Based on WhaleStats, Curve Finance [CRV] joined 9 others as a part of the highest ten traded by Ethereum [ETH] whales on 4 November. The whale monitoring platform confirmed that the highest 100 whales had engaged about 5,000 CRV in buying and selling exercise inside the interval.

JUST IN: $CRV @curvefinance now on prime 10 by buying and selling quantity amongst 100 greatest #ETH whales within the final 24hrs ?

Test the highest 100 whales right here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see knowledge for the highest 5000!)#CRV #whalestats #babywhale #BBW pic.twitter.com/3tqToPPBes

— WhaleStats (monitoring crypto whales) (@WhaleStats) November 4, 2022

Right here’s AMBCrypto’s Worth Prediction for Curve Finance [CRV] for 2023-2024

“One greenback” and others gained’t observe

Following the replace, particulars from CoinMarketCap indicated a value uptick for the on-chain liquidity token. As of 4 November, CRV was exchanging palms at $1— a milestone it had failed to achieve since 18 September.

Nonetheless, the landmark would have been not possible with out the rising quantity. The worth monitoring platform revealed that CRV’s quantity had elevated 56% between 3 and 4 November to achieve $108.23 million. This indicated that an improved variety of CRV transactions rallied around the community inside the aforementioned interval.

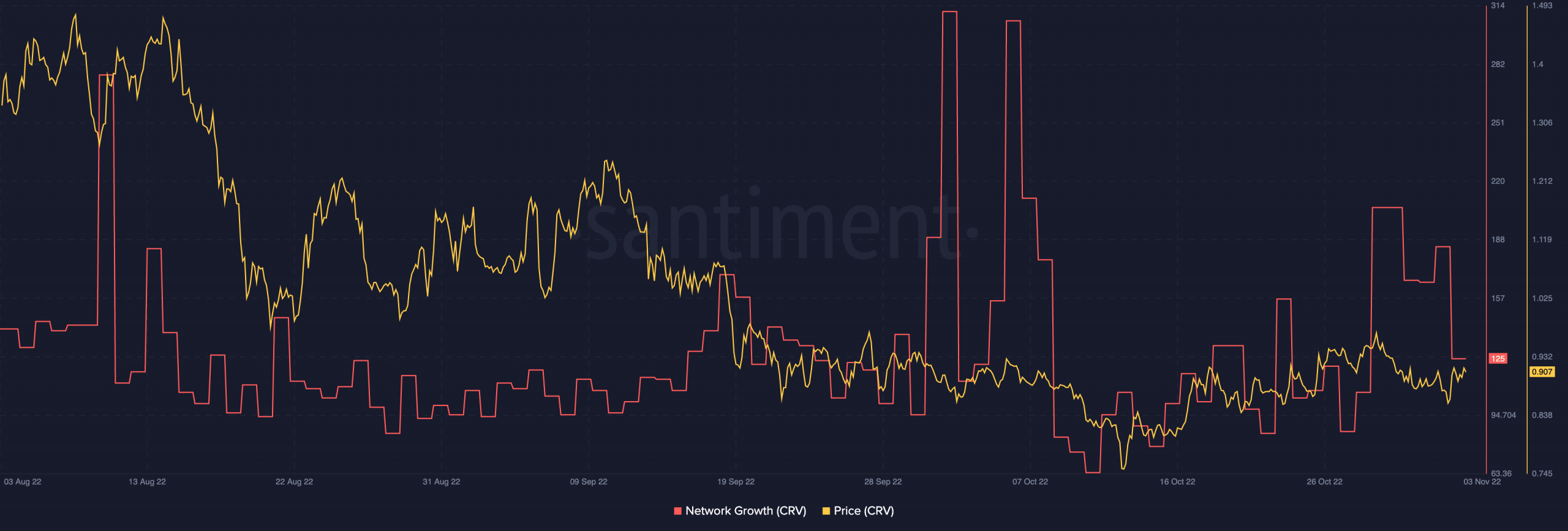

Regardless of the will increase, not all elements of Curve adopted. Based on Santiment, the network growth which was 184 on 2 November had decreased to 125 at press time. Because of the discount, CRV would possibly have to decrease their expectations of a continued value enhance.

