Bitcoin (BTC) has been caught between $45,400 and $47,500 for the previous two days, indicating a troublesome tussle between the consumers and sellers as each try to ascertain management over the development.

Knowledge from on-chain analytics agency Glassnode confirmed that 100,000 Bitcoin left exchanges in March. These giant portions of withdrawals have solely occurred twice within the historical past of Bitcoin with the biggest being in March 2020. Nevertheless, this doesn’t imply the value will rally instantly. In 2020, the momentum picked up solely by the fourth quarter of the 12 months.

For the close to time period, analysts stay divided with some anticipating Bitcoin to drop to $44,800 and even to $43,000 whereas others anticipate a rally to the psychological stage at $50,000.

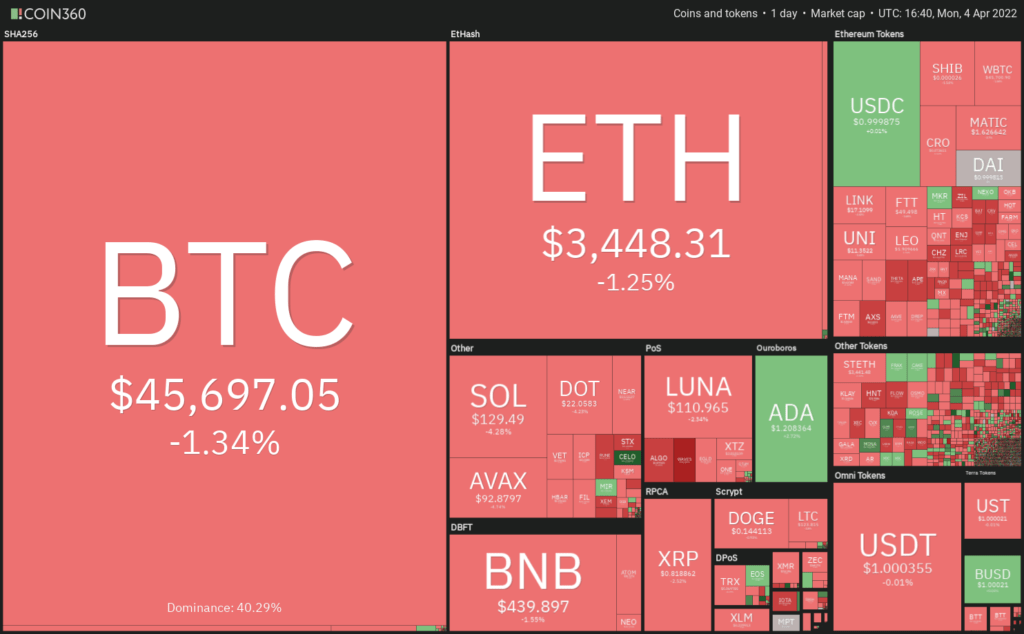

Each day cryptocurrency market efficiency. Supply: Coin360

Each day cryptocurrency market efficiency. Supply: Coin360Because the crypto markets mature, they proceed to draw new traders. A report by Gemini crypto trade highlighted that the variety of customers who bought their first cryptocurrency in 2021 soared by greater than 50% in India, Brazil and Hong Kong. Even Latin America, Asia Pacific, america and Europe witnessed greater than 40% new customers who began investing in 2021.

Might Bitcoin and altcoins bounce off their assist and lengthen the restoration? Let’s examine the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

The lengthy wick on the candlestick of the previous two days means that bears are promoting close to the 200-day easy transferring common ($48,266). A minor optimistic has been that the bulls haven’t allowed Bitcoin to interrupt under the essential assist at $45,400.

BTC/USDT each day chart. Supply: TradingView

BTC/USDT each day chart. Supply: TradingViewNevertheless, this tight-range buying and selling is unlikely to proceed for lengthy. If the value breaks under the 20-day exponential transferring common ($44,467), the BTC/USDT pair may drop to the 50-day SMA ($41,689). Such a transfer may invalidate the short-term bullish setup.

