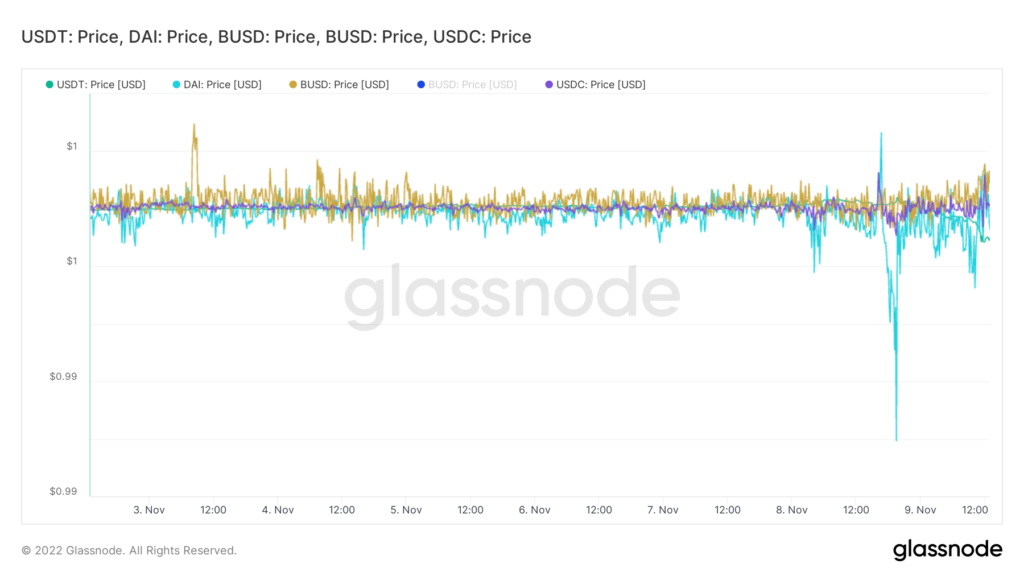

The continuing turmoil within the crypto markets is now impacting stablecoins as USDT, USDC, DAI, and GUSD all drop to round $0.998. The worth is just not indicative of a dying spiral, as seen by Terra Luna in Could, however it does showcase heightened worry inside the market. The one vital stablecoin not at present affected by the market volatility is Binance USD which has retained its greenback peg all through.

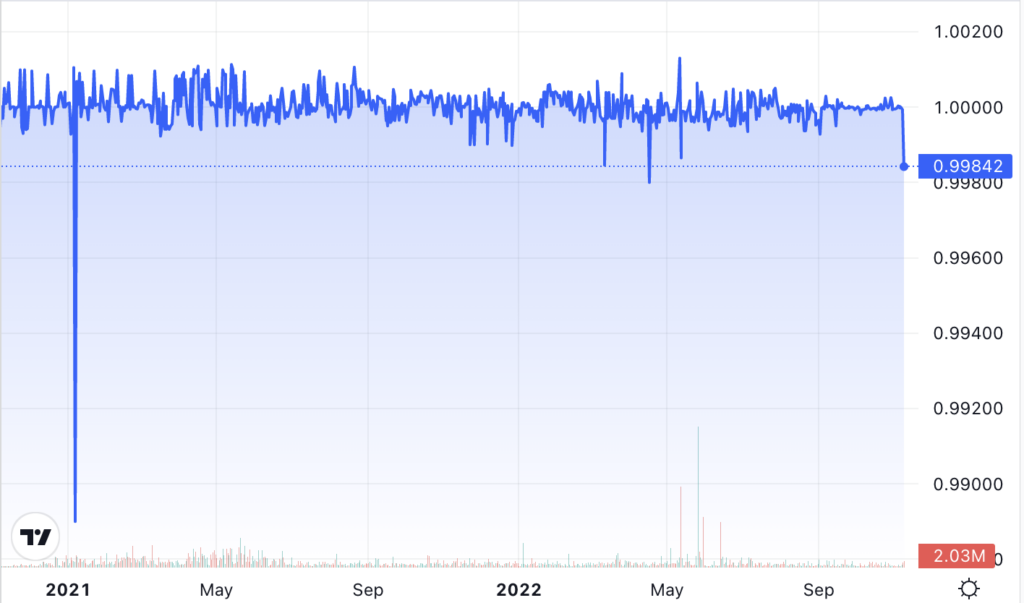

Tether USDT fell to its lowest stage since June. Whereas USDT regained its peg following Terra UST’s collapse, it dropped as little as $0.995 in Could. As of press time, USDT has fallen beneath its Greenback peg to $0.998 throughout all exchanges, as proven within the chart beneath.

Bitfinex and Tether CTO Paolo Ardoino tweeted that the USDT peg throughout main exchanges remained inside 10bp parity calling out a “glitch” in Coingecko knowledge that urged the stablecoin had fallen by as much as 3%.

Seeing a worth discrepancy of USDt on coingecko. Whereas USDt trades near parity (+-10bps), coingecko experiences 3% from parity.

Appears like a glitch to me.

Binance, Bitfinex, Coinbase are all buying and selling inside 10bps from parity.— Paolo Ardoino ? (@paoloardoino) November 9, 2022

Circle’s USDC has additionally dropped to an analogous stage, buying and selling at $0.998, a worth not seen since Could. The fluctuation is just not but at a stage to be trigger for severe alarm amongst stablecoin holders. Nonetheless, it clearly signifies that the market forces at the moment are beginning to impression stablecoins.

Throughout market uncertainty, stablecoins usually spike above their Greenback parity as traders promote crypto for stablecoins. Nonetheless, when market costs decline similtaneously stablecoins drop beneath the Greenback peg, it signifies traders are fleeing to fiat.

Information analyzed from Glassnode showcases the impression on main stablecoins. DAI seems to have been affected the worst, dropping near 1% to $0.99. Nonetheless, all stablecoins are at present inside a extensively accepted vary eradicating the worry of one other severe de-pegging incident.

Binance’s BUSD has not deviated from a variety of $0.999 to $1.001 all through the present volatility. The change quantity for Binance outweighs any of its rivals by a large margin. Binance has a every day buying and selling quantity of $51 billion, whereas the subsequent closest competitor, Coinbase, traded simply $5.7 billion over the identical interval. The truth is, Binance has had a better spot buying and selling quantity over the previous 24 hours than the complete CoinMarketCap prime 20 exchanges mixed.