America Client Value Index soared to 9.1% in June, exceeding expectations of an 8.8% rise year-on-year. Presently, the Fed funds futures level to an 81 foundation factors charge hike for July, suggesting that some members anticipate a 100 foundation factors hike.

A number of on-chain indicators have been pointing to a probable backside in Bitcoin (BTC) however the analysts from market intelligence agency Glassnode will not be satisfied that the low has been made. In “The Week On-Chain” report on July 11, the analysts stated that the market might need to fall additional “to completely take a look at investor resolve, and allow the market to determine a resilient backside.”

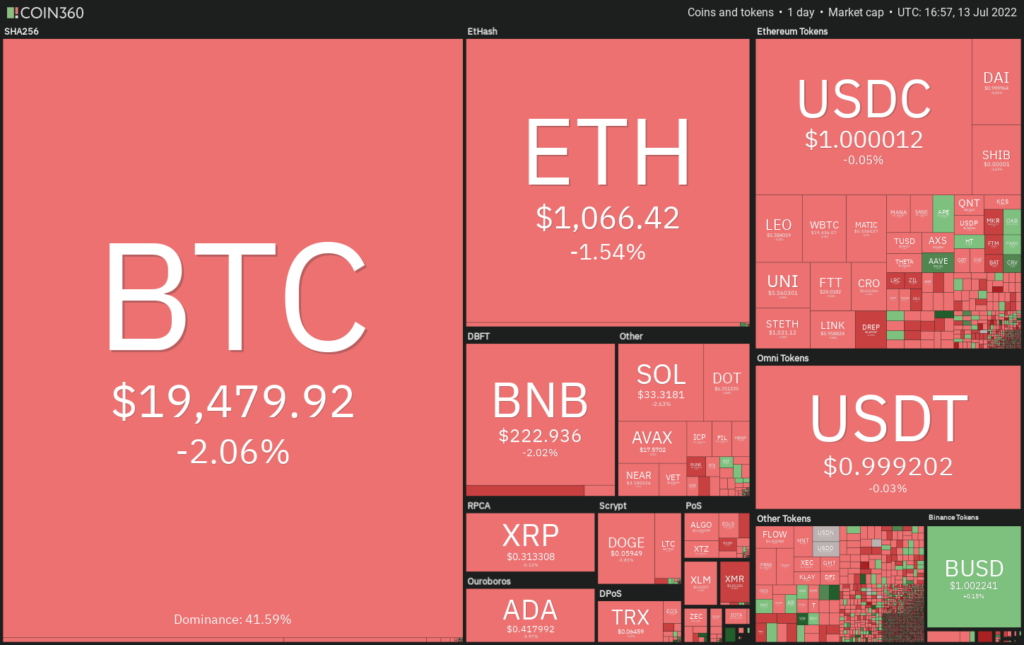

Day by day cryptocurrency market efficiency. Supply: Coin360

Day by day cryptocurrency market efficiency. Supply: Coin360Whereas the quick time period stays bearish, strategists are assured about its long-term prospects. CoinShares chief technique officer Meltem Demirors stated on CNBC that Bitcoin might prolong its “downward correction” within the close to time period however it’s more likely to make a brand new all-time excessive “within the subsequent 24 months.”

What are the necessary ranges on Bitcoin and the main altcoins that would arrest the decline? Let’s research the charts of the top-10 cryptocurrencies to search out out.

BTC/USDT

Bitcoin dropped again to the help line of the symmetrical triangle on July 12, indicating that the break above the triangle on July 7 might have been a bull entice.

BTC/USDT every day chart. Supply: TradingView

BTC/USDT every day chart. Supply: TradingViewThe patrons are attempting to defend the extent however the lengthy wick on the July 13 candlestick exhibits that the bears are promoting close to the 20-day exponential transferring common ($20,796). Each transferring averages are sloping down and the relative power index (RSI) is within the damaging zone, indicating that bears are in command.