Conversely, if the value rises from the present stage or the 20-day EMA, it can recommend that merchants proceed to purchase on dips. That might improve the prospects of a break above the 200-day SMA. If that occurs, the pair may rally to $52,000.

ETH/USDT

Ether (ETH) broke and closed above the 200-day SMA ($3,487) on April 3 however the bulls couldn’t maintain the upper ranges. This implies that the bears are attempting to drag the value decrease and lure the aggressive bulls.

ETH/USDT each day chart. Supply: TradingView

ETH/USDT each day chart. Supply: TradingViewIf the value breaks under $3,411, the bears will attempt to pull the ETH/USDT pair to the 20-day EMA ($3,197). This is a vital stage for the bulls to defend if they need the optimistic momentum to stay intact.

If the value rebounds off the 20-day EMA, the consumers will once more attempt to thrust and maintain the value above the 200-day SMA. In the event that they handle to try this, the pair may rally to $4,000.

Then again, if the 20-day EMA assist offers means, the promoting may intensify and the pair might drop to the 50-day SMA ($2,895).

BNB/USDT

Binance Coin (BNB) has been buying and selling near the $445 stage for the previous few days. Though the bulls pushed the value above this stage repeatedly, they might not maintain the upper ranges and problem the 200-day SMA ($467). This means that demand dries up at greater ranges.

BNB/USDT each day chart. Supply: TradingView

BNB/USDT each day chart. Supply: TradingViewThe bears will now attempt to pull the value to the 20-day EMA ($421) which is a vital assist to be careful for. If the value rebounds off this stage, the consumers will make another try to clear the overhead hurdle and push the BNB/USDT pair to $500.

Alternatively, if the value breaks under the 20-day EMA, it can recommend that the short-term merchants could also be reserving income. That might pull the value to the 50-day SMA. A break under this assist will recommend that the break above $445 might have been a bull lure.

SOL/USDT

Solana’s (SOL) restoration stalled slightly below the 200-day SMA ($150). This implies that greater ranges are attracting promoting by the bears. The bears will now attempt to pull the value to the breakout stage at $122.

SOL/USDT each day chart. Supply: TradingView

SOL/USDT each day chart. Supply: TradingViewIf the value rebounds off $122, the bulls will make one other try to clear the overhead hurdle on the 200-day SMA. In the event that they succeed, the SOL/USDT pair may rally towards the psychological stage at $200. The rising 20-day EMA ($111) and the relative power index (RSI) close to the overbought zone point out benefit to consumers.

Opposite to this assumption, if bears sink the value under $122, the pair may drop to the 20-day EMA. This is a vital assist to regulate as a result of a break under it may end in a decline to the 50-day SMA ($96).

XRP/USDT

The bulls tried to push Ripple (XRP) above the overhead resistance at $0.86 however the bears didn’t budge. The failure to rise above $0.86 might entice profit-booking from short-term merchants which may sink the value to the 50-day SMA ($0.78).

XRP/USDT each day chart. Supply: TradingView

XRP/USDT each day chart. Supply: TradingViewIf the value as soon as once more bounces off the 50-day SMA, it can recommend that bulls are accumulating on dips. That might preserve the XRP/USDT pair caught between the 50-day SMA and the 200-day SMA ($0.89) for just a few days.

The flattish 20-day EMA ($0.82) and the RSI close to the midpoint additionally recommend a consolidation within the close to time period.

If bears pull the value under the 50-day SMA, the pair may plummet to $0.70. Alternatively, if consumers drive the value above the 200-day SMA, the pair may rally to the psychological stage at $1.

ADA/USDT

Cardano (ADA) turned up on April 1 and has reached the overhead resistance at $1.26 the place the bulls are more likely to encounter sturdy resistance from the bears.

ADA/USDT each day chart. Supply: TradingView

ADA/USDT each day chart. Supply: TradingViewThe upsloping 20-day EMA ($1.08) and the RSI close to the overbought zone point out that the trail of least resistance is to the upside. If bulls push the value above $1.26, the ADA/USDT pair may rally to the 200-day SMA ($1.48) after which to $1.63.

