So, that was the crypto market’s September (aka Septembear). As England’s former Take a look at batsman Paul Collingwood mentioned when Aussie legend Adam Gilchrist retired: “Thank God for that”.

There’s no assure October will probably be any higher, however let’s check out what carried out and didn’t over the previous 30 days.

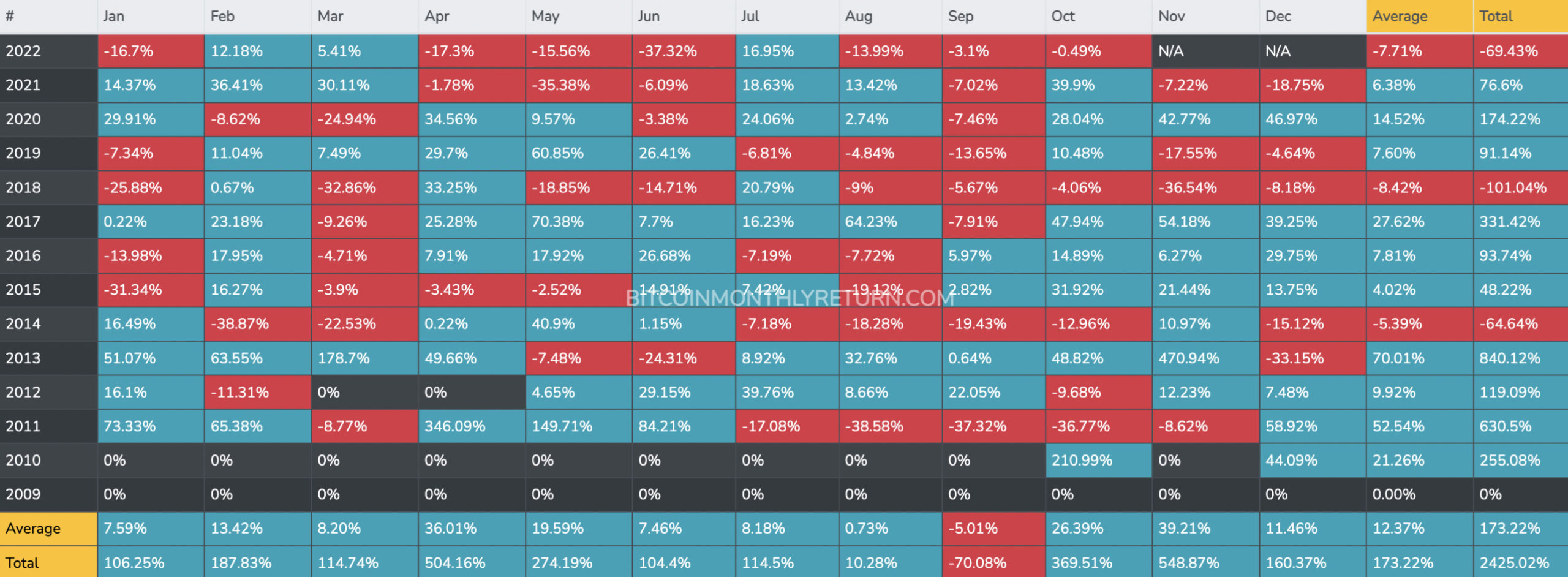

If we’re trying simply at Bitcoin because the main crypto market barometer, September (-3.1%) wasn’t fairly as dangerous as usually feared, as you possibly can see from the Bitcoin month-to-month returns desk beneath.

Starting the month at about US$20k, BTC closed it round US$19,300. Not a horrible drop in crypto phrases, however there was actually a number of choppiness and blended sentiment in between (see CoinGecko chart beneath).

October, generally known as “Uptober” within the cryptosphere, is often one of many high three months for crypto traders judging by the information. So there’s some hope floating spherical for the subsequent few weeks – primarily based largely on previous efficiency.

That mentioned, these are clearly fairly extraordinary occasions for macroeconomics. It’s most likely method an excessive amount of to hope for one more 2017 or 2021, however we’d provide a small prayer to the fickle crypto portfolio gods that we don’t have a repeat of 2011.

