OpenSea CFO Brian Roberts has stepped down after roughly 11 months with the corporate. Up to now, neither occasion has made statements on the main points of his exit. He introduced his departure through LinkedIn and likewise acknowledged that he would proceed as the corporate’s advisor. Learn on to know why employees adjustments are a typical theme within the crypto bear market.

Why Did OpenSea CFO Brian Roberts Step Down?

Roberts beforehand served seven years constructing ride-sharing web2 firm Lyft. In his official assertion on LinkedIn, he mentioned that he’s nonetheless bullish on web3 and particularly OpenSea. He additionally went on to say that the corporate is “heads down constructing” and that one of the best is but to come back. “I had the uncommon alternative to construct a workforce actually from the bottom up and handpicked recreation changers.” says the previous OpenSea CFO.

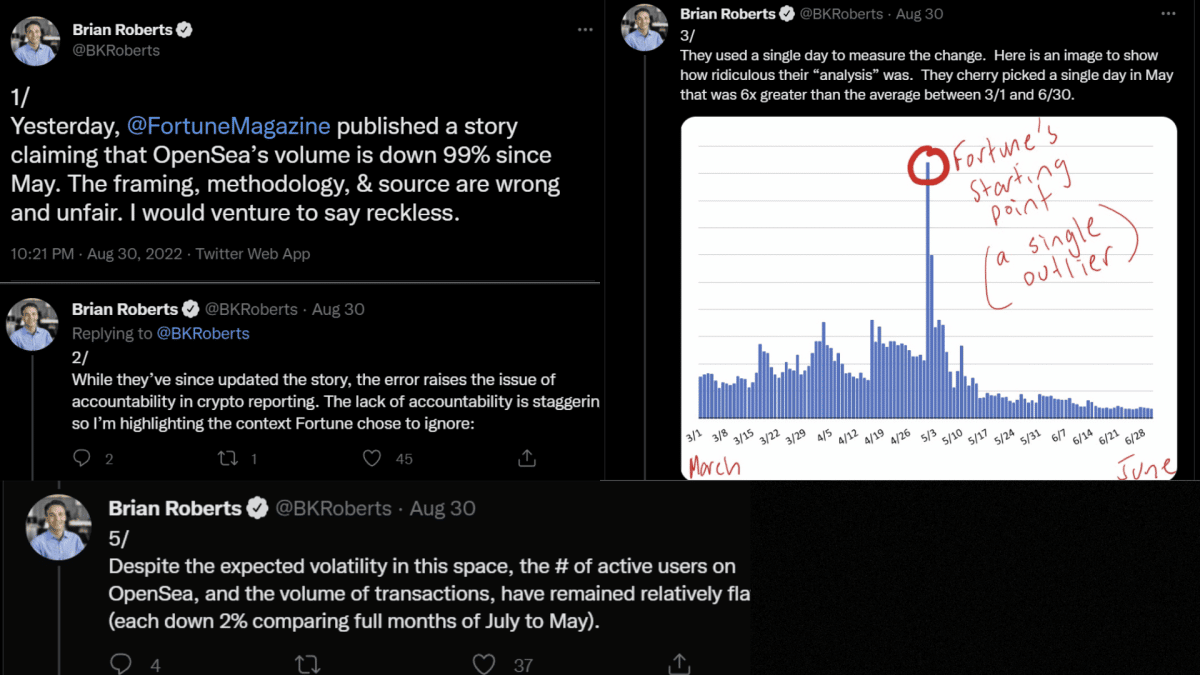

The worlds main NFT market has had no scarcity of layoffs this 12 months. Within the turbulent crypto cycle, OpenSea had already laid off 20% of its workforce in July. Alongside Roberts, Ryan Foutty, VP of Enterprise Improvement, has additionally left the function on the identical day. Regardless of the downturn amid crypto markets, the OpenSea CFO stood bullish and defended OpenSea earlier this 12 months:

What Do The Newest OpenSea Statistics Say?

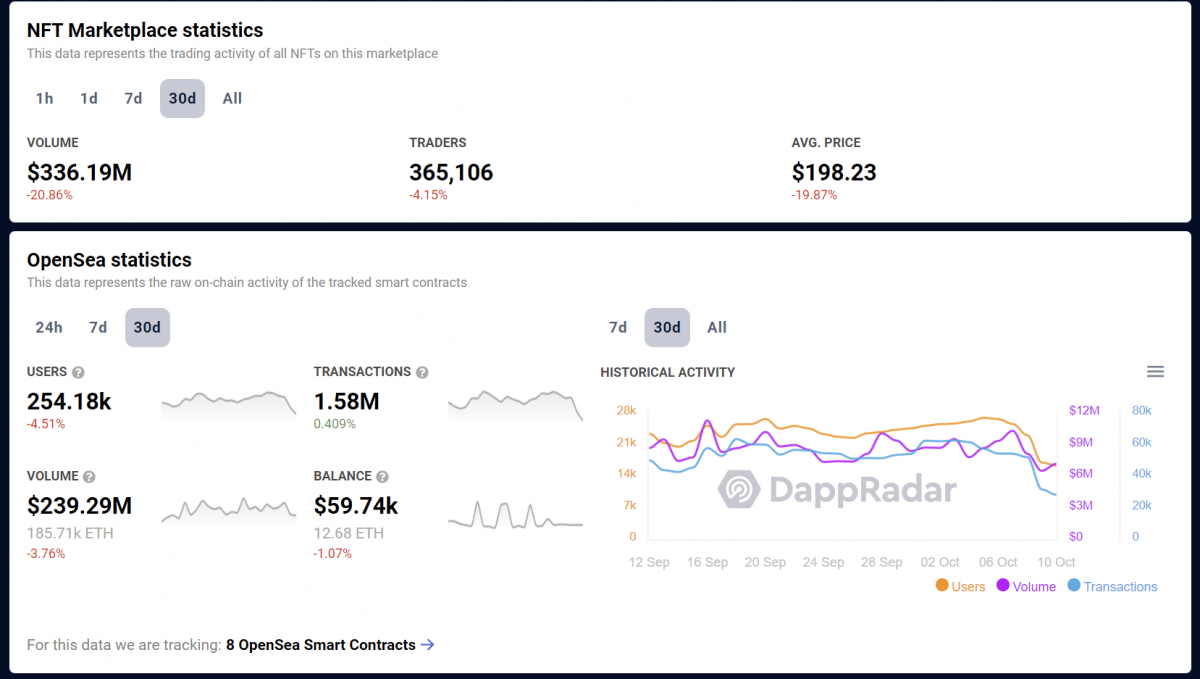

Regardless of the continued bear market, OpenSea continues to innovate and construct by means of the bear. The web3 large nonetheless ranks because the world’s main NFT market on Ethereum. The statistics beneath point out its efficiency for the final 30 days. In an area that strikes a mile a minute, and judging by how early it’s for NFT expertise, OpenSea remains to be going sturdy.

For the final 30 days, OpenSea has recorded over 1.5 million transactions and round $340 million in quantity. With a person drop of solely 4.5% general, it’s secure to say that the web3 market is holding on to its main place.

Although digital belongings have shed $2 trillion in worth for the reason that final bull market in November 2021, NFTs are right here to remain. The crypto markets have been dealt heavy blows this 12 months owing to ever-changing financial insurance policies, conflict, and blunders at mega crypto corporations. Although frequent changeovers happen in web3, the area continues to be by and for, the builders.