Conversely, if the value as soon as once more turns down from the overhead resistance, the pair may drop to the 20-day EMA. A break and shut under this assist may pull the value all the way down to the psychological stage at $1.

LUNA/USDT

Terra’s LUNA token broke out of the overhead resistance at $111 on April 2 and made a brand new all-time excessive at $118 on April 3. This implies that the bulls are within the driver’s seat.

LUNA/USDT each day chart. Supply: TradingView

LUNA/USDT each day chart. Supply: TradingViewNevertheless, the unfavourable divergence on the RSI warns that the bullish momentum could also be weakening and the LUNA/USDT pair may witness a minor correction or consolidation.

If the value slips under the 20-day EMA ($100), merchants who might have purchased at decrease ranges may guide income. That might pull the value all the way down to the 50-day SMA ($84).

Conversely, if the value rebounds off the 20-day EMA, it can recommend that the bulls proceed to defend the extent aggressively. The consumers will then attempt to push the pair above $118. In the event that they succeed, the pair may rise to $125 and later march towards $150.

Associated: Neutrino Greenback breaks peg, falls to $0.82 amid WAVES value ‘manipulation’ accusations

AVAX/USDT

Avalanche (AVAX) repeatedly broke above the overhead resistance at $98 previously few days however the bulls couldn’t maintain the upper ranges. This means that bears are defending the extent with vigor.

AVAX/USDT each day chart. Supply: TradingView

AVAX/USDT each day chart. Supply: TradingViewThe bears will now attempt to pull the value to the 20-day EMA ($89). This is a vital stage to be careful for as a result of a powerful rebound off it can recommend that the sentiment stays bullish and merchants are shopping for on dips.

That might enhance the opportunity of a break and shut above the $98 to $100 resistance zone. If that occurs, the AVAX/USDT pair may rally to $120.

Opposite to this assumption, if the value continues decrease and breaks under the 20-day EMA, the subsequent cease may very well be the 50-day SMA ($82). The pair may then lengthen its range-bound motion for just a few extra days.

DOT/USDT

Polkadot (DOT) broke and closed above the overhead resistance at $23 on April 3 however the bulls couldn’t maintain the upper ranges. This implies that the bears haven’t but given up and are promoting on each rise.

DOT/USDT each day chart. Supply: TradingView

DOT/USDT each day chart. Supply: TradingViewThe bears are attempting to maintain the value under $23 and lure the aggressive bulls who might have gone lengthy on a breakout above the resistance. The essential stage to observe on the draw back is the 20-day EMA ($21).

If this assist cracks, the DOT/USDT pair may drop to $19. If the value rebounds off this stage, the DOT/USDT pair may stay range-bound between $19 and $23 for just a few days.

Conversely, if the value turns up from the present stage and breaks above $24, the pair may rally to the 200-day SMA ($29).

DOGE/USDT

Dogecoin (DOGE) rebounded off the 20-day EMA ($0.13) on April 3, indicating that the bulls proceed to defend this stage aggressively. The rising 20-day EMA and the RSI within the optimistic zone point out benefit to consumers.

DOGE/USDT each day chart. Supply: TradingView

DOGE/USDT each day chart. Supply: TradingViewThe shopping for continued at this time and the bulls tried to renew the up-move towards the overhead resistance zone between $0.17 and the 200-day SMA ($0.18) however the lengthy wick on the candlestick means that bears are promoting at greater ranges.

If the value continues decrease and breaks under the 20-day EMA, it can recommend that the DOGE/USDT pair may stay range-bound between $0.10 and $0.17 for just a few extra days.

The bulls should propel and maintain the value above the 200-day SMA to sign a possible change in development.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger. You must conduct your personal analysis when making a choice.

Market knowledge is supplied by HitBTC trade.

Supply: Cointelegraph.com