Europe’s largest digital asset funding group Coinshares believes there may be solely “minor unfavourable sentiment” inside the crypto markets now following a grueling 2022 bear market.

As Bitcoin threatens to the touch $18,000 for the primary time since mid-December, Coinshares analysis reveals that outflows from international crypto funds are beginning to wane. In response to a current weblog submit, Bitcoin noticed simply $6.5 million in outflows, indicating that sentiment “stays unfavourable,” however solely simply.

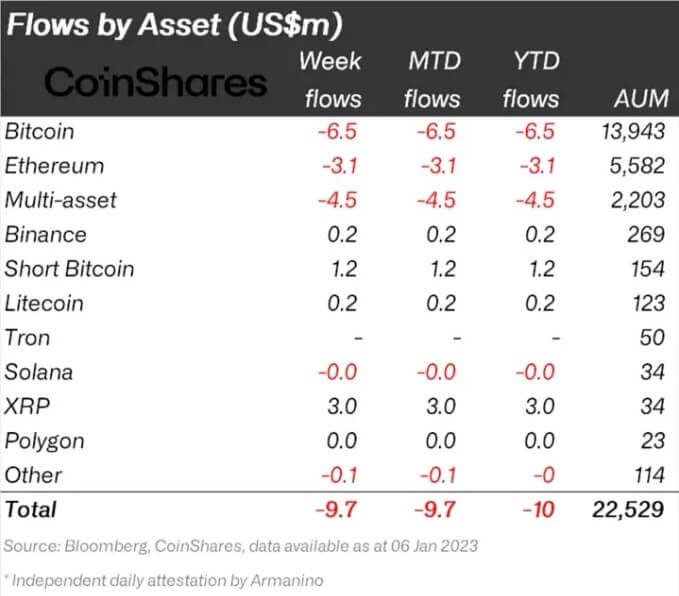

“Digital asset funding merchandise noticed outflows totaling US$9.7m, highlighting continued delicate unfavourable sentiment that has continued for the final 3 weeks.”

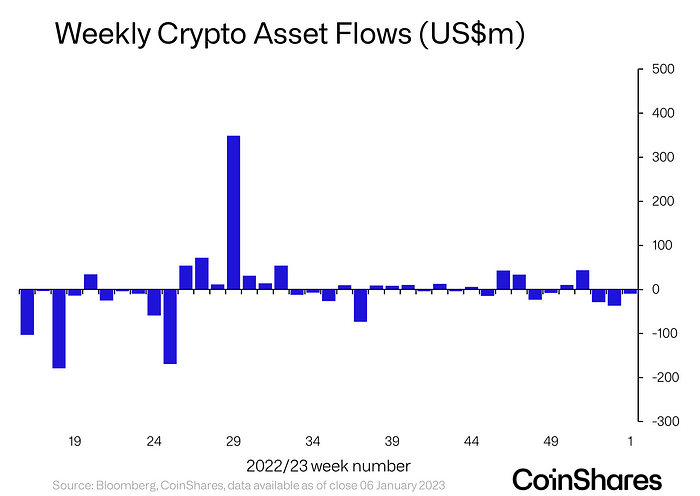

The chart beneath showcases the persistent outflows from crypto funds, constant over the previous six months, with solely 5 weeks of inflows all through the interval. Nonetheless, outflows have didn’t amass any substantial quantity, as figures recommend inflows and outflows canceled out to stay fairly flat.

The most important weekly outflow over the previous 52-week interval reached roughly $175 million, whereas essentially the most vital influx hit round $350 million.

Eighteen weeks of outflows examine to seventeen weeks of inflows all through a difficult bear market throughout the previous 52 weeks.

Nonetheless, Ripple’s XRP “bucked the development,” because it noticed $3 million in inflows over the past week, which Coinshares attributed to “the bettering readability on its authorized case with the SEC.”

Alongside XRP, different belongings that prevented constructive outflows included Binance (BNB Chain,) Litecoin, and Polygon. These belongings had both nominal inflows or remained flat throughout the week.

The bearish development inside crypto has but to be damaged, as highlighted by the $1.2 million inflows into “Quick Bitcoin” funds.

Coinshares referred to the development as “continued delicate unfavourable sentiment that has continued for the final three weeks.” Nonetheless, the primary chart clearly reveals that the elevated outflows seen through the FTX disaster have abated within the first week of 2023.

In response to Coinshares disclosure, it presently has $1.4 billion in belongings underneath administration. Its crypt funds look to serve these in search of publicity to crypto by conventional monetary Alternate Traded Merchandise (ETPs.)

Such funding autos could now not be totally consultant of the general crypto market sentiment as traders transfer towards chilly storage following the collapse of BlockFi, Voyager, Celsius, and FTX.

Whereas crypto exchanges differ from ETPs in lots of features, the custodial nature of the providing brings related dangers, on condition that possession of the underlying crypto belongings doesn’t belong to the traders.

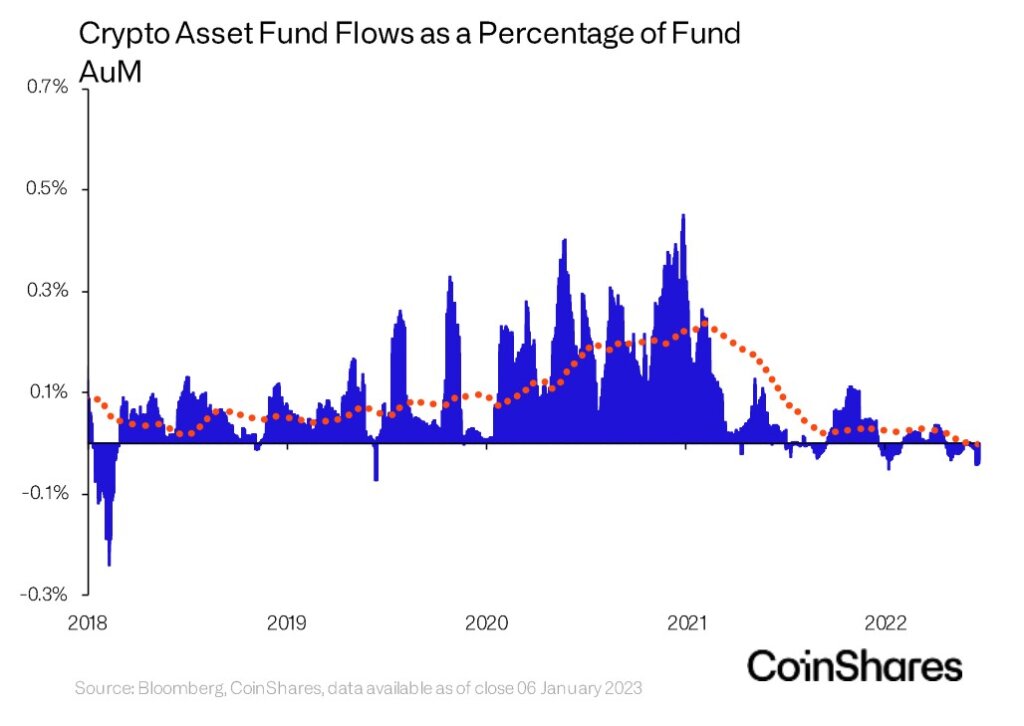

The stream of cash throughout crypto asset funds has fallen unfavourable as a share of the worldwide belongings underneath administration inside funding funds. Crypto asset funds peaked at roughly 0.25% of world fund flows on the finish of 2020 earlier than experiencing a drastic sell-off all through the 2021 bull market.

Funds such because the Grayscale Bitcoin Belief have been watched carefully by crypto traders over current weeks as a result of it buying and selling at an excessive low cost amid turmoil inside its dad or mum firm Digital Forex Group.

Nonetheless, on Jan. 10, GBTC jumped 12%, inflicting the low cost to drop by over 20% in 2023. Whether or not the worth motion is indicative of the fund securing its place as a essential funding car for these with restricted entry to crypto continues to be up within the air.

Regardless, the minimal influence of crypto ETPs throughout the broader ETP market showcases how little institutional crypto publicity exists within the markets in comparison with conventional belongings.

The entire crypto belongings underneath administration throughout funds presently sit at $22.5 billion, with $14.9 billion being held with Grayscale.

Compared, U.S. ETFs misplaced $596.9 billion in 2022, which is 72x higher than the entire worth belongings underneath administration for crypto merchandise. The total value of ETPs globally reached $9.3 trillion in 2022 regardless of the online outflows.

The crypto market continues to be effectively behind conventional monetary belongings when it comes to its influence on the worldwide economic system. Nonetheless, in contrast to legacy monetary merchandise, self-custody is a core tenet of crypto, and the transfer away from ETPs may change into a well-recognized development because the crypto business matures.