The 2 preeminent sensible contract platforms every bumped into efficiency issues on Saturday after excessive site visitors calls for from NFTs briefly introduced transactions to a standstill.

The Solana blockchain halted — once more — and needed to be restarted. Ethereum continued unabated, however the price of blockspace skyrocketed to ranges not seen since 2020.

Whereas the proximate reason behind the outages was the identical — excessive site visitors — the supply of demand and every community’s response to it was fairly totally different.

Solana was absolutely offline — blocks weren’t being produced — for round 8 hours, based on standing.solana.com, resuming operation solely after community validators carried out a “cluster restart.”

The outage stemmed from excessive congestion attributable to actions of specialised bots, or automated software program applications, making an attempt to “blind mint” NFTs (non-fungible tokens) and instantly resell them on secondary markets. The site visitors turned so intense that the community suffered a breakdown in consensus — a cascade impact which finally shut the blockchain down.

Yesterday some validators recorded in extra of 100gbps in community ingress and 4 million packets per second (i.e. transactions being submitted).

That is 100,000 mbps, most dwelling web connections are lower than 100mbps…

— Laine | stakewiz.com (@laine_sa_) Might 1, 2022

“Restarts are extremely irritating, time consuming & upsetting to SOL supporters, traders and everybody else concerned. This one went off remarkably nicely, all issues thought-about, however it’s not ever a fascinating scenario,” tweeted one Solana validator, in a thread endorsed by Solana Labs co-founder Anatoly Yakovenko.

Most of those transactions got here by way of Metaplex, whose Sweet Machine device Solana-based NFT tasks depend on to launch their collections, based on the group. In response, Metaplex is instituting a first-time 0.01 SOL payment to stop bots from successfully spamming the community with invalid transactions throughout makes an attempt to mint.

Solana itself presently lacks a payment market to manage spam or sudden surges in site visitors, though one was proposed by Yakovenko in January, a suggestion he reiterated final month.

Solana additionally suffered main outages in January 2022 for related causes, however involving arbitrage and liquidation bots, moderately than NFT flippers. Not like that incident and a 10-hour outage in September 2021, the worth of Solana’s SOL token was comparatively unscathed, falling briefly by about 9%, and now buying and selling for $88.16 per information collected by Blockworks.

Ethereum by no means stops, however it does get dear

The Ethereum community has a close to good uptime file since its inception, however durations of excessive demand could make the blockchain pricey attributable to excessive spikes in transaction charges. That’s what occurred when Yuga Labs’ newest NFT undertaking — a digital land sale impressed by Bored Ape Yacht Membership, known as Otherside — launched.

The corporate known as it “the most important NFT mint in historical past by a number of multiples.” As of Monday, over roughly 95,000 land plot NFTs are listed on NFT market OpenSea with a ground value of 4.2 ether, or about $11,700.

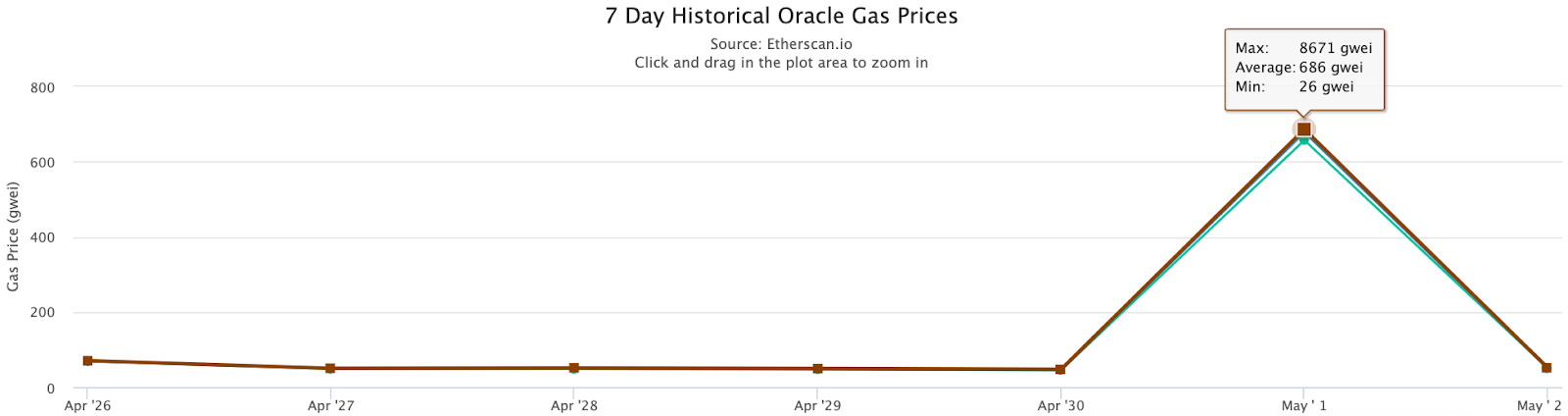

Would-be landowners within the metaverse undertaking — which doesn’t but exist — needed to qualify for a whitelist, together with registration for know your buyer (KYC) functions, and had been restricted to 2 NFTs every. However as they tried to attain their swath of digital actual property, gasoline charges on Ethereum mainnet shot as excessive as 8,600 gwei, briefly sending the price of transactions into the 1000’s of {dollars}.

Supply: Etherscan

Ethereum’s payment market is predicated on provide and demand, however its most throughput is round 13 transactions per second, which makes the protocol vulnerable to excessive spikes throughout peak demand.

On high of that, Yuga Labs’ NFTs lacked routine strategies to attenuate gasoline utilization necessities, based on Will Papper of SyndicateDAO.

“In fact, gasoline optimizations are just one a part of the equation. You want a greater mint mechanism design…Cash spent on gasoline is cash that might go to builders,” Papper mentioned on Twitter following the occasion.

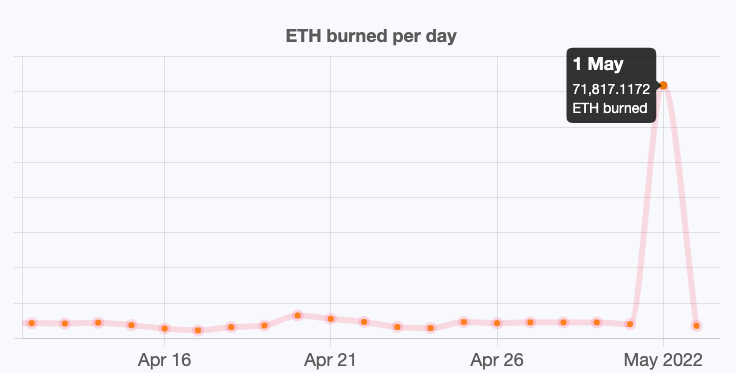

Greater than 64,078 ETH, round $180 million, was spent through the NFT mint, information from Etherscan present. As a result of Ethereum improve EIP-1559 final 12 months, the quantity of ether burned exhibits a commensurate soar on Might 1.

Supply: ethburned.information

Apart from the coverage and technical fixes to stop so-called “gasoline wars,” NFT tasks have the choice to maneuver their mints to Ethereum layer-2 networks like ImmutableX or sidechains like Polygon’s PoS chain.