A brand new metric from on-chain knowledge analysts Glassnode seems on the relative measurement of entities actively accumulating or distributing cash by way of their Bitcoin holdings. In brief, the “Accumulation Pattern Rating” measures whale exercise.

The present Accumulation Pattern Rating exhibits whales are exercise distributing tokens, suggesting a low likelihood of reversing the current worth stoop, ought to this sample persist.

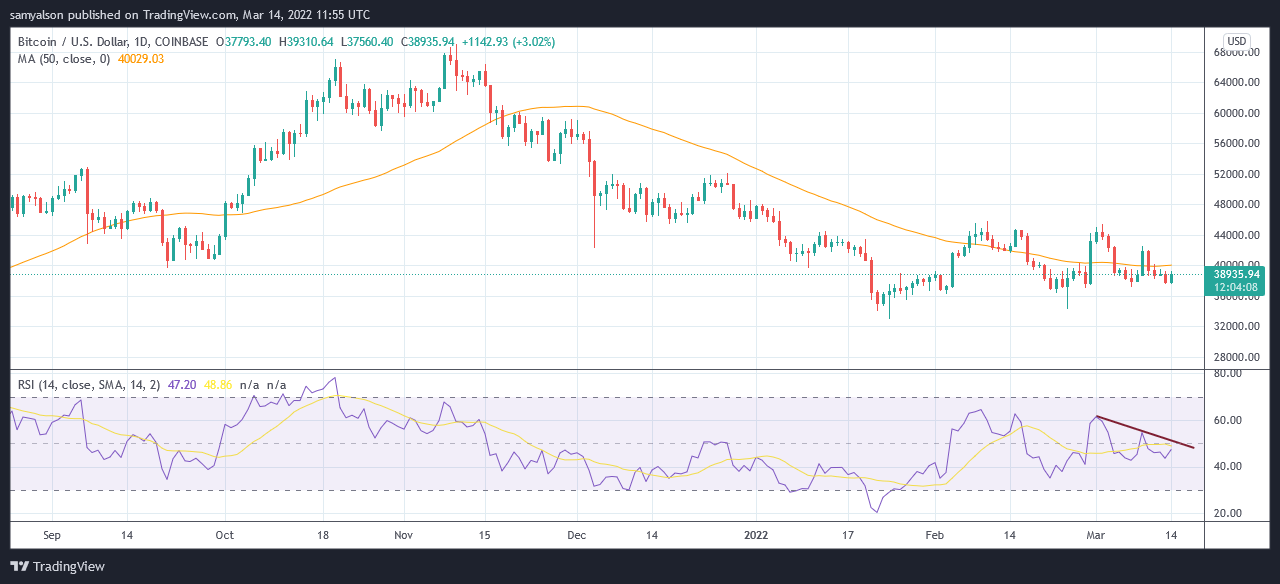

Since November, Bitcoin has been trending downwards, having peaked at $69,000. Early February noticed a break of the downtrend, however $BTC has been transferring sideways ever since, posting a low of $34,300 throughout this era.

This limbo state has divided opinion on whether or not we’re in a bear market or not. Nevertheless, towards a backdrop of financial uncertainty, sentiment is skewed to the previous.

At present’s worth motion sees a 3% achieve accompanied by an upturn within the Relative Power Index (RSI), to 46% on the time of writing. Though this shifts momentum in direction of the overbought territory, it stays to be seen if bulls can break the momentum downtrend.

In response to the information, with whales in a distribution part, indicators level to additional ranging if not a worth drop from right here.

What’s the Accumulation Pattern Rating?

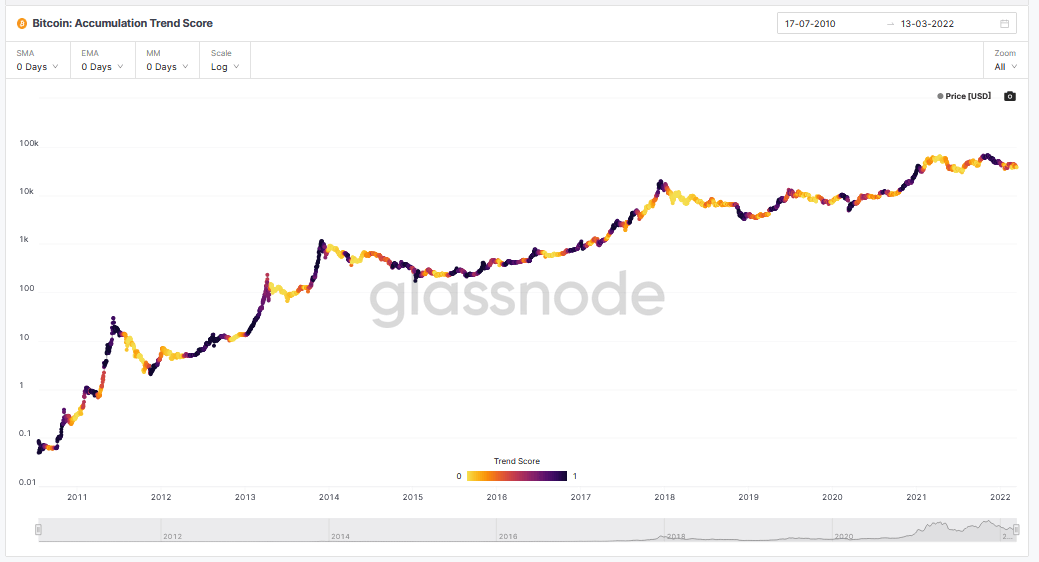

The Accumulation Trend Score represents the dimensions of the entities’ steadiness (their participation rating) and the variety of new cash acquired/bought over the past month (their steadiness change rating).

The rating falls alongside a scale of 0 to 1. A rating nearer to 0 means bigger entities are on steadiness distributing, not accumulating, whereas a rating nearer to 1 exhibits bigger entities are accumulating, not distributing.

Nevertheless, a rating of 1 doesn’t essentially correlate with surging worth or vice versa. For instance, mid-April 2021 noticed the value of $BTC peak at $65,000 (the best worth in 2021). However the Accumulation Pattern Rating was hovering on the low finish, with April 4, 2021, exhibiting a rating of 0.

The beginning of 2022 opened with a rating of round 0.7, indicating whales primarily had been accumulating. The present rating is 0.027, exhibiting a whole turnaround in sentiment.

Small fish are snapping up Bitcoin

Information from on-chain analysts Ecoinometrics helps the view that whales are promoting. Nevertheless, their evaluation additionally included inspecting what “small fish” are doing, and opposite to the whales, retail traders are at present shopping for Bitcoin.

They conclude that the chance of a transfer larger is low on condition that the whales are out of the image.

“#Bitcoin whales and small fish… two totally different worlds proper now. The small fish are accumulating like there isn’t any tomorrow whereas the whales are distributing. With out the whales, I doubt there’s sufficient momentum for a sustained pattern upward.”

The FOMC meeting will happen both this coming Tuesday or Wednesday. Analysts anticipate U.S rates of interest will rise by 0.25%-0.5%. Whereas some say it will have little influence on surging inflation, the Fed should additionally contemplate the impact of elevating charges too excessive.

All eyes are on what the Fed will do subsequent.

Get your every day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

It is free and you may unsubscribe anytime.