Victim’s Heartbreaking Tale Highlights the Rise of Sophisticated Scams Targeting Vulnerable Individuals

A 72-year-old grandmother from Taranaki, Jill Creasy, has lost a staggering $224,000 to scammers who exploited her trust through an AI-generated deepfake video of New Zealand Prime Minister Christopher Luxon. The video, which surfaced on Facebook in July, falsely encouraged pensioners to invest in Bitcoin, claiming it would help supplement their incomes.

Creasy, who was drawn in by the seemingly legitimate advertisement, subsequently fell victim to a complex scam. She was approached by a Greek national named Adam Manolas, who posed as an investment adviser with Terma Group, claiming to operate from Manchester. After she expressed interest in investing her savings, Manolas guided her to download a remote access software called AnyDesk, which allowed him to take control of her computer.

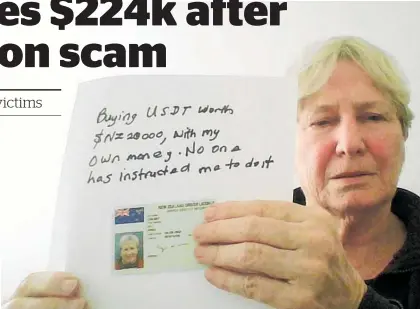

The fraud unfolded over 26 days, during which Creasy transferred money to purchase Bitcoin through Easy Crypto. Most transactions, capped at $20,000 per day due to her bank’s limits, were executed under Manolas’s direction. Unfortunately, the Bitcoin she believed was securely deposited in her Binance wallet was redirected to a separate account controlled by the scammers.

A computer expert later tracked the stolen Bitcoin to a third Binance “holding account,” which was reportedly processing nearly $3 million daily, suggesting a significant network of victims was affected. As her investments dwindled, Manolas even withdrew funds from accounts set up specifically for Creasy’s grandchildren. On one of their last calls, she overheard him tell colleagues, “This woman has no money.”

Promised an 8.5% return on her investment, Creasy was told her initial outlay had grown to nearly $320,000. However, when the expected dividend payment failed to materialize in late August, she began to realize she had been scammed. “First of all, I felt angry, and then I felt foolish, then I felt really ashamed,” she said, reflecting on the emotional toll of the incident.

Despite efforts to recover her funds, Creasy learned that the authorities had limited power to trace the international offenders. “It’s my fault, I facilitated him getting into my account. I was conned, and it’s a terrible feeling because you can’t really believe it,” she lamented. After reporting the fraud to both the police and TSB, she faced the painful reality that her life savings were gone.

Creasy’s outrage is compounded by her perception of the scammers as highly skilled con artists. She expressed a desire to hire a hacker to locate Manolas, even contemplating drastic measures against him. “I told the detective, ‘If you give me a Luger I’d drop him’,” she said, underscoring her frustration with the justice system’s inability to hold the criminals accountable.

A technology expert who assisted Creasy noted that the scammers appeared to operate within a large-scale international criminal network, utilizing cryptocurrency exchanges to launder stolen funds. “They preyed on Creasy due to her limited technological expertise and vulnerability,” he explained, highlighting the sophisticated methods used to gain her trust.

The Prime Minister’s office responded to the situation, emphasizing that Luxon would never endorse specific investments and urging New Zealanders to remain vigilant against scams. “It is distressing for anyone who falls victim to a scam,” a spokesperson said.

The Financial Markets Authority later issued a public warning regarding deepfake scams, following an investigation that revealed the extent of the fraud. In a statement, TSB clarified that Creasy had unknowingly enabled the scam by allowing remote access to her device and thus bore responsibility for the loss.

The bank advised customers to avoid sharing account details and to be wary of remote access software, a tactic often employed by scammers. Similarly, Easy Crypto confirmed it worked diligently to monitor and identify scams, emphasizing that the decision to proceed with the transactions ultimately rested with the customer.

Police are continuing their investigation, reminding the public that legitimate companies do not use remote-access software. They encourage anyone with suspicions to disconnect and contact the company directly or consult a trusted individual for advice. As Jill Creasy’s story illustrates, the battle against sophisticated scams is ongoing, leaving vulnerable individuals at risk of losing their hard-earned savings.