Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- Polkadot pulls again to the 78.6% retracement degree

- Two decrease timeframe help zones to be careful for within the near-term

On decrease timeframes, Bitcoin [BTC] had a bearish outlook after its incapability to defend the $20k help zone. A drop beneath $19.2k would usher in additional promoting stress, whereas a transfer above $20.2k may recommend a restoration was on its means. Bitcoin’s value improvement would doubtless have a robust say within the path of Polkadot on the value charts.

Right here’s AMBCrypto’s Value Prediction for Polkadot [DOT] in 2022-23

Polkadot additionally had a decrease timeframe bearish momentum. Nevertheless, it approached a area of sturdy help on the charts. A bullish response on this zone may ship DOT towards the $8 mark. In different information, Polkadot claimed that DOT, which was initially supplied as a safety, has morphed into software program.

A pullback right into a day by day bullish order block- may the rally proceed?

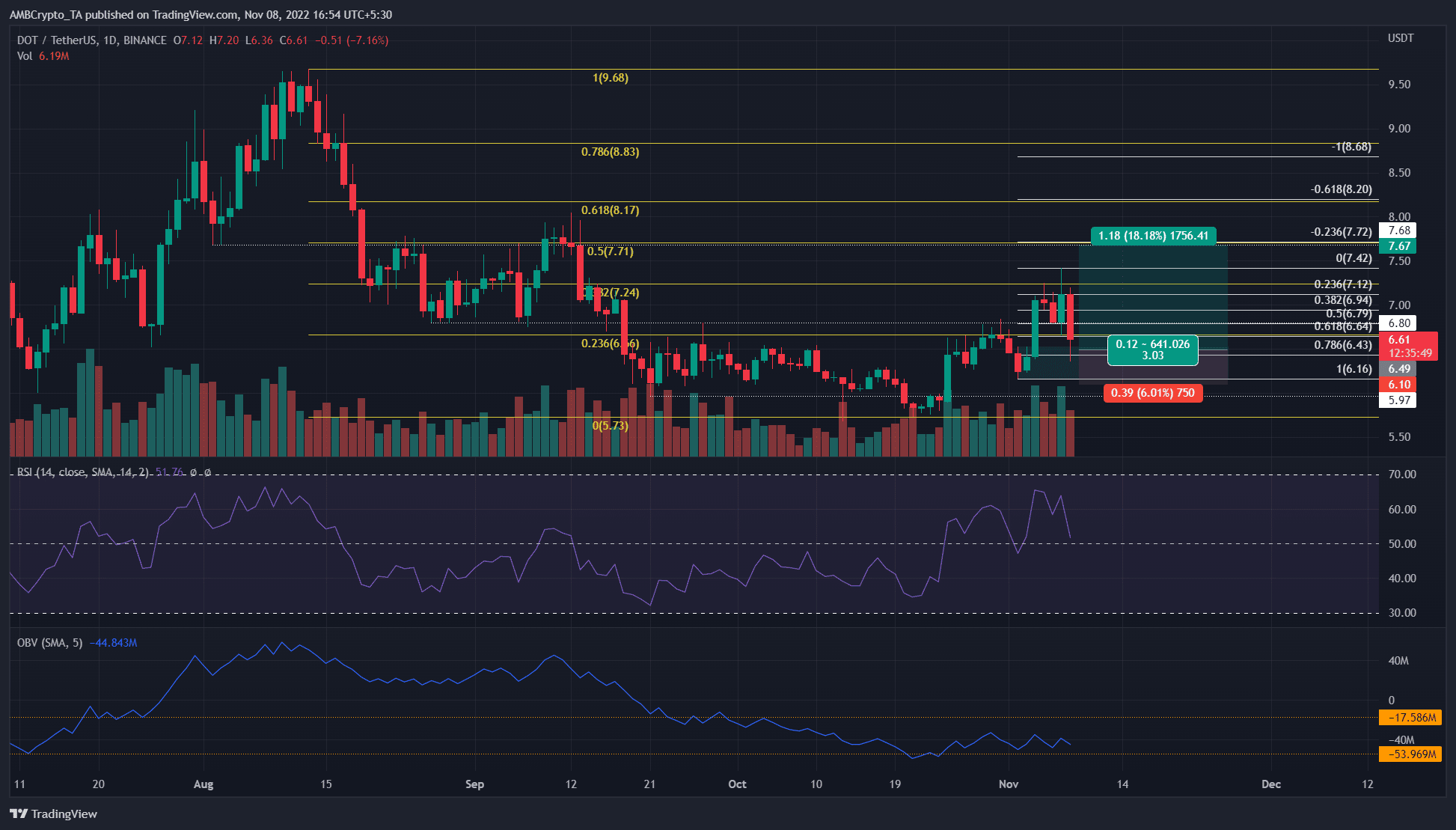

Supply: DOT/USDT on TradingView

From 21 October, Polkadot witnessed sizeable features. This could possibly be said contemplating DOT’s bounce from $5.73 on 20 October to $7.42 on 7 November, a transfer that measured almost 30%.