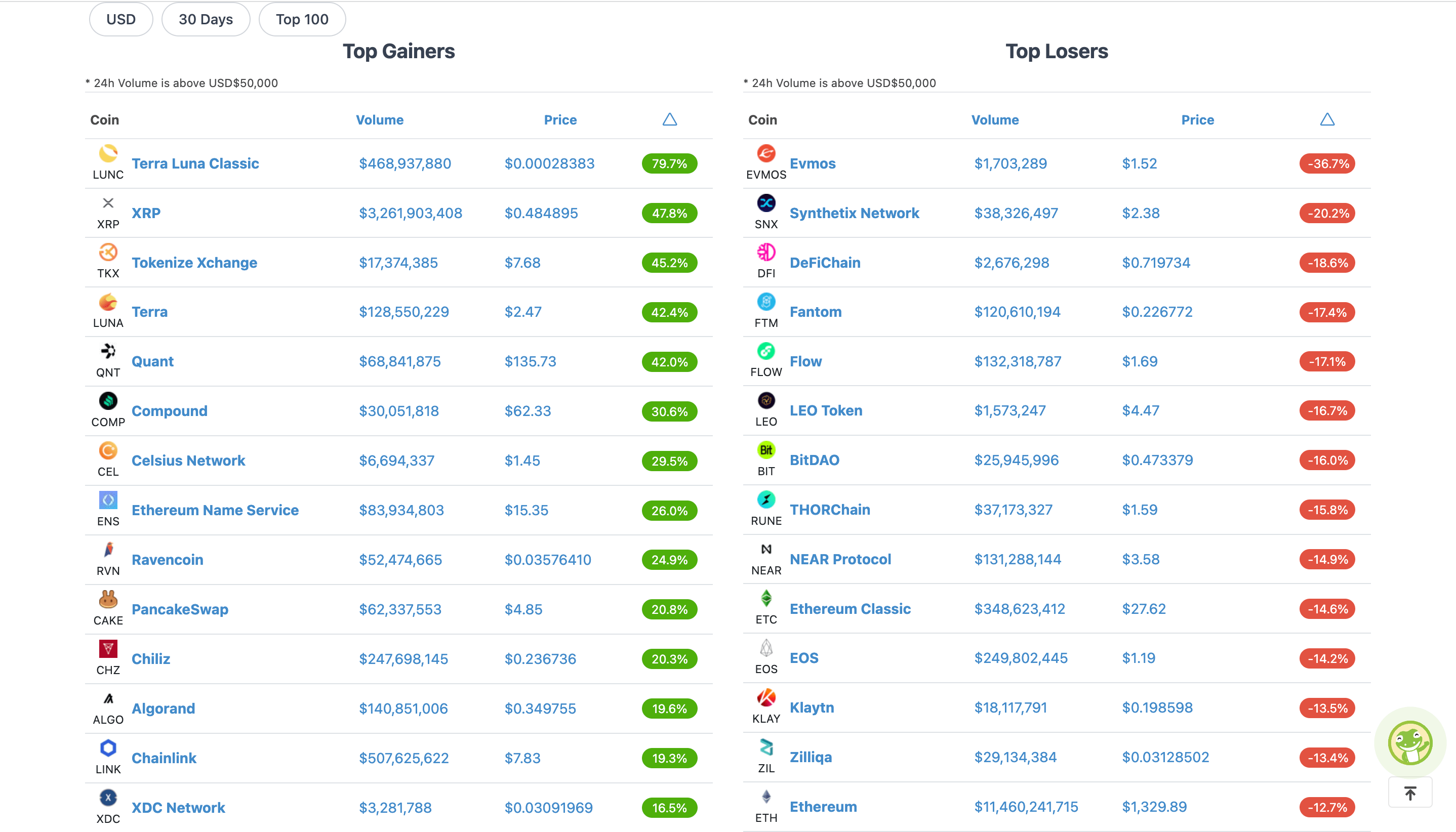

September’s main gainers and losers within the high 100

Terra firmer (than it was in Might)

Terra Luna Traditional (LUNC) (+79.7%) led the beneficial properties for the month, by a substantial margin.

We’ve sometimes flagged the buying and selling/investing danger on this one, given the controversial latest historical past of the Terra model.

Terra (LUNA) (+42.4%) additionally makes the highest gainers’ listing, whereas its founder, Do Kwon, is reportedly needed by Interpol for obvious violations of South Korea’s Capital Markets Act.

It’s a bit of complicated, however LUNC is the unique Terra LUNA coin, whereas the one now referred to as LUNA (often known as LUNA2) was created as an airdrop by Kwon as a part of a “regeneration” technique for the Terra ecosystem.

In Might we witnessed the implosion of Terra’s LUNA community, by which billions of investor {dollars} had been misplaced, triggering a domino-like “crypto contagion” impact that introduced down or severely broken a number of high-profile platforms and crypto-market entities.

