With the elevated name for larger regulation within the crypto business, sights are set on how this may have an effect on the core fundamentals of net 3. One space that’s typically neglected is the supply of information used to energy DeFi and the broader business at giant.

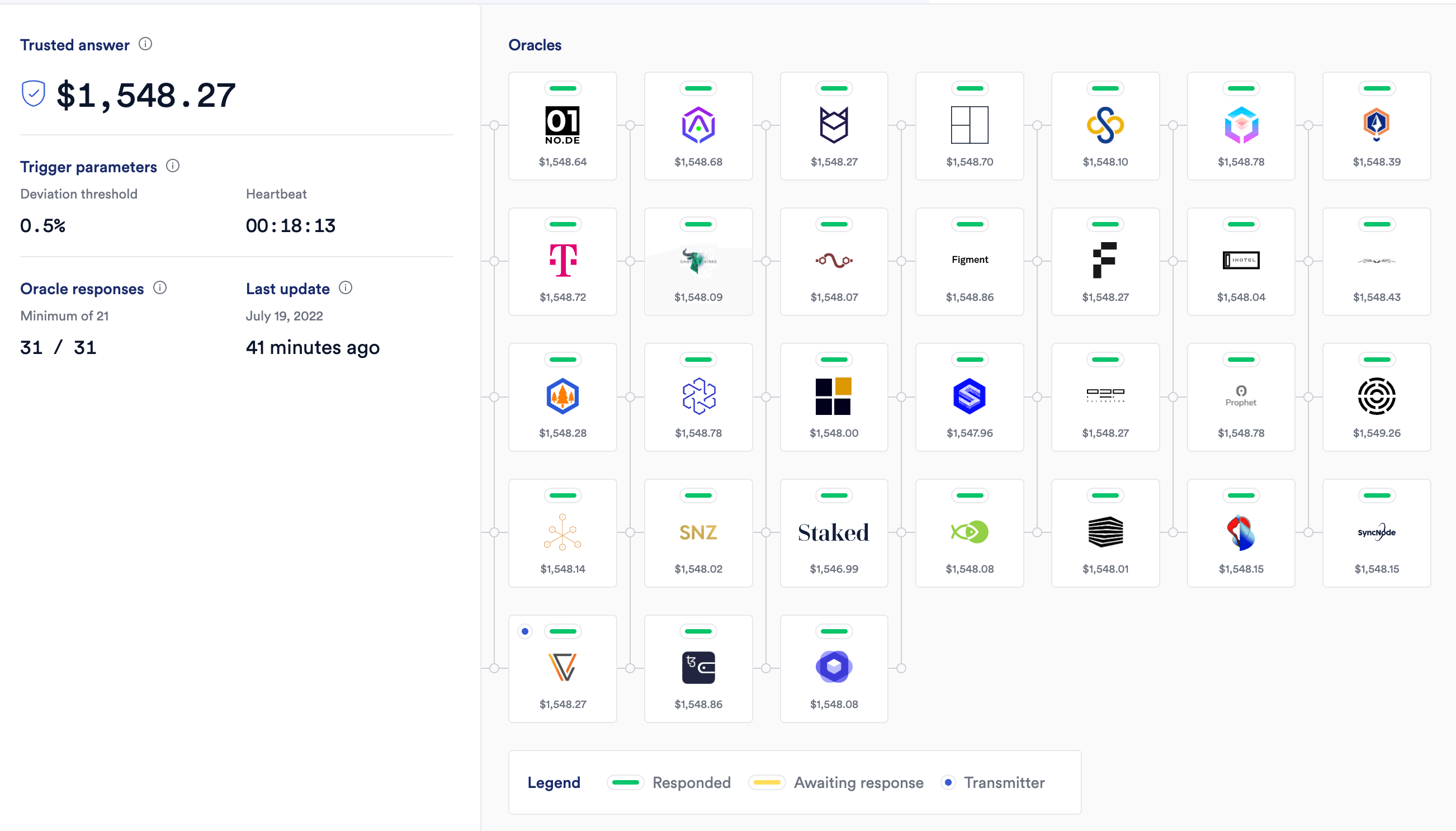

Datastreams akin to oracles mixture a variety of value information right into a single supply, then offered as reliable. The methodology depends on belief aggregation as a benchmark for the veracity of data.

Chainlink, one of many world’s largest oracles, makes use of “verified feeds” so as to add an extra layer of safety to the aggregation course of. Nevertheless, the feeds might not adjust to the necessities for institutional entities regulated by organizations such because the SEC or ESMA.

Nevertheless, oracle value manipulation has change into a significant challenge creating expensive exploits on platforms akin to Mirror Protocol, Inverse Finance, and Deus Finance. The problem comes when sufficient information streams are exploited, and the oracle value not represents the true world worth. This exploit can then result in funds being drained utilizing flash loans to reap the benefits of the value disparity.

At EthCC, Alexander Coenegrachts, founding father of Kaiko, introduced it had gained the CAST problem that provided

“As much as €150K of prize reward for startups and the chance for every winner to take part in actual transactions of Safety Tokens with worldwide establishments”

Kaiko affords an “enterprise grade” answer for “regulatory compliant” information streams, opening the door for conventional institutional gamers to reap the benefits of crypto markets. Laws akin to “the GAAP framework within the US, and its AIFMD within the EU” requires compliant information streams for sure institutional actors.

The provision of totally compliant pricing oracles might doubtlessly open the door to crypto indices the place sourcing such information has been, partially, liable for the dearth of a spot Bitcoin ETF in the USA. The flexibility to make the most of such oracles might additionally make basket ETF masking the highest 10 cryptocurrencies possible as soon as different regulatory hurdles have been surpassed.

The supplier of information for merchandise that should conform to GAAP or AIFMD should even be compliant. Kaiko’s current licensing offers make

“Kaiko’s aggregated quote the primary Securities Pricing Answer out there available on the market to be sourced by the purchase facet to Mark-to-Matrix or Mark-to-Mannequin digital belongings in compliance with US GAAP and EU AIFMD.”

This can be a large step ahead for the crypto business in a transfer to legitimize itself inside the conventional monetary sector. Kaiko’s information is already utilized by S&P World, Dow Jones, and GBBC in addition to a wealth of crypto-native firms akin to Ledger, Messari, and Coin Shares.