If the value breaks beneath the help line, the BTC/USDT pair may drop to the $18,626 to $17,622 help zone. This is a vital zone for the bulls to defend as a result of if it offers manner, the pair may decline to $15,000.

The primary signal of power will likely be a break and shut above the 20-day EMA. Such a transfer will recommend robust shopping for at decrease ranges. That would improve the opportunity of a rally to the 50-day easy transferring common ($24,084).

ETH/USDT

Ether (ETH) broke beneath the help line of the ascending triangle sample on July 12 which invalidated the bullish setup. A minor constructive is that the bulls are attempting to push the value again into the triangle.

ETH/USDT every day chart. Supply: TradingView

ETH/USDT every day chart. Supply: TradingViewIn the event that they handle to do this, it should recommend that the break beneath the triangle might have been a bear entice. The bulls will then try to push the value again above the overhead resistance at $1,280. A break and shut above the 50-day SMA ($1,383) may improve the prospects of the beginning of a brand new up-move.

Opposite to this assumption, if the value turns down from the help line, it should recommend that bears have flipped the extent into resistance. The sellers will then attempt to sink the ETH/USDT pair beneath $998 and problem the pivotal help at $881. If this help cracks, the pair may begin the following leg of the downtrend.

BNB/USDT

The bulls couldn’t capitalize on Binance Coin’s (BNB) break above the 20-day EMA ($231). This failure was exploited by the bears who bought aggressively at greater ranges and pulled the value again beneath the 20-day EMA on July 11.

BNB/USDT every day chart. Supply: TradingView

BNB/USDT every day chart. Supply: TradingViewThe BNB/USDT pair tried a rebound off the robust help at $211 on July 13 however the lengthy wick on the candlestick exhibits that the bears are promoting close to the 20-day EMA. If the value breaks beneath $211, the promoting may intensify and the pair might slide to the very important help at $183.

Conversely, if the value rebounds off $211 and rises above the 20-day EMA, it should recommend robust demand at decrease ranges. The patrons will then make one other try and clear the overhead hurdle on the 50-day SMA ($253).

XRP/USDT

Ripple (XRP) plunged beneath the help line of the symmetrical triangle on July 11. This means that the uncertainty among the many bulls and the bears resolved to the draw back.

XRP/USDT every day chart. Supply: TradingView

XRP/USDT every day chart. Supply: TradingViewThe bulls tried to push the value again into the triangle on July 13 however the lengthy wick on the candlestick means that bears are promoting on minor intraday rallies. If the value breaks beneath $0.30, the XRP/USDT pair may drop to the essential help at $0.28. A break and shut beneath this stage may sign the beginning of the following leg of the downtrend.

The primary signal of power will likely be a break and shut above the 20-day EMA ($0.33). Such a transfer will recommend that the slide beneath the triangle might have been a bear entice. The pair might sign a possible development change on a break above the resistance line of the triangle.

ADA/USDT

Cardano (ADA) slipped beneath the rapid help at $0.44 on July 11, indicating that bears are in command. The promoting continued and the bears pulled the value to the necessary help at $0.40.

ADA/USDT every day chart. Supply: TradingView

ADA/USDT every day chart. Supply: TradingViewThe patrons tried to begin a restoration on July 13 however the lengthy wick on the day’s candlestick exhibits that bears are attempting to flip the $0.44 stage into resistance. If the value breaks beneath $0.40, the promoting may choose up momentum and the ADA/USDT pair may resume the downtrend. The pair may then decline to $0.33.

To invalidate this damaging view, patrons must push and maintain the value above the transferring averages. If that occurs, the pair may try a rally to $0.60.

SOL/USDT

Solana (SOL) broke beneath the help line of the symmetrical triangle on July 11 and makes an attempt by the bulls to push the value again into the triangle failed on July 12.

SOL/USDT every day chart. Supply: TradingView

SOL/USDT every day chart. Supply: TradingViewNonetheless, the bulls haven’t given up and are once more attempting to push the value again into the triangle on July 13. In the event that they succeed, it should recommend that the breakdown on July 11 might have been a bear entice. The patrons will then attempt to overcome the barrier on the resistance line and begin a brand new up-move towards $50.