Why do these cash proceed to see occasional pumpage? Whales may properly be having their enjoyable so it’s undoubtedly been an “enter at personal danger” commerce.

That mentioned, LUNC did have a direct purpose for at the least a part of its latest surge. It might be put all the way down to an announcement from crypto change Binance, which is reportedly planning to implement a “burn mechanism to burn all buying and selling charges on LUNC spot and margin buying and selling pairs”. This could successfully reduce the token’s provide.

» Binance To Implement Terra Traditional (LUNC) Burn Mechanism

Fast thread on what we’re doing and why beneath.https://t.co/b86RlCGPmv

— CZ ? Binance (@cz_binance) September 26, 2022

The Ripple impact

As for XRP, on the time of writing, it’s up greater than 12% over the previous 24 hours and near 50% for your entire of September.

The cash switch community and digital foreign money was created by Ripple Labs, which remains to be within the thick of a much-publicised and bitter authorized dispute with the US Securities and Alternate Fee. The SEC contends that the preliminary token gross sales of XRP in 2018 violated US Securities legal guidelines. Ripple strongly disputes this.

A win for the SEC would set a worrying precedent for the overwhelming majority of the crypto trade, particularly all initiatives that engaged in ICO (preliminary coin providing) token gross sales. A win for Ripple Labs could be seen as an enormous increase – not just for XRP however for crypto generally.

There have been developments within the authorized case this month which might be probably seen as favouring Ripple Labs’ probabilities of a victory. Therefore the XRP pumpage. To get the larger image, try our latest articles on the topic right here, right here and right here.

Evmos and Synthetix sink

It may be more durable generally to pinpoint why sure cash have fared worse than others. Significantly when they look like stable initiatives with stable fundamentals.

Evmos (EVMOS) (-36.7%), as an example, had a banging August, main the highest 100 crypto beneficial properties in that month, which was primarily based round pleasure for its fee-burning community improve that’s all about sustainable progress for the token mannequin.

There’s been nothing to counsel the September Evmos dip has been warranted, so maybe it’s a case of purchaser fatigue or “promote the information”, a la Ethereum and its headline-dominating Merge. Ethereum (ETH), by the way was additionally an in the end double-digit loser in September (-12.7%).

Synthetix (SNX) was one other notable September decliner and but there appears to be a hell of quite a bit happening with the protocol by way of DeFi “constructing” and upgrades.

