The cryptocurrency business remains to be pretty new compared with the extra conventional asset lessons and its rising quickly. Blockchain expertise is the driving engine of the crypto house, it permits the upkeep of a safe and decentralized ledger of transactions.

With the intention to produce new currencies computer systems are used to unravel advanced computational issues which validate the transactions on the blockchain. That is known as ‘mining’ and creates new cash that are then distributed among the many miners.

With the crypto market being price over $1.7 trillion, firms had been fashioned amongst different issues to give attention to the mining facet of coin creation, with new ones arising and becoming a member of the fray. Finbold has analyzed this new area and pinpointed a publicly-traded crypto mining firm that’s rising quicker than the others.

Riot Blockchain Inc. (NASDAQ: RIOT)

RIOT is greater than only a crypto mining firm, it additionally hosts mining tools for institutional purchasers in addition to designs and produces electrical tools for Bitcoin mining. These two further income streams are completed by means of 2 subsidiaries, Whinestone, and ESS Metron, respectively.

The corporate elevated its revenues by 1,665% to $213.2 million in 2021 and diminished its loss to $7.9 million in comparison with the loss in 2020 of $12.7 million. Metrics which might be particular to the crypto mining sector additionally rose dramatically, particularly hashing capability elevated by 444% which suggests extra cash could be mined leading to extra revenue.

Shares of the corporate in addition to profitability rely extremely on the worth of Bitcoin probably the most distinguished crypto coin out there. With regulatory points in China surrounding the crypto house Bitcoin plummeted from all-time highs to beneath and round $40,000 per coin.

This has had a detrimental influence on the share value of RIOT which plummeted from the November 2020 highs to now commerce beneath all every day Easy Transferring Averages. Shares appear poised to check the beneath $13.5 resistance and if it holds a leg up could be seen. Traders searching for an entry level ought to monitor the inventory because it misplaced over 6% within the final buying and selling session.

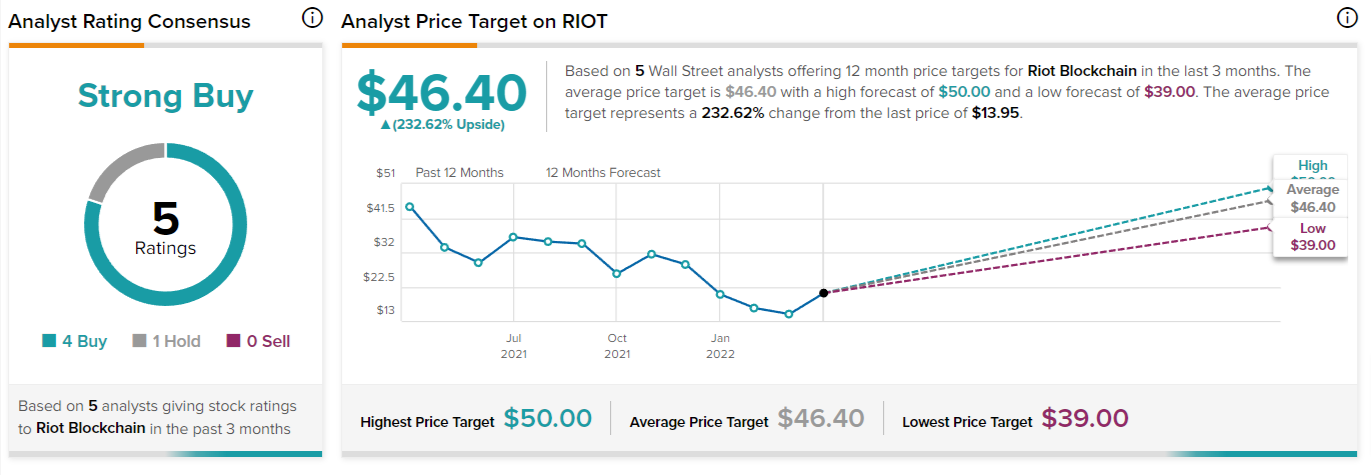

Analysts masking the inventory stay bullish giving the inventory a powerful purchase ranking regardless of the lackluster efficiency of the shares. For the subsequent 12 months, the typical value they see is $46 which is an eyewatering 232.62% larger than the present buying and selling value of solely $13.95.

How protected is it

In contrast to ‘conventional’ shares the crypto miners have a particular area of interest whose macro and micro occasions revolve across the value of cryptocurrencies. After all, some conventional parts like investing in enhancing capability, transparency and stewardship play an vital position however they appear to take a backseat to the crypto costs.

So long as Bitcoin is doing nicely market members can anticipate Riot and different miners to rally. Inflation would possibly truly be helpful as Bitcoin is commonly likened to digital gold and has develop into a type of protected haven for the youthful technology of traders.

Similar to crypto, miners generally tend to commerce uneven and with large fluctuations. Presently, the inventory is priced attractively for traders trying to make an entry, however threat urge for food must be gauged as a result of there’s the opportunity of extra volatility within the value within the close to future.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.