The latest decline within the value of bitcoin shouldn’t be the one factor that these within the house have needed to cope with. It has spilled into different essential points of the group resembling mining. Private and non-private miners have been having a tough run of it these days with their money circulation plummeting as a result of decline in bitcoin’s worth. Nonetheless, that isn’t the one downside that these miners have needed to cope with. Mining manufacturing has been hit exhausting for public miners.

Bitcoin Manufacturing Drops

On the finish of a really profitable 2021, many public bitcoin miners had come forth with roadmaps for the way they might enhance their BTC manufacturing. Every considered one of these corporations had come ahead with excessive guarantees of the place they wished to get their hashrate to. Naturally, provided that the market was doing nicely at that time, there was no purpose on the a part of traders to doubt these plans. However the first half of 2022 has painted a brutal image.

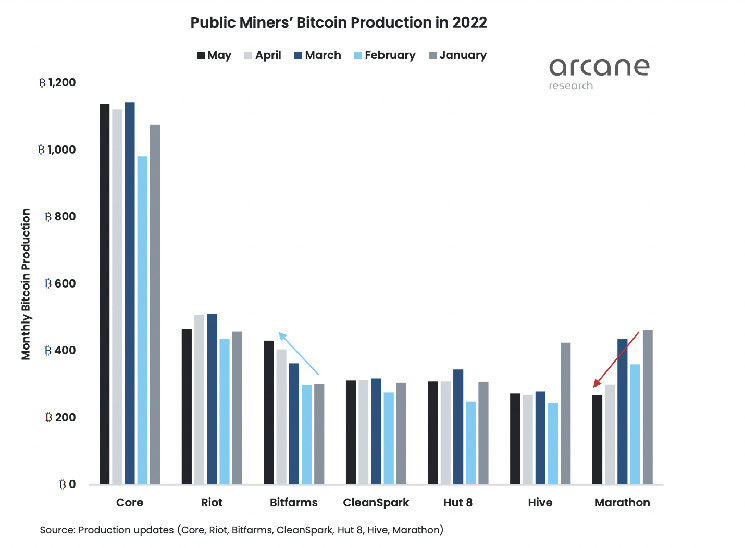

Marathon Digital is undoubtedly one of many leaders within the house on the subject of public bitcoin mining, and it has struggled the toughest on the subject of fulfilling its guarantees of upper BTC manufacturing. Marathon had kicked off the 12 months with an excellent manufacturing uncommon of 462 BTC. Nonetheless, since then, its manufacturing has continued to plummet. By the top of Might, the mining firm had solely produced 268 BTC, a 42% drop from the quantity in January.

The case throughout different prime public miners was comparable. Though not all of them have recorded a gradual plummet like Marathon, they’ve been unable to take care of constant development in BTC manufacturing. Even Core Scientific has discovered itself on this rut.

public miners’ manufacturing stay unsteady | Supply: Arcane Analysis

Bitfarms was the one exception and it has continued to take care of constant development via the primary half of 2022. To place this into perspective, Bitfarms had seen 301 BTC produced in January. On the finish of Might, the BTC produced had risen 43% to 431 BTC.

A whole lot of these corporations are confronted with a rise in mining issue over the past 5 months. Moreover, they proceed to cope with money circulation and profitability points given the bitcoin value crash. These losses are additionally closely featured of their inventory costs. For Marathon Digital, its inventory value is down from its $83.45 year-to-date excessive to be buying and selling at a present value of $6.87 on the time of this writing. This exhibits an 81% drop within the final 12 months alone.

BTC losses momentum and falls to $21,000 | Supply: BTCUSD on TradingView.com

Nonetheless, Bitcoin block manufacturing is on the rise as soon as once more. It’s now sitting at 6.23 blocks produced per hour in comparison with the 5.86 blocks per hour from the earlier week, representing a 6.19% improve. Nonetheless, miner revenues stay muted with a 0.76% drop within the final week.

With the costs falling, bitcoin miners stand the danger of shedding extra of their money circulation. It’s predicted that if the present bear market continues, an excellent variety of miners would fold up as a result of incapacity to fund their mining actions.