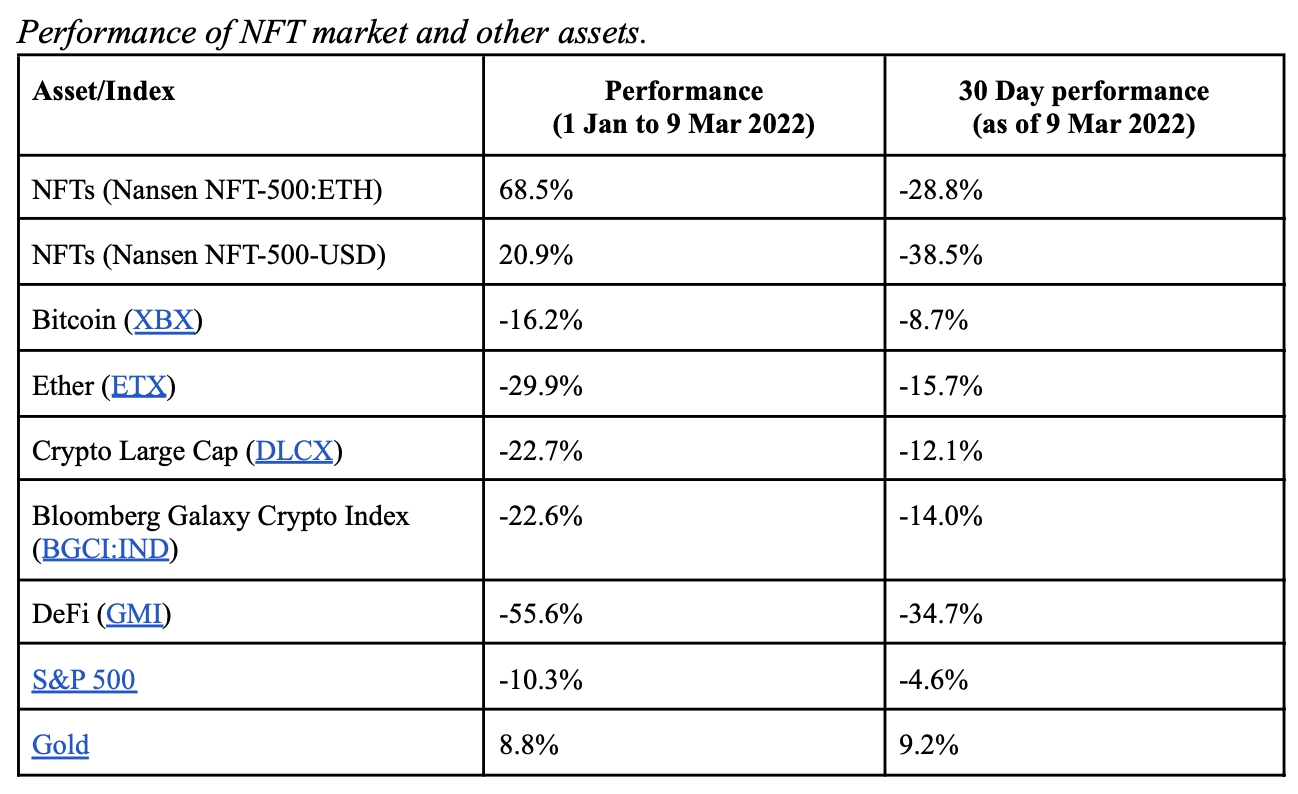

The marketplace for non-fungible tokens (NFTs) has outperformed the broader crypto market this yr each when measured in ethereum (ETH) and US greenback phrases, based on the Ethereum-focused knowledge analytics agency Nansen.

The year-to-date outperformance of the NFT market relative to the crypto market stands at 68.5% when denominated in ETH, and 20.9% when denominated in USD, their new report mentioned. This exhibits that the NFT house has held up higher than ETH, with crypto costs tumbling decrease for the higher a part of the yr.

For the reason that starting of 2022, the value of ETH had fallen by 32% on the time of writing, whereas bitcoin (BTC) was down by 19% over the identical interval.

