The top of a serious American hedge fund thinks the crashes and pumps of Bitcoin (BTC) might be much less unstable going ahead.

In a brand new weblog submit, Pantera Capital CEO Dan Morehead says extra institutional possession of BTC and the next Bitcoin market worth will average the highest crypto asset’s value swings.

“Whereas we’ve had two -80% bear markets already, I imagine these are a factor of our primordial previous. Future bear markets might be shallower. The earlier two have been -61% and -54%.

Sadly, there’s no free lunch. The flipside is we in all probability gained’t see the 100x rallies anymore both.”

Morehead argues that the present bear market is completed and Bitcoin has moved on to a brand new rally cycle.

“The following 6-12 months are more likely to see an enormous rally as buyers flee inventory, bond, and actual property markets – for blockchain.”

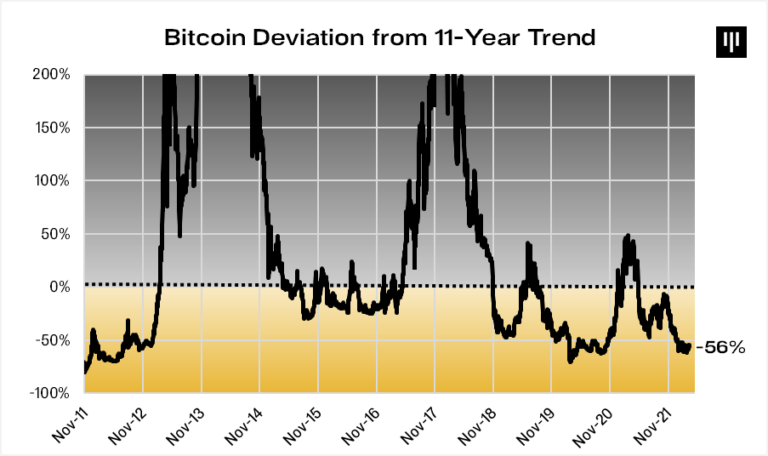

The CEO additionally notes that BTC in early April was 56% under the 11-year exponential progress pattern, which he says is a “uncommon” degree of cheapness for the Bitcoin market.

Bitcoin is buying and selling at $41,341 at time of writing. BTC is up greater than 4% prior to now 24 hours however down greater than 4% from the place it was priced per week in the past.

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/RomanYa/Sensvector