Supply: Santiment

Moreover, the above knowledge steered that the variety of addresses created on the Curve community decreased between 3 and 4 November. Therefore, person adoption was not near its peak. So, these concerned with accumulating to assist CRV re-reach the crest had been present buyers. To maintain this stage, CRV would possibly require the token to achieve extra traction amongst crypto buyers exterior its jurisdiction.

For its Whole Worth Locked (TVL), Curve managed to carry on to its value of three November. Based on DeFi Llama, CRV’s TVL was $5.95 billion as of 4 November. This was a 2.88% enhance within the final seven days. Thus, this implied that the chains beneath the Curve protocol had comparatively attracted extra liquidity deposited regardless of its shortcomings in including extra buyers.

Supply: DeFi Llama

Buyers, it could be time to rethink!

Contemplating the CRV standing, it was not unusual for buyers to not strive grabbing a share of the income. Nonetheless, on-chain indication would possibly require warning quite than pleasure.

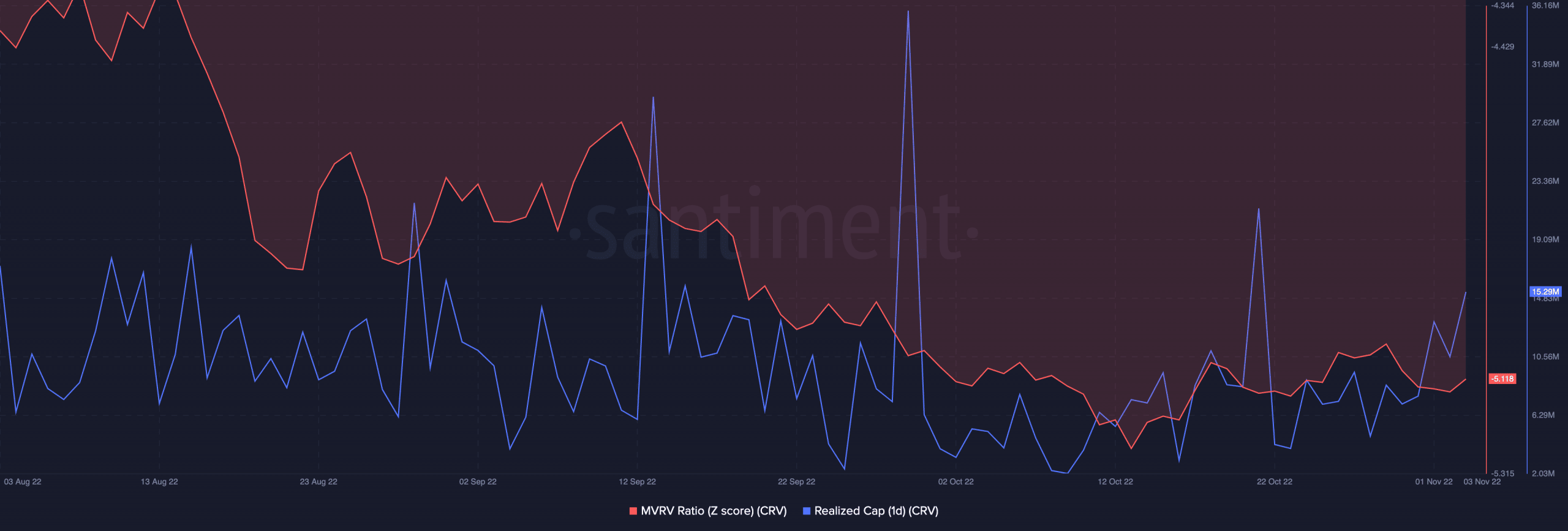

Based on Santiment, the Market Worth to Realized Worth (MVRV) z-score showed that CRV is likely to be exiting its undervalued state. Though a z-score of -5.118 would have translated to Curve being a depreciated asset, the general present market situation won’t subscribe to the standpoint.

As well as, the present z-score was greater than the worth it was on 2 November. Apart from, the CRV realized cap aiming greater than 15.29 million meant that the worth assigned to CRV was prone to a lower. Nonetheless, remaining in a extra impartial place is likely to be the following for CRV after this uptick ends.

Supply: Santiment