Nevertheless, 8 November got here with a pointy retracement the place DOT moved southward to the $6.4 space. The $6.9-$7 decrease timeframe help was damaged, however the larger timeframe bias remained bullish. This was as a result of the $6.16 larger low of the rally was unbeaten but. Furthermore, this degree has been a big degree of help since late September.

At $6.16, a bullish order block was noticed. There was a very good probability that this space would see a constructive response from the value because of the confluence with the $6.16 help degree.

Two units of Fibonacci retracement ranges (yellow and white) have been plotted. That they had confluence at $7.72 and $8.2. With DOT retaining its larger timeframe bullish construction, it was doubtless {that a} transfer above $6.8 may propel DOT to $7.7 and $8.2.

The Relative Energy Index (RSI) remained above impartial 50 on the day by day chart to point out that momentum remained biased in favor of the consumers. But, the On-Stability Quantity (OBV) didn’t see a surge in current days, which considerably undermined the thought of a robust rally for DOT up to now week.

Growth exercise is on a downtrend, and weighted sentiment additionally down

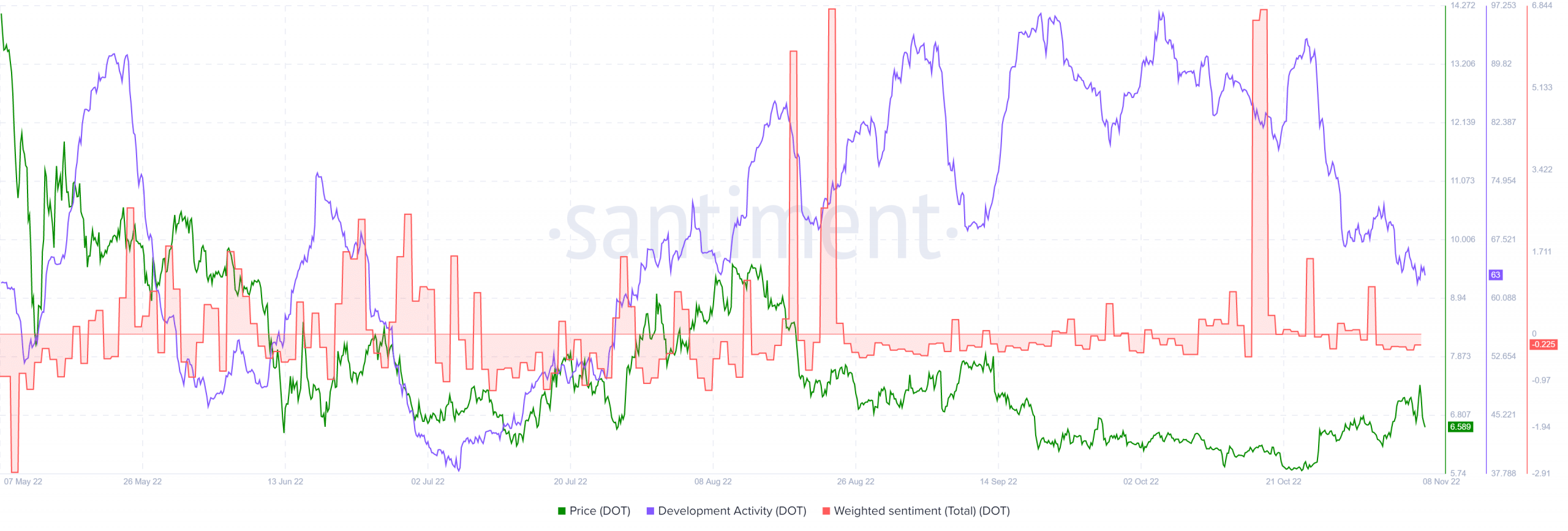

Supply: Santiment

Regardless of the rally from $5.7 in October, weighted sentiment has not been constructive. This steered a scarcity of appreciable constructive engagement on social media, and will additionally level towards the shortage of hype round DOT in current days.

Growth exercise was additionally in a downtrend however remained properly above the July lows. The funding rate remained within the constructive territory on some exchanges over the day past, with Binance and Okex being the exceptions.

If DOT can climb previous $6.8 with a hefty shopping for quantity, a push additional north would grow to be extra credible. On the time of writing, the bearish sentiment behind Bitcoin in current hours may see the king publish additional losses, which in flip would drag DOT southward.