Additionally, based on the agency, the year-to-date efficiency of its Nansen NFT-500 (ETH) index exhibits that the NFT market has what’s described as “a comparatively weak correlation” with the crypto market when measured in US greenback phrases.

Measured in ETH phrases, nevertheless, the 2 markets are inversely correlated, the report added.

The Nansen NFT-500 index is one out of six NFT indexes created by Nansen since September 2021 to trace efficiency throughout the NFT market.

“Index investing sometimes seeks to supply traders publicity to a market sector versus selecting winners,” Louisa Choe, Analysis Analyst at Nansen, informed Cryptonews.com.

Drilling right down to particular sectors of the NFT market, Nansen mentioned that its Artwork-20 index exhibits that artwork NFTs is the main sector within the house, with a year-to-date return of 192% in ETH phrases and 108% in USD phrases.

On the different finish of the spectrum was the gaming section of the NFT market.

Regardless of being described by Nansen because the “fastest-growing section of the NFT market,” gaming-related NFT collections noticed the worst efficiency this yr with a return of 42% in ETH and simply 14% when measured in US {dollars}, the report mentioned.

Additional within the report, Nansen additionally mentioned that the gaming-focused a part of the NFT market is among the many least unstable segments of the market.

The explanation for this could possibly be that the gaming section is “mature and have an increasing person base,” Nansen hypothesized. As proof for this, it pointed to the doorway of main corporations equivalent to Grayscale, which presents a Decentraland (MANA) funding belief, into the house as one issue that makes the associated NFTs much less unstable as an funding.

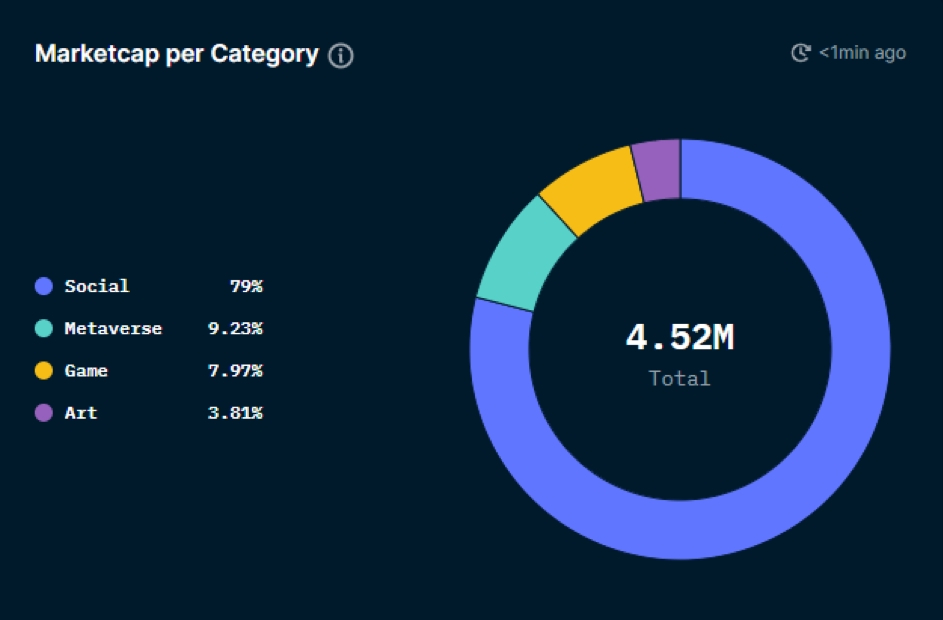

Price noting is that the gaming section solely accounts for a comparatively minor share of the general NFT market, with a market share of shut to eight%.

The largest section by far is what’s referred to as social NFTs, which embrace profile footage to be used in social media. This section makes up a whopping 79% of the whole NFT market, Nansen’s report mentioned.

_____

Be taught extra:

– NFTs Will Turn into ‘Crucial Items’ of Sports activities Trade – PwC

– Examine These Ukraine NFT Initiatives In opposition to the Russian Invasion

– NFTs in 2022: From Phrase of the Yr to Mainstream Adoption & New Use Instances

– NFT Market Cools Down As Ukraine Battle Pushes Traders Towards Secure-Haven Belongings