Broadly adopted cryptocurrency analyst Benjamin Cowen is warning that Ethereum (ETH) could collapse as a consequence of a minimum of one huge financial fear.

In a brand new technique session, Cowen tells his 779,000 Youtube subscribers that the main good contract platform may decline by greater than 65% from its present value of $1,174.

“I do suppose you’re nonetheless taking a look at a leg decrease right here on Ethereum’s valuation in opposition to the US greenback. I believe round that $400-$600 vary is an efficient spot to start on the lookout for that very same kind of worth that we noticed within the final cycle.”

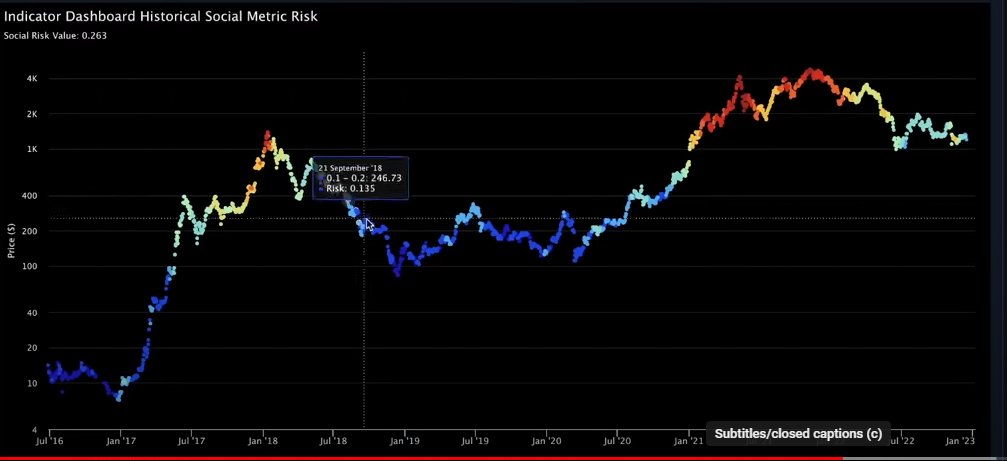

Cowen can be maintaining an in depth watch on the social threat metric, an indicator that gauges retail curiosity within the area by monitoring the variety of folks tuning in to crypto YouTube channels and following accounts on Twitter devoted to digital belongings.

In line with Cowen, Ethereum’s social threat metric means that ETH is organising for one more sell-off occasion.

“I nonetheless suppose Ethereum is probably going taking a look at decrease costs ultimately. I believe that is supported by the concept of the social threat. Social threat is lastly placing in new lows. When the social threat goes down usually the Bitcoin dominance goes up…

As a social threat plummets prefer it did again over right here in 2018, that was the place Ethereum took its subsequent leg down.”

Cowen additionally says {that a} looming recession, more likely to be triggered by the Federal Reserve’s sustained rate of interest hikes, would drive Ethereum approach down.

“I perceive that you realize a $600 Ethereum or perhaps a $400 Ethereum is one other 50% correction or extra from these ranges. However I do suppose there may be motive to suppose that it may occur, not solely from a value perspective and a technical perspective.

And I do know there’s type of the elemental concept of all of the Ethereum that’s been burned and whatnot. However the different facet of it’s that we’re taking a look at a recession…

If a recession is coming, it’s doubtless not a superb factor for threat belongings like cryptocurrencies.”

I

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Artwork Furnace