Though Robinhood is especially well-known for the GameStop debacle from 2021, its presence within the crypto house solely grew to become sturdy because the meme coin craze that began round September 2021.

At present, the trade is evolving and increasing its companies after launching a crypto pockets final month and asserting the arrival of its non-custodial pockets right this moment.

Robinhood Brings One other Crypto Pockets

In a press launch, the cryptocurrency trade acknowledged that it’s creating a brand new cryptocurrency pockets that’s set to launch someday after the tip of quarter two of 2022.

This pockets shall be a non-custodial pockets, which principally permits customers to be the only real proprietor of the personal keys, that are essential to accessing their pockets and conducting transactions on any blockchain.

Simply final month, Robinhood had additionally launched its very personal cryptocurrency pockets.

Being the primary on the platform, Robinhood acknowledged through the launch that the crypto pockets would allow its customers to make use of the belongings they commerce on the trade for a number of functions as an alternative of promoting them for cash upon requirement.

Nonetheless, the best way the non-custodial pockets differs from the cryptocurrency pockets is that the consumer will not be depending on Robinhood in any method.

Non-custodial wallets, for instance, wouldn’t be affected ought to Robinhood’s system shut down.

However this independence additionally opens up the consumer to the potential of losses because the pockets’s personal keys will solely be the pockets holder’s accountability. Shedding it’d trigger the consumer to lose their funds utterly.

Additional commenting on the launch of the pockets, Robinhood’s co-founder and Chief Government Officer (CEO), Vlad Tenev, stated,

“By providing the identical low value and nice design that folks have come to anticipate from Robinhood, our web3 pockets will make it simpler for everybody to carry their very own keys and expertise all of the alternatives that the open monetary system has to supply.”

Robinhood’s Deal with Cryptocurrency

As a way to push itself past the boundaries of its present attain, Robinhood has been lively recently. Simply final month, in April, Robinhood finalized a purchase order deal to amass a London-based fintech platform, Ziglu. This allowed the crypto trade to determine its presence in the UK as properly.

The rationale why these efforts are essential is that Robinhood’s revenues have declined this yr.

Because the quarter one 2022 experiences reveal, Robinhood’s whole web income decreased by 43%, from $522 million in Q1 2021 to only $299 million in Q1 2022.

Moreover, regardless of the market rallies of mid-February and later March, the cryptocurrency income of the platform decreased by 39% to only $54 million within the first quarter of this yr, from $88 million within the first quarter of 2021.

Though the general web loss did cut back to only $392 million from $1.4 billion in Q1 2021, it didn’t do a lot for Robinhood.

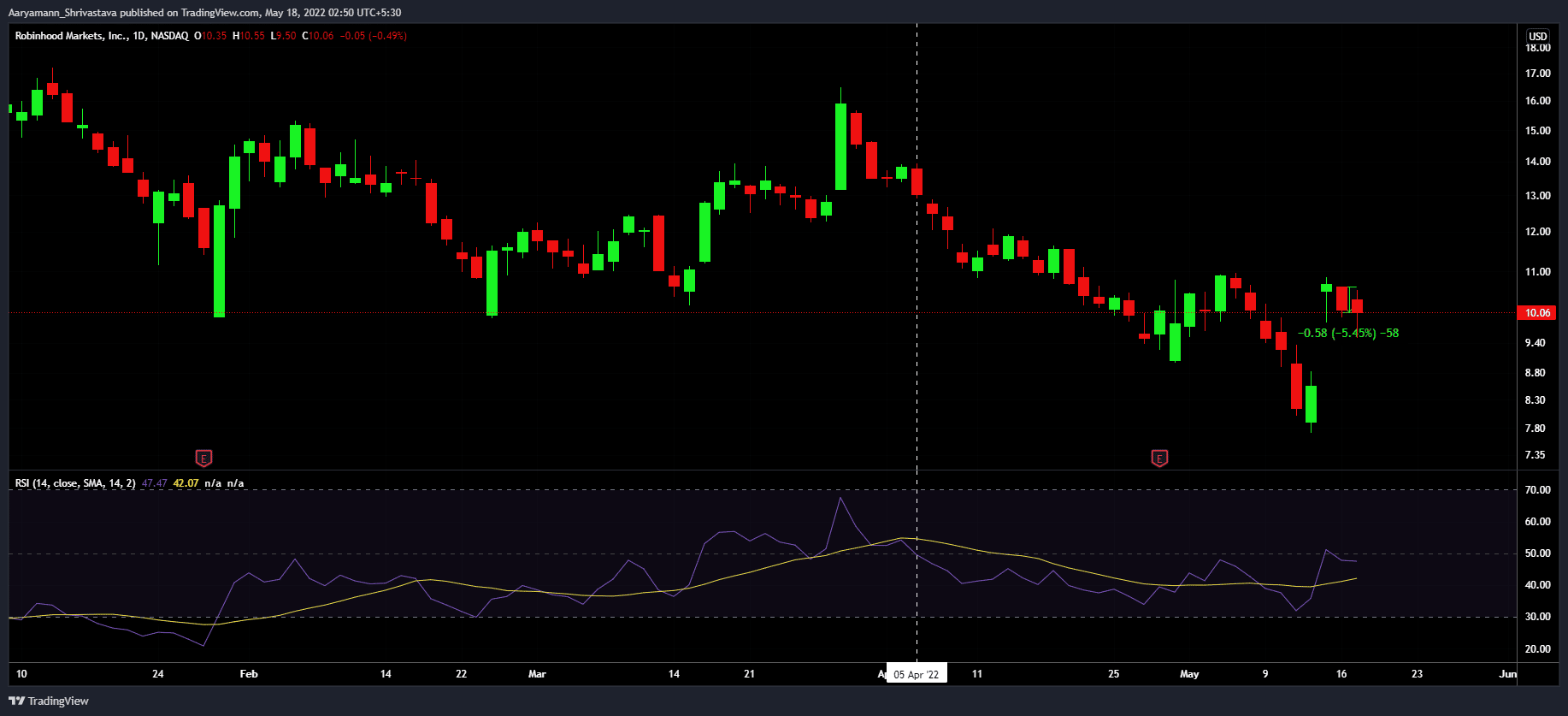

Even on the time of writing on Might 18, Robinhood’s ticker HOOD declined by 5.45% within the span of 48 hours, protecting its RSI restrained within the bearish, impartial zone for a month and a half straight.

Thus, to counter these negatives, Robinhood is doing essentially the most it will probably to draw extra customers and buying and selling quantity on its trade.

To bolster these efforts, it even prolonged the buying and selling hours for its inventory market trade by 4 hours. Robinhood goals to finally supply fairness buying and selling companies 24 hours a day, day-after-day.

In conclusion, whereas Robinhood is taking the correct steps by leaning on the crypto marketplace for its progress, it must additionally hold the present situation of the market in thoughts earlier than relying on it.

The crash of Might 9 impacted a whole lot of buyers, and the bearishness that ensued may hold newer buyers at bay for some time.