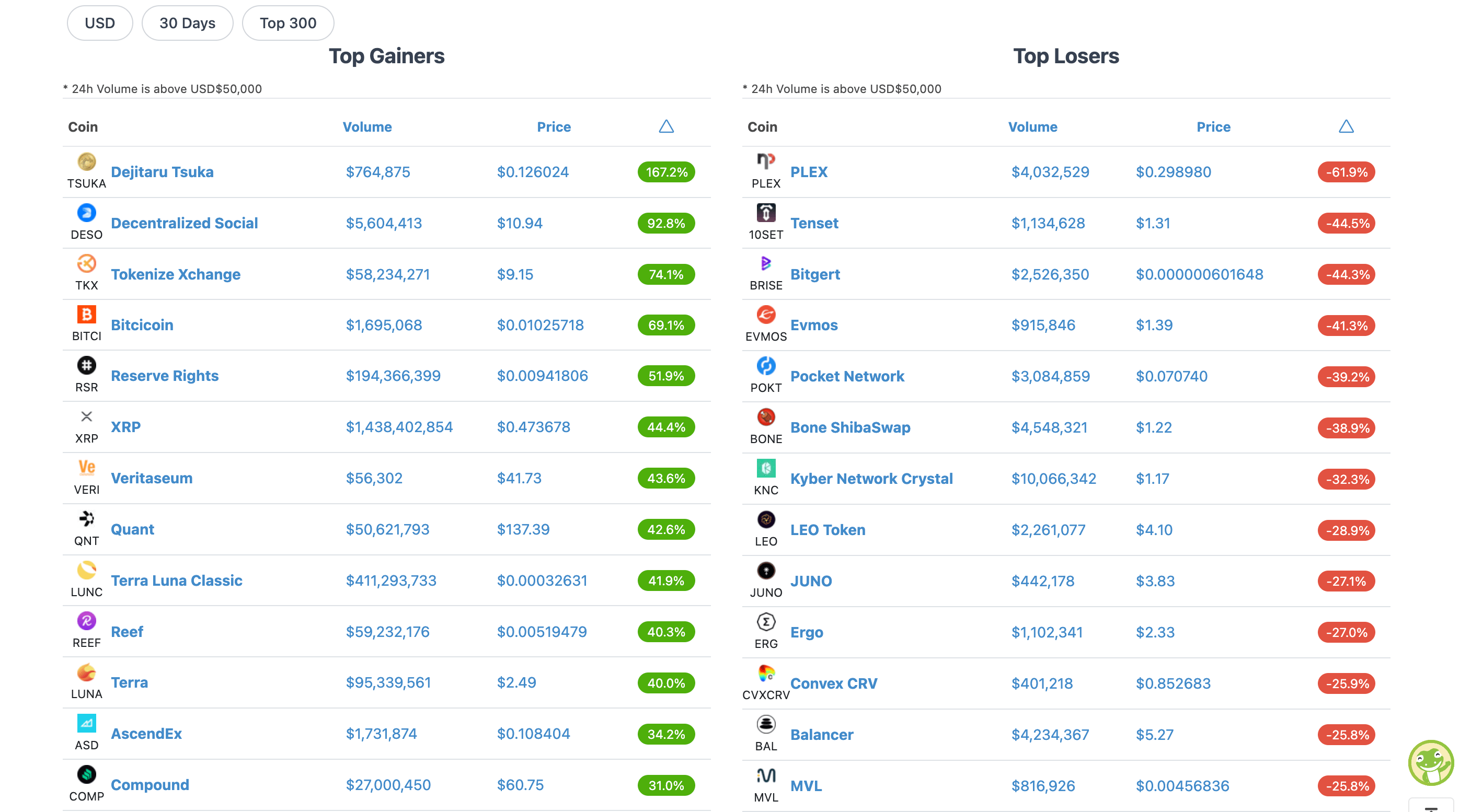

High 10 gainers and losers within the high 300: What’s TSUKA?

Lastly, zooming out a tad, right here then, had been the highest 10 winners and losers from the highest 300 cryptos by market cap, with thanks once more to CoinGecko…

What the fungible is Dejitaru Tsuka (TSUKA)? Admittedly it’s flown underneath Coinhead’s radar, but it surely’s pumped greater than 167% over the previous 30 days or so.

A fast look tells us it’s a “meme coin” ERC-20 (Ethereum-based) token. And in line with The Every day HODL web site, it’s rumoured to have been created by “Ryoshi” – the identical developer behind Dogecoin’s predominant canine-coin competitor, Shiba Inu (SHIB).

Contemplating Shiba Inu’s historical past of completely outsized stupendous beneficial properties (in its earlier days), then maybe it’s little marvel this one has had a little bit of a pump on the again of one other, older narrative.

Per CoinGecko stats, SHIB is presently up 19,838,473.6% from its near-inception low again in 2020. TSUKA is, on the time of writing, up 883% from its all-time-low about two months in the past.

What does it do, and what’s its level? That doesn’t appear straightforward to reply.

“Dejitaru Tsuka touts itself as a decentralized group centered round meditation, reflection and analysis,” wrote The Every day HODL.

The Dejitaru Tsuka dragon is the “harbinger of abundance and wealth”, in line with the meme coin’s web site, which cites Japanese lore.

At the moment, 26 September 2022, marks our 4 month anniversary

We wish to take this chance to rejoice YOU ?

All of the superb sangha members who’ve constructed this lovely group collectively ?

Take these 2 minutes to rejoice in some heartwarming group messages $tsuka pic.twitter.com/gXVtdG4Lqk

— TSUKA (@Dejitaru_Tsuka) September 26, 2022

Righto. In any case, we’d preserve a little bit of a non-financially suggested eye on it. Meme cash can generally be a little bit of main indicator for crypto-market hype and frothiness.

Total, although, regardless of a considerably tepid September for crypto worth motion, it nonetheless very a lot feels just like the 12 months of dwelling much more dangerously than traditional for danger markets.

There’s been the odd speak of it on Crypto Twitter here and there, however we wouldn’t guess too closely on the Fed making a shock pivot earlier than the top of the 12 months to begin up the cash printer as soon as once more.

That mentioned, the UK simply introduced they’re doing precisely that amid loopy inflation ranges there, so who da hell is aware of what these central bankers are literally considering and planning.

investing in 2022:pic.twitter.com/vuo990sUj1

— yzy.eth (@LilMoonLambo) September 29, 2022