Bitcoin (BTC) miners are holding an increasing number of Bitcoin whereas “relentlessly increasing” their operations in 2022.

A report by Arcane Analysis signifies that publicly listed Bitcoin miners are “consistently searching for enlargement alternatives,” as they “plan to extend hashrate quicker than the entire community in 2022.”

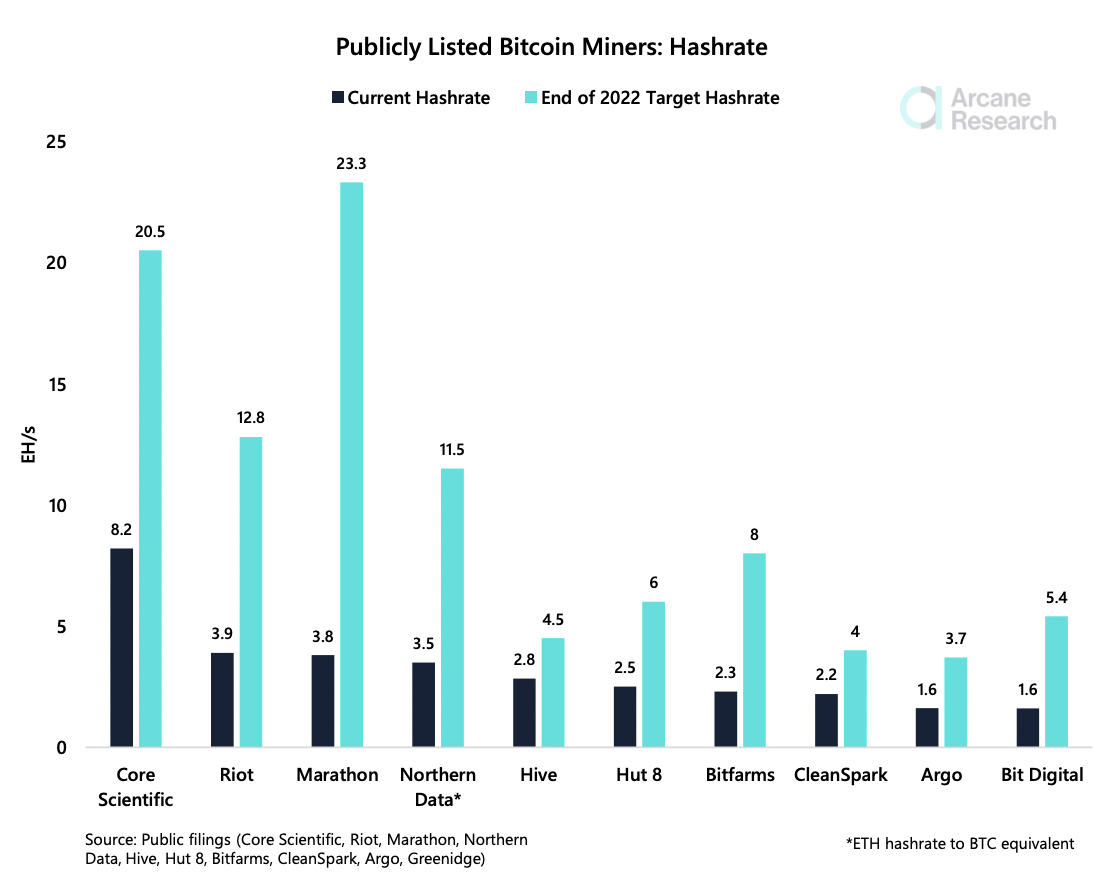

Publicly listed Bitcoin miners projected hashrates. Supply: Arcane Analysis

44.95% of the worldwide hash price derives from North American miners, based on the most recent figures from the Cambridge Bitcoin electrical energy consumption index. With the huge projected will increase in goal hash price among the many publicly traded Bitcoin miners, it is “more likely to enhance.”

Jaran Mellerud, an analyst for Arcane Analysis, advised Cointelegraph that “most publicly listed miners pursue a hodl technique, doing their finest to maintain as a lot they’ll of their mined Bitcoin.”

“This hodl technique allows them to function Bitcoin funding autos for buyers who wish to personal bitcoin not directly by means of an funding construction.”

Whit Gibbs, the founder and CEO of Compass Mining defined to Cointelegraph that “public mining corporations undoubtedly have a bonus in relation to hodling Bitcoin as a result of they’ve entry to the capital markets.”

“They need not liquidate their Bitcoin with a view to purchase extra machines, enhance their rack house, and so on.. They’re in a position to go to the capital markets and get that cash to proceed to increase. In order that they’re in a position to maintain massive positions in Bitcoin.”

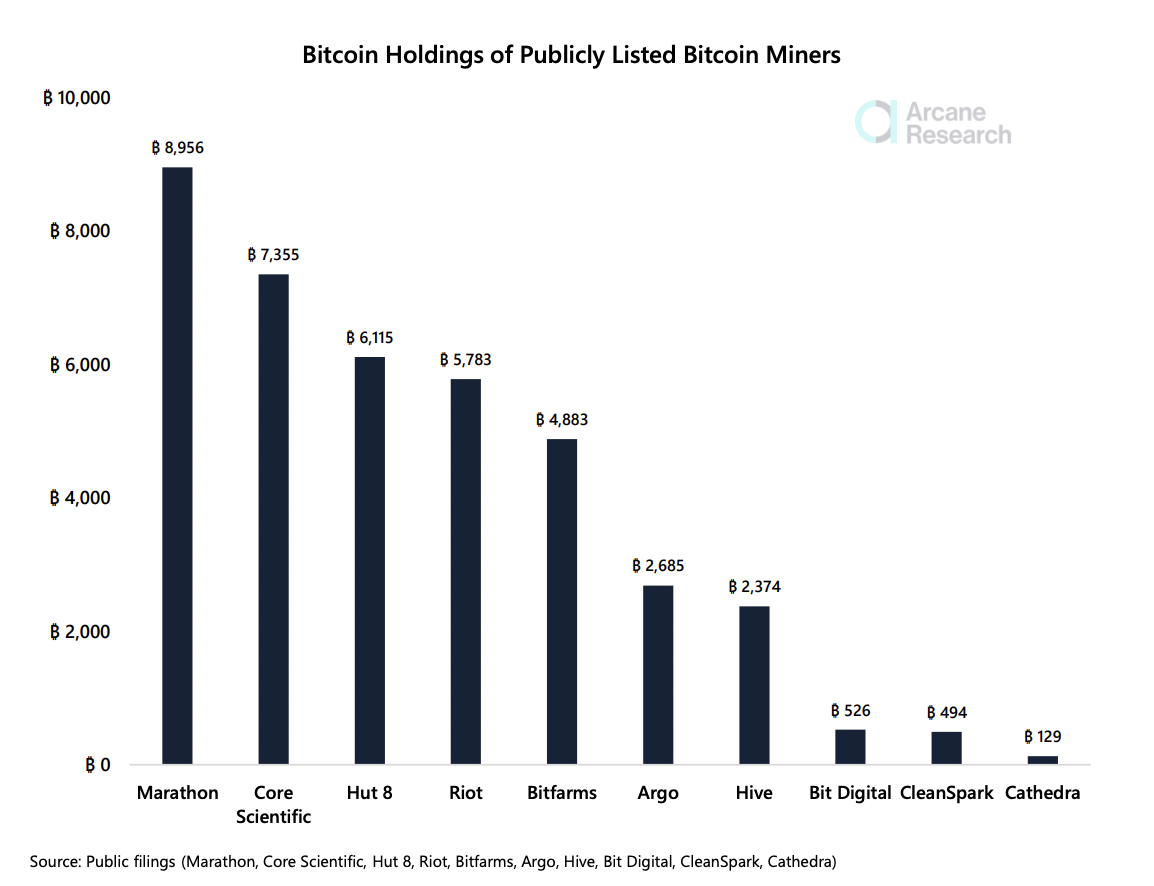

A few of the largest miners maintain enormous quantities of Bitcoin, Gibbs provides “it is loopy how a lot a few of them are holding.” As printed on BitcoinTreasuries, Bitcoin mining firm Marathon maintain the third-largest quantity of Bitcoin amongst companies worldwide, proper behind Tesla and Microstrategy.

Bitcoin holdings of publicly listed Bitcoin miners. Supply: Arcane Analysis

