Abstract:

- Over $7.485 billion price of Tether (USDT) has been redeemed for US {dollars} within the final week.

- The full provide of Tether (USDT) has lowered from the current all-time excessive of $81.237 billion to $75.75 billion.

- The redemption of Tether and the decline of its circulating provide come on the backdrop of each UST and USDT depeging.

- Tether’s CTO has confirmed that USDT can sustain with market demand for the stablecoin and redemption providers for USD.

Over $7.485 billion price of Tether (USDT) has been redeemed for US {dollars} within the final week. In response to a current report on stablecoins by Glassnode, the circulating provide of Tether has declined from close to the $81.237 billion all-time excessive to $75.75 billion within the acknowledged interval.

The report by Glossnode goes on to elucidate that the redemption of Tether for USD might need been catalyzed by the preliminary huge depegging of TerraUSD (UST) that quickly affected USDT’s personal peg to the $1 mark. The report acknowledged:

While UST was vital in dimension ($21B), many think about USDT at $83B in dimension to be systemically necessary to the market in its present kind, being the dominant quote pair on many exchanges.

Over the interval from noon 11-Could to noon 12-Could, USDT traded beneath its $1 peg to a low of $0.9565, earlier than recovering inside 36hrs to commerce at a slight low cost of $0.998.

Tether introduced on 12-Could in the course of the worst of the peg stress that redemptions remained open and energetic, and that $2B price have been already underway.

Tether is Dedicated to All Redemptions from Verified Prospects

On the acknowledged twelfth of Could, Tether issued an official statement by its web site, additional confirming that the corporate continues to honor redemptions of USDT for USD at a one-to-one ratio. The crew at Tether additionally reiterated that USDT has ‘maintained its stability by a number of black swan occasions and extremely risky market circumstances and even in its darkest days Tether has by no means as soon as did not honor a redemption request from any of its verified clients.’

Tether’s CTO Responds to Questions About USDT’s Reserves

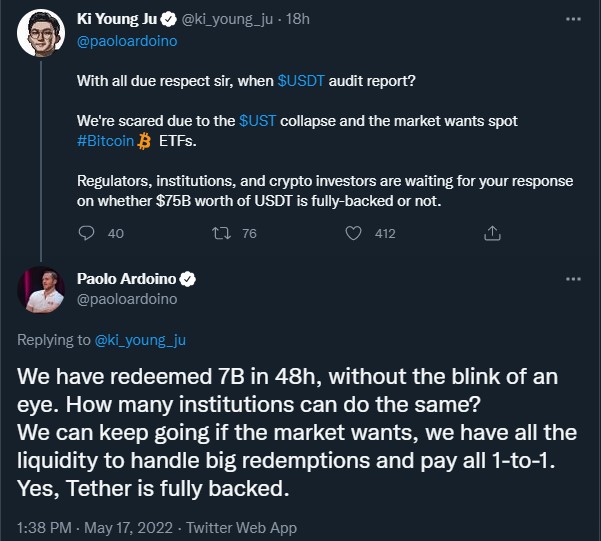

Earlier at this time, the CEO of CryptoQuant, Ki Younger Ju, requested Tether’s CTO, Paolo Ardoino, in regards to the standing of an audit report on USDT’s reserves. In response to Mr. Younger Ju, regulators and establishments are ready on a affirmation on whether or not Tether’s $75 million or so price of USDT, is fully-backed or not.

In his response, Mr. Ardoino cited the above $7 billion price of USDT redemption for USD as proof that the corporate has the liquidity to show that the stablecoin’s reserves do exist.

A screenshot of the conversation between the CEO of CryptoQuant and Tether’s CTO might be discovered beneath.