intermediate

Irrespective of whether or not you’re a newbie or an knowledgeable investor, one among your greatest priorities in buying and selling will seemingly be discovering the right entry and exit factors. Though loads of instruments will help you with that, overbought and oversold ranges are extensively thought-about among the many greatest ones. These indicators are an important a part of technical evaluation and might be simply used to establish key shopping for and promoting alternatives.

On this article, we are going to focus on what overbought and oversold situations and indicators imply and can take a look at some methods to acknowledge them. We will even present examples of how you should use these indicators to your benefit available in the market!

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, worth predictions, and data on the most recent developments instantly in your inbox!

Keep on high of crypto developments

Subscribe to our e-newsletter to get the most recent crypto information in your inbox

What Are Overbought and Oversold Indicators?

Overbought and oversold indicators are technical indicators used to establish when a safety turns into too costly or too low cost. One can apply these indicators to achieve extra perception when deciding on shopping for or promoting a safety.

How Do They Work?

Overbought and oversold indicators work by evaluating the present worth of a safety to its previous costs. Regardless of being named “indicators,” they don’t seem to be precise alarms — they simply present you that there’s a sure worth sample available in the market. After they seem, it means it’s best to pay nearer consideration to the market and different indicators as there’s a chance {that a} rally or a large sell-off is developing.

Overbought Indicators

An overbought sign happens when the present worth is far larger than the previous costs. This normally occurs when there’s a number of shopping for stress available in the market, and the worth of the safety goes up in a short time.

Oversold Indicators

An oversold sign happens when the present worth is far decrease than the previous costs. This sometimes happens when there’s a number of promoting stress available in the market, with the worth of an asset quickly declining.

Learn how to Establish Overbought and Oversold Indicators

There are lots of other ways to establish overbought and oversold indicators. Among the hottest strategies embrace technical indicators, such because the Relative Energy Index (RSI) or the Stochastic Oscillator.

In the event you don’t need to use buying and selling interfaces or something like that, you should use one of many many obtainable web sites that decide whether or not an asset is oversold or overbought. They are going to present you a ready-to-use ranking that can replicate the present general market pattern for that asset. Most of those readings are calculated mechanically, however it’s best to nonetheless be cautious and never totally belief them.

Overbought Indicators

As we talked about earlier, overbought indicators happen when the present worth is far larger than the previous costs. It sometimes follows a protracted and intense rally.

Keeping track of a digital asset’s worth motion may also be a great way to establish overbought indicators promptly. For instance, if the worth of a safety is shifting up in a short time after which begins to consolidate, this might be a sign that it’s overbought. Moreover, overbought costs normally have a tough time crossing over the resistance line.

Oversold Indicators

An oversold sign happens when the present worth is far decrease than the previous costs. It’s a direct results of an excessive amount of promoting stress present available in the market, which ends up in a protracted interval of asset worth decline.

One other method to establish whether or not it’s an overbought or oversold market (or neither) is to concentrate to cost actions. If the worth of an asset is shifting down in a short time after which begins to consolidate, this might be a sign that it’s oversold.

You may also attempt to establish oversold market situations utilizing assist and resistance ranges. Oversold belongings sometimes don’t go under the assist line.

Overbought and Oversold Indicators

There are numerous overbought and oversold indicators on the market that would aid you in selecting a second to purchase or promote a safety. Among the hottest indicators embrace the Relative Energy Index (RSI), the Stochastic Oscillator, and the Williams %R.

