Abstract:

- Michaël van de Poppe opined that Mt.Gox’s Bitcoin reimbursement course of wouldn’t tank the market.

- The defunct trade was scheduled to reimburse collectors over 100,000 BTC tokens beginning this August however additional delays emerged

- North of 750,000 Bitcoin tokens was stolen from the Tokyo-based platform in a large hack in February 2014.

- Information of the reimbursement supposedly triggered panic within the crypto market.

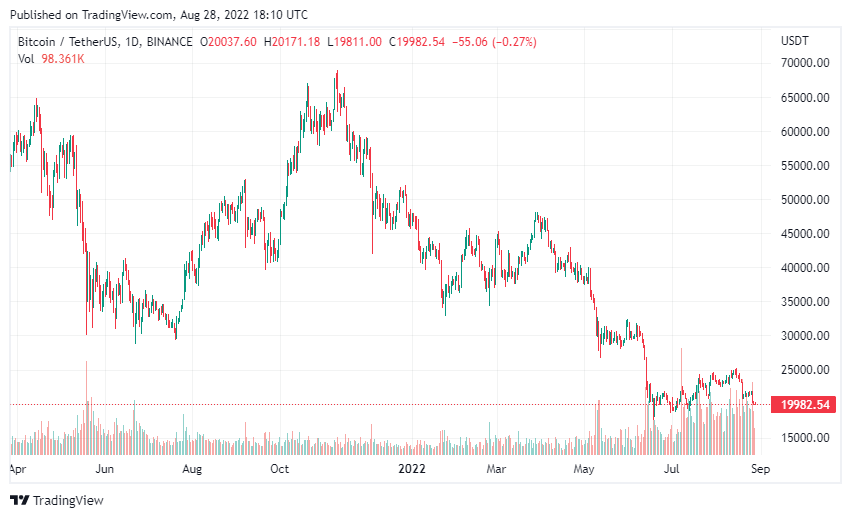

- Bitcoin traded simply above $20,000 on Sunday after dipping beneath on Saturday.

One crypto proponent surmised that panic within the digital forex market is “unwarranted” as Mt.Gox was scheduled to kick off its reimbursement course of involving some 137,000 Bitcoin following a historic hack on the platform again in 2014.

Based mostly in Tokyo, Mt.Gox operated as one of many greatest BTC exchanges of its time. The platform accounted for roughly 70% of all Bitcoin transactions on the peak of its energy. On Monday, February 24, 2014, the trade closed its official web site following uncommon buying and selling exercise.

In response to studies, a hacker leveraged credentials from a compromised auditor to switch hundreds of BTC to themselves. The occasion triggered a drastic drop in Bitcoin’s value on the trade and over 800,000 BTC tokens have been stolen, per studies.

The hacked cash have been valued at greater than $400 million on the time.

Mt.Gox Civil Rehabilitation Plan

A Tokyo District Courtroom authorized the so-called Mt.Gox “Civil Rehabilitation Plan” six years after the Bitcoin trade suffered a large hack. The plan proposed partial compensation for collectors, per studies.

The reimbursement plan was scheduled to kick off this August 2022 however the course of was delayed.

Sentiments throughout the crypto group advised panic and concern over Mt.Gox clients dumping their reimbursed BTC luggage and additional tanking the crypto market. At press time, the whole crypto market cap hovered above $1 trillion after a risk-on rally in earlier weeks.

Bitcoin additionally struggled to remain above the $20,000 stage after briefly falling beneath over the weekend.

Nonetheless, technical analyst Michaël van de Poppe identified that worry over Mt.Gox Bitcoin was “unwarranted”. Poppe pressured the phrases of the rehab plan and the way the process may take months to finish.