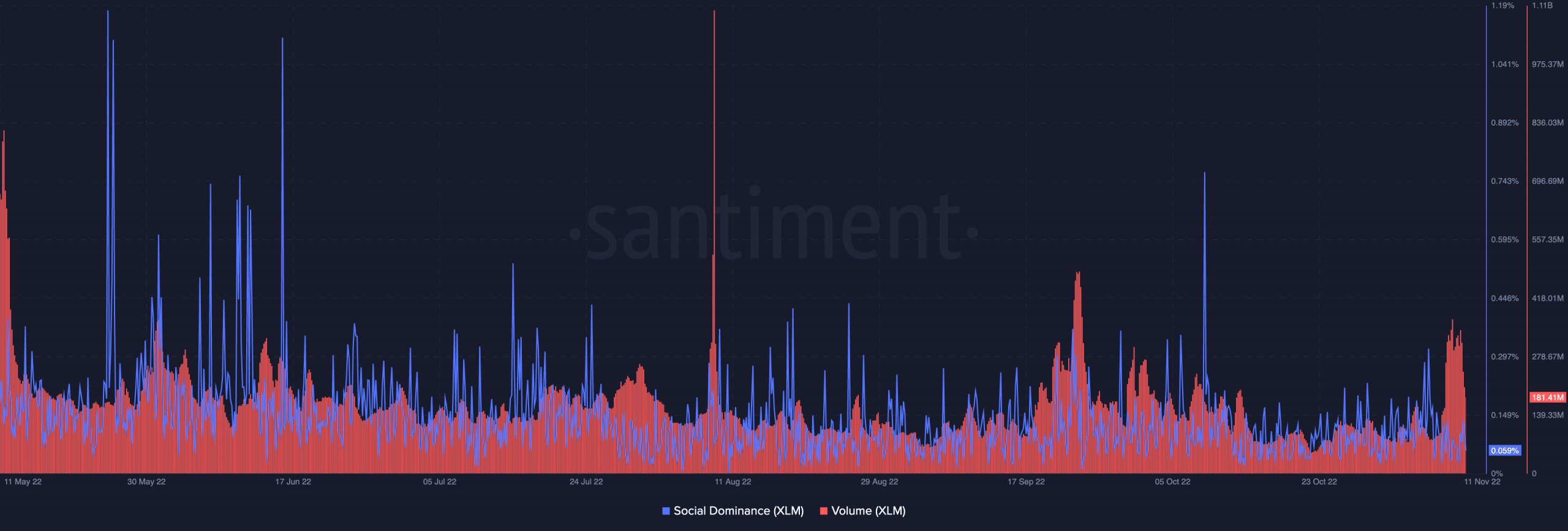

As well as, XLM buyers didn’t belief the crypto market sufficient to remain put in holding the altcoin. At press time, the quantity of the 24-ranked cryptocurrency had decreased by 48.39%. This knowledge indicated that there had been increased sell-offs between the day prior to this until the time of writing.

Primarily based on the above Santiment knowledge, XLM had recovered whereas buying and selling at $0.96. Nonetheless, buyers who took benefit of the transient worth rise most well-liked to exit early as a result of quantity lower.

As for its social dominance, XLM appeared removed from the highest of minds lately. With its worth at 0.063%, it inferred that only some invested in social search and discussions about Stellar Lumens. Contemplating this standing, you would argue that XLMs’ reversal to restoration may end result from the Bitcoin [BTC] upswing.

Supply: Santiment

Right here’s what foresight says

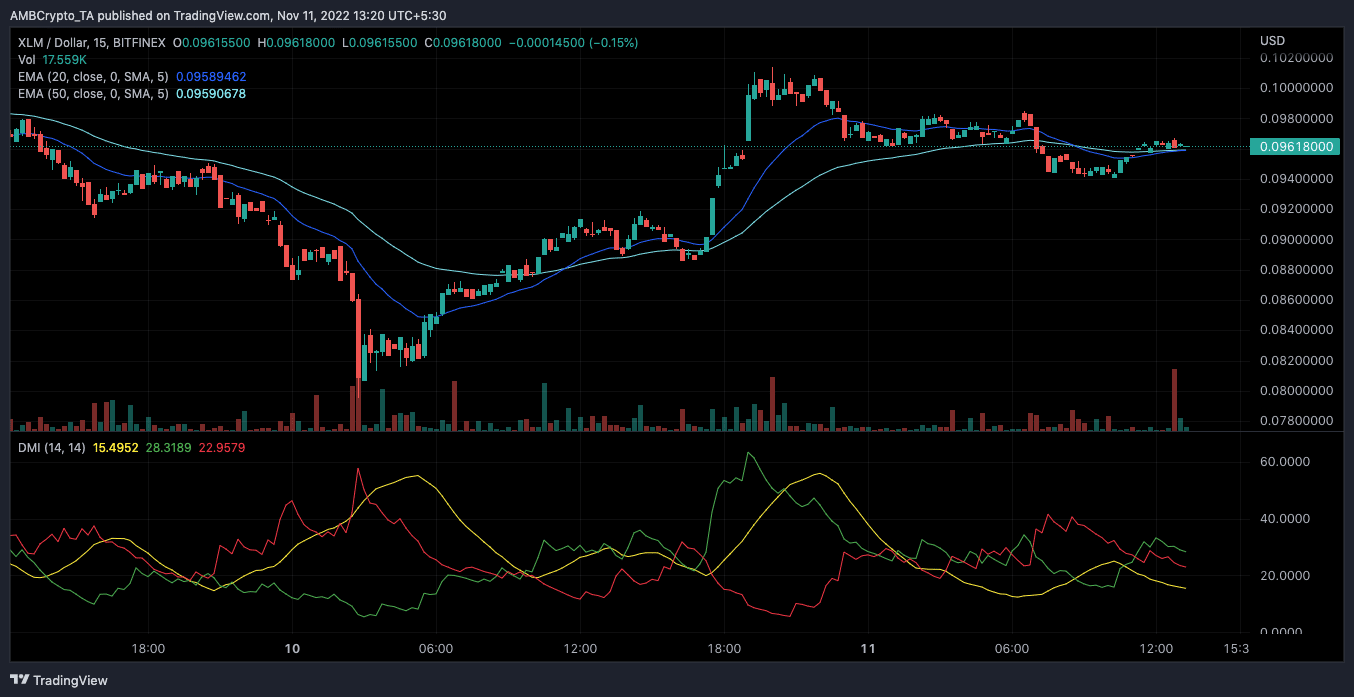

On the four-hour chart, XLM appeared prepared to surrender the maintain on its current reclaim of the $0.09 area. This was as a result of the Exponential Transferring Common (EMA) indicated a wrestle for authority.

At press time, the 50 EMA (cyan), which had initially regained management for sellers, was now in a bout with the 20 EMA (blue). This indicated that the following transfer of XLM could be to stay impartial.

For the Directional Motion Index (DMI), consumers (inexperienced) may nonetheless push XLM within the bullish path. Nonetheless, the Common Directional Index (ADX) confirmed that the customer power wanted to be extra stable for an extra push.

XLM may want the ADX (yellow) to rise to 25. With the ADX at 15.49, XLM may discover it difficult to regain the greens.

Supply: TradingView