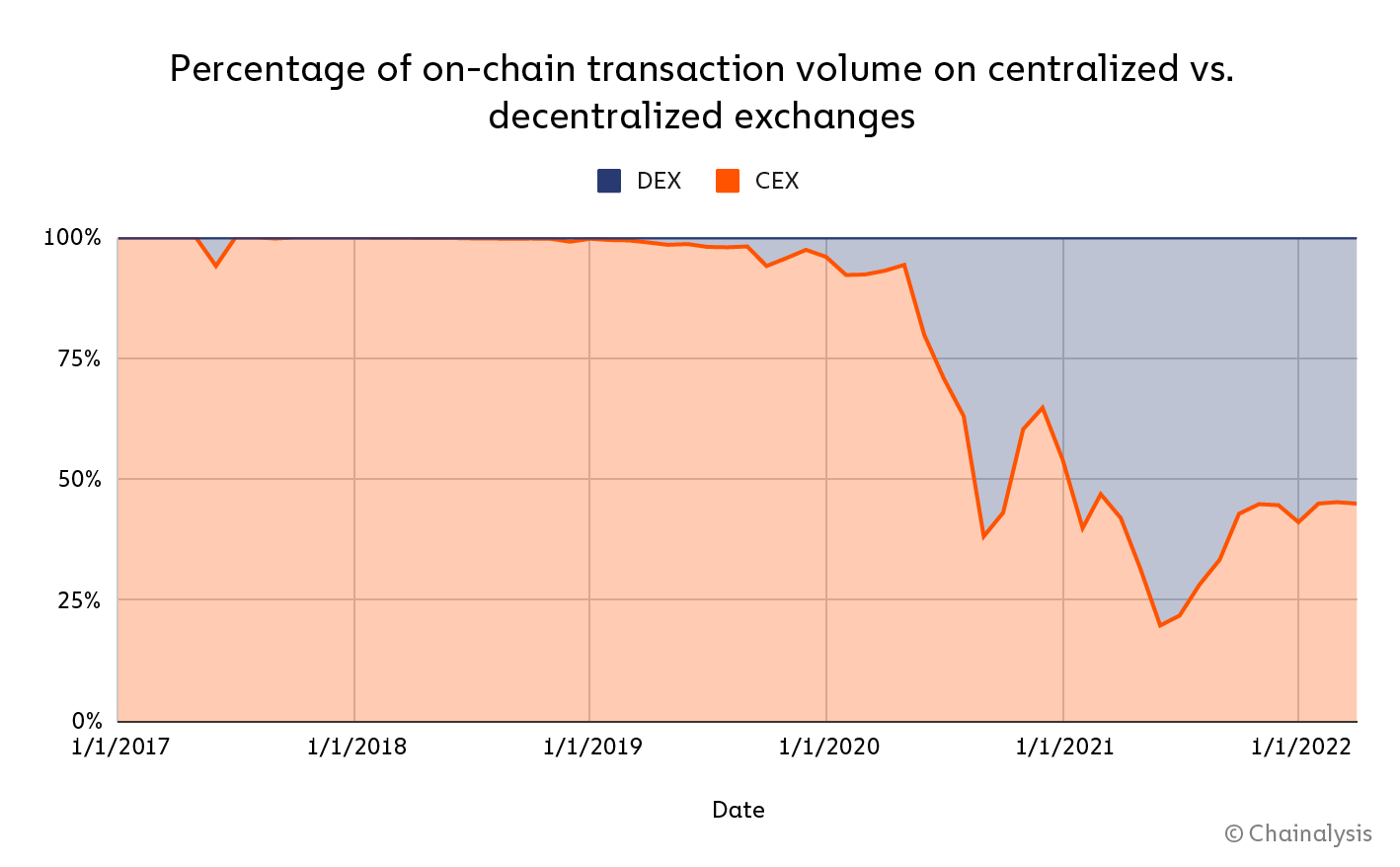

Decentralized exchanges (DEXs) have seen larger on-chain transaction volumes than centralized exchanges (CEXs) since 2020, Chainalysis’ new report reveals.

A preview of the State of Web3 Report reveals that between April 2021 and April 2022, the on-chain transaction quantity of DEXs was $224 billion, which is miles forward of the $175 billion for CEXs.

In response to the report, the key motive for DEXs main over CEXs is the expansion of DeFi previously few years.

Typically, the transaction volumes on centralized and decentralized exchanges are inclined to mirror the market efficiency of the crypto business. So it’s often excessive throughout a bull market and declines throughout a bear market.

The report identified that the primary time DEX buying and selling quantity surpassed that of CEX was in September 2020, when the on-chain buying and selling quantity of centralized exchanges dropped by 50%.

In June 2021, DEX’s buying and selling quantity reached its peak because it facilitated 80% of on-chain transaction volumes that month. Nevertheless, that determine has now dropped to 55%, displaying a slight dominance of the transaction quantity.

In response to the report, since most centralized change transactions occur off-chain by way of order books, it’s not possible to seize each transaction. So the report centered solely on property despatched to centralized exchanges on-chain.

5 DEXs dominate

Per the report, many of the buying and selling quantity on decentralized exchanges comes from the highest 5 exchanges. Nevertheless, the highest 5 centralized exchanges don’t get pleasure from this type of market dominance.

Presently, the highest 5 DEXs are Uniswap, SushiSwap, Curve, dYdX, and the 0x Protocol supported about 85% of all buying and selling quantity from decentralized exchanges and aggregated DEXs.

Nevertheless, the highest 5 CEXs – Binance.com, OKX.com, Coinbase.com, Gemini.com, and FTX.com – solely help about 50% of all on-chain centralized change transactions.

The reviews present the seemingly causes for the dominance of those few decentralized exchanges. One is the current emergence of the DeFi sector which implies most decentralized exchanges are but to determine themselves to take care of a powerful person base.

Moreover, DEXs depend on liquidity, and the highest 5 have essentially the most liquidity. So they may entice extra customers since larger liquidity ensures value stability for the most important merchants.

In the meantime, the potential for decentralized exchanges sustaining their dominance over centralized exchanges relies on whether or not they can proceed to supply cheaper buying and selling charges whereas circumventing the regulatory hurdles being confronted by centralized exchanges.