RSI

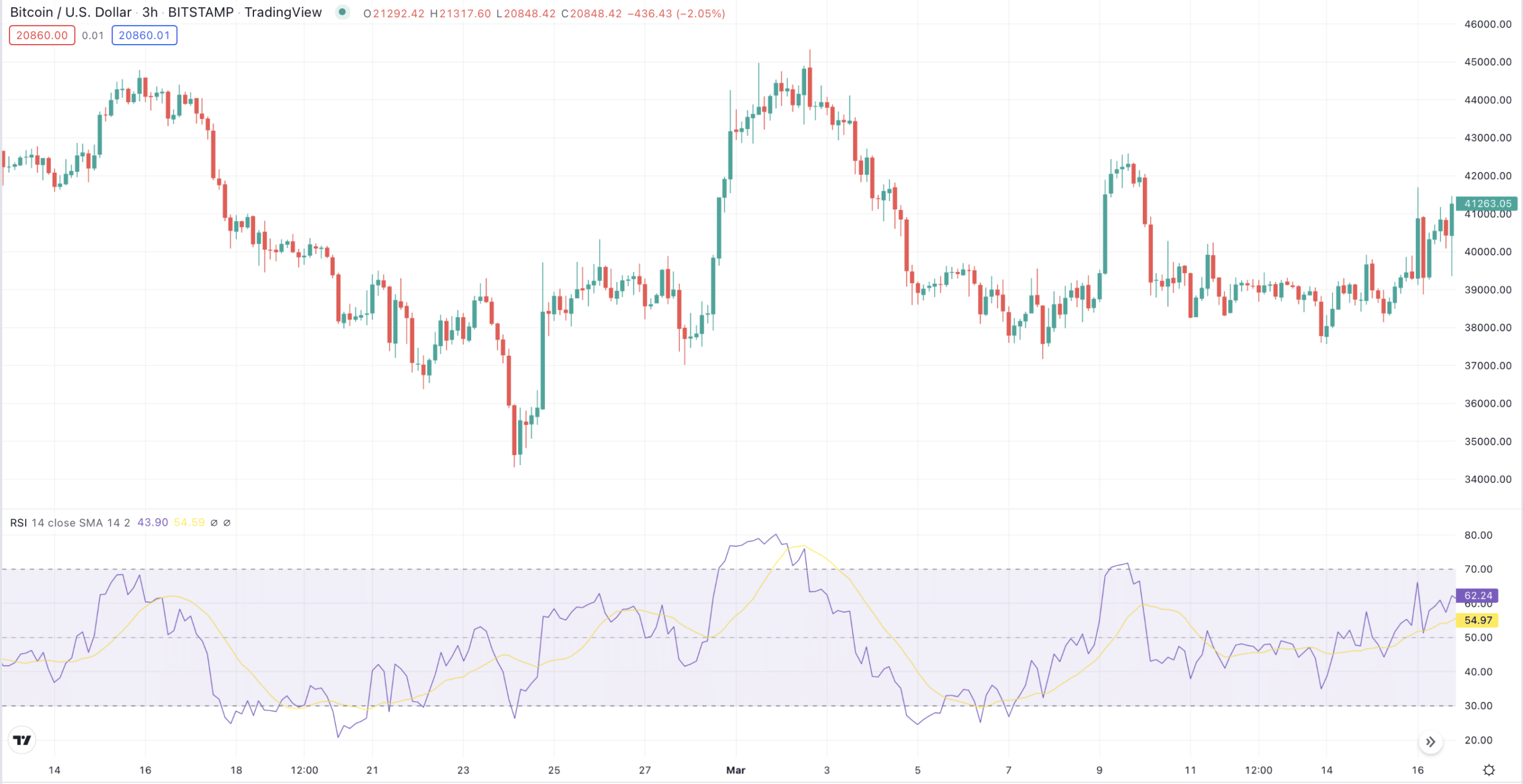

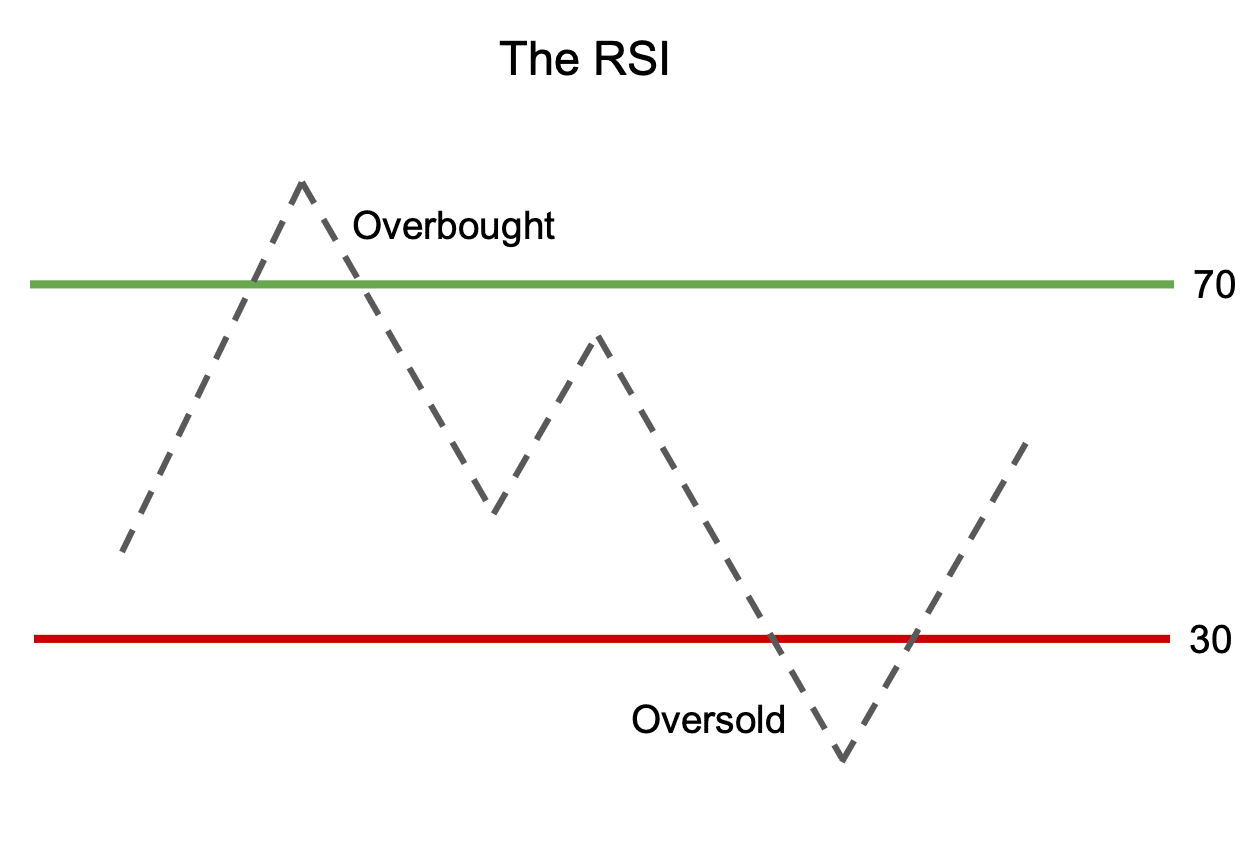

The Relative Energy Index (RSI) is a well-liked overbought and oversold indicator. It measures the power of the present worth relative to previous costs. If the RSI is above 70, it’s stated to be overbought. If the RSI is under 30, it’s stated to be oversold. Though you’ll be able to calculate the RSI your self, it’s built-in into nearly all buying and selling platforms — simply allow it within the instrument settings.

RSI vs. MACD

The MACD (Shifting Common Convergence Divergence) line is one other common overbought and oversold indicator. It measures the distinction between two shifting averages. If the MACD is above 0, it’s stated to be overbought. If the MACD is under 0, it’s stated to be oversold.

MACD is usually thought-about to be much less dependable than the RSI. The latter provides fewer however stronger indicators and is dependable even outdoors of trending markets, in contrast to the MACD.

MACD has some areas the place it may outperform the RSI; nonetheless, it’s sometimes suggested in opposition to making use of it in crypto markets.

Stochastic Oscillator

The Stochastic Oscillator is one other common overbought and oversold indicator. It measures the present worth relative to previous costs. If the Stochastic Oscillator is above 80, it’s stated to be overbought. If the Stochastic Oscillator is under 20, it’s stated to be oversold.

Are Overbought and Oversold Indicators Dependable?

Overbought and oversold indicators should not excellent. They won’t at all times inform you precisely when to purchase or promote a safety. Nevertheless, they will function invaluable instruments that will help you resolve on getting into or exiting a commerce.

It is very important do not forget that overbought and oversold indicators must be only one a part of your general buying and selling technique. It isn’t smart to base your determination to purchase or promote a safety solely on an overbought or oversold sign. That is very true for the crypto market, which is extremely unpredictable and risky and doesn’t at all times comply with typical buying and selling patterns.

There is no such thing as a excellent time to purchase or promote a safety. Though overbought and oversold indicators will help you make up your thoughts when to enter or exit a commerce, they don’t seem to be 100% dependable — in any case, any sign can transform false.

Some Tips about Utilizing Overbought and Oversold Ranges in Your Buying and selling Technique

Oversold and overbought indicators can nonetheless profit you even in case you’re a newbie or don’t need to trouble with complicated indicators or buying and selling terminals. For instance, if Ethereum is claimed to be overbought for the time being, it means its worth is near reaching its most now. Mainly, there are too many patrons, and the asset itself can’t assist it. So, you’ll be able to anticipate a bearish pattern to emerge quickly.

The alternative can also be true. If an asset, for instance, Bitcoin, is claimed to be oversold, which means a bull run might start quickly. Though these indicators should not completely dependable, they could be a good and simply accessible indicator of the final perspective of the market.

The easiest way to commerce with overbought and oversold ranges, nonetheless, is to make use of a number of indicators and anticipate a affirmation sign earlier than getting into a commerce. For instance, you would anticipate the RSI to maneuver out of the overbought or oversold territory or for the worth to interrupt out of the consolidation sample.

After all, that can in all probability imply you’ll get much less revenue than in case you traded the asset proper once you noticed the sign — however additionally, you will decrease your losses. On the finish of the day, it’s best to construct your buying and selling technique primarily based in your perspective in direction of threat and funding/buying and selling as an entire.

FAQ

Is an overbought or an oversold sign higher?

There is no such thing as a proper or fallacious reply to this query. It relies on your buying and selling technique and what you are attempting to attain.

Ought to I purchase when the RSI provides an oversold sign?

It relies upon. You must at all times anticipate a affirmation sign earlier than getting into a commerce.

What’s the greatest overbought/oversold indicator?

There is no such thing as a one greatest indicator. Select the one that matches your buying and selling technique and funding objectives, but in addition remember the fact that indicators work greatest together.

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.