Opposite to this assumption, if the value turns down from the present stage or the overhead resistance and breaks beneath $31, the promoting may intensify and the SOL/USDT pair may drop to $26.

DOGE/USDT

Dogecoin (DOGE) slipped beneath the 20-day EMA ($0.07) on July 10. The bears made use of this chance and pulled the value beneath the robust help at $0.06 on July 12.

DOGE/USDT every day chart. Supply: TradingView

DOGE/USDT every day chart. Supply: TradingViewIf the value sustains beneath $0.06, the promoting may choose up momentum and the DOGE/USDT pair may retest the essential help at $0.05. This is a vital stage to control as a result of a break beneath it may sign the resumption of the downtrend. The pair may then drop to $0.04.

Alternatively, if the value rises from the present stage, the patrons will attempt to push the pair above the transferring averages. In the event that they succeed, the pair may rise to $0.08 and subsequent to $0.10.

Associated: Dogecoin misses bullish goal after Elon Musk snubs Twitter — what’s subsequent for DOGE worth?

DOT/USDT

Polkadot (DOT) broke and closed beneath the essential help of $6.36 on July 12, indicating aggressive promoting by the bears. A minor constructive is that the RSI has maintained the constructive divergence, indicating that the bearish momentum could also be ending.

DOT/USDT every day chart. Supply: TradingView

DOT/USDT every day chart. Supply: TradingViewThe patrons are attempting to push the value again above $6.36 and entice the aggressive bears. If that occurs, the DOT/USDT pair may rally to the overhead resistance at $7.30. The patrons must clear this hurdle and the 50-day SMA ($8.04) to point that the downtrend could also be over.

Conversely, if the value fails to maintain above $6.36, it should recommend that bears stay in management. The sellers will then attempt to resume the downtrend and sink the pair to $5.

SHIB/USDT

Shiba Inu (SHIB) dropped beneath the psychological stage at $0.000010 on July 12, indicating robust promoting by the bears. A minor constructive is that the bulls bought the dip and try to maintain the value again above $0.000010.

SHIB/USDT every day chart. Supply: TradingView

SHIB/USDT every day chart. Supply: TradingViewEach transferring averages have flattened out and the RSI is slightly below the midpoint, indicating a stability between provide and demand. In a spread, merchants typically purchase close to the help and promote near the resistance.

If patrons drive the value above the transferring averages, the SHIB/USDT pair may try a rally to $0.000012. The bulls must clear this resistance to open the doorways for a doable rally to $0.000014. This view may invalidate on a break beneath $0.000009.

LEO/USD

The repeated failure of the patrons to maintain UNUS SED LEO (LEO) above $6 suggests an absence of demand at greater ranges. Which will have attracted promoting from the aggressive bears.

LEO/USD every day chart. Supply: TradingView

LEO/USD every day chart. Supply: TradingViewThe value turned down from $5.91 on July 10 and plunged beneath the 20-day EMA ($5.60). This was adopted by additional promoting which pulled the value beneath the 50-day SMA ($5.42) on July 12. If bears maintain the value beneath the 50-day SMA, the LEO/USD pair may drop towards the help line of the descending channel.

Conversely, if the value rebounds off the present stage, the bulls will make one other try and clear the overhead hurdle on the resistance line and problem the essential stage at $6. A break and shut above this stage may sign the beginning of a brand new up-move.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You must conduct your personal analysis when making a call.

Market information is offered by HitBTC alternate.

Supply: Cointelegraph.com

Disclaimer: Cardano Feed is a Decentralized Information Aggregator that allows journalists, influencers, editors, publishers, web sites and group members to share information concerning the Cardano Ecosystem. Consumer should at all times do their very own analysis and none of these articles are monetary advices. The content material is for informational functions solely and doesn’t essentially mirror our opinion.