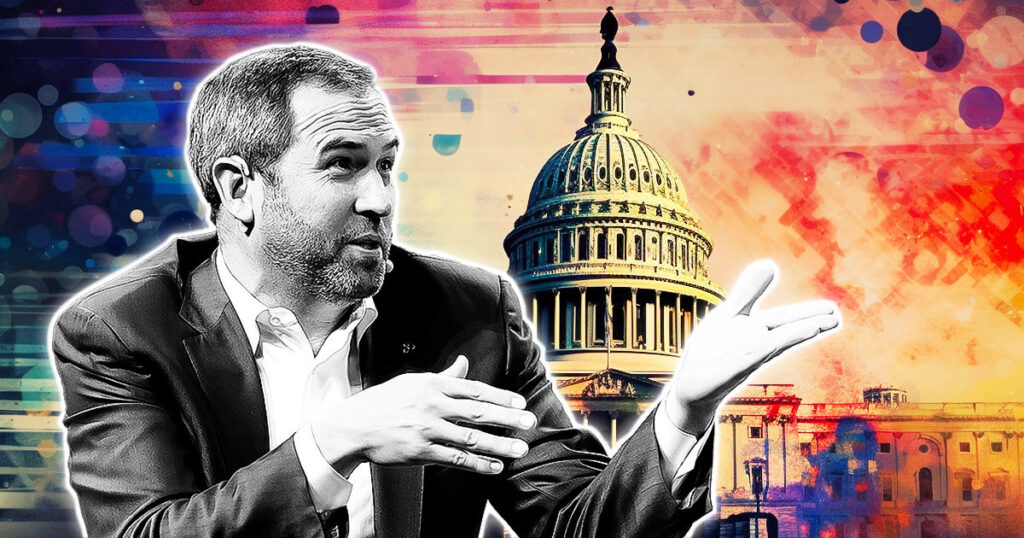

Ripple CEO Brad Garlinghouse mentioned U.S. crypto companies are more and more targeted on overseas jurisdictions because of the difficult regulatory panorama domestically.

“I believe it’s truthful to say the U.S. has made it as complicated as doable as to what the rule of the street are for the crypto business.”

A spate of regulatory enforcement actions and uncertainty in regards to the guidelines has resulted in capital and funding outflows from American shores, mentioned Garlinghouse — naming the EU as a big beneficiary as a consequence of this pattern.

Speaking to CNBC, the Ripple CEO laid the blame sq. on the Securities and Change Fee (SEC,) saying the company had been “on the forefront of that confusion.”

Growth abroad is the plan

Ripple has been in a authorized dispute with the SEC since December 2020 over allegations of promoting $1.3 billion of unregistered securities — within the XRP token.

The continuing court docket case is predicted to conclude shortly, with Garlinghouse predicting a verdict inside the subsequent six months.

Nonetheless, for the reason that submitting, Ripple has been rising its non-U.S. enterprise. For instance, in increasing its On-Demand Liquidity (ODL) service in Japan and partnering with non-U.S. banks similar to Oman’s BankDhofar.

Garlinghouse talked about that the majority of Ripple’s prospects are actually abroad, including that the majority of this 12 months’s new hires will give attention to recruiting non-U.S. residents.

“95% of our prospects are non-U.S., and this 12 months most of our hiring might be non-U.S. for a few of these very same causes.”

Concerning Ripple’s latest acquisition of Metaco, Garlinghouse acknowledged that the corporate’s operations are primarily centered in Europe, aligning nicely with the kind of prospects sought and the jurisdictions Ripple is focusing on for growth.

“We predict Metaco is an ideal match, from the place we’re making an attempt to develop our prospects at present.”

Ripple acquires Swiss custody agency Metaco

On Might 17, Ripple introduced buying Swiss-based crypto custody agency Metaco in a $250 million deal.

The tie-in will see Ripple develop its enterprise choices for digital asset custody, issuance, and settlement companies, primarily within the European market.

Garlinghouse instructed CNBC that Metaco is an ideal match for Ripple as a result of each corporations make regulatory compliance a key enterprise focus.

The put up Ripple CEO factors to regulatory confusion as US crypto companies search progress elsewhere appeared first on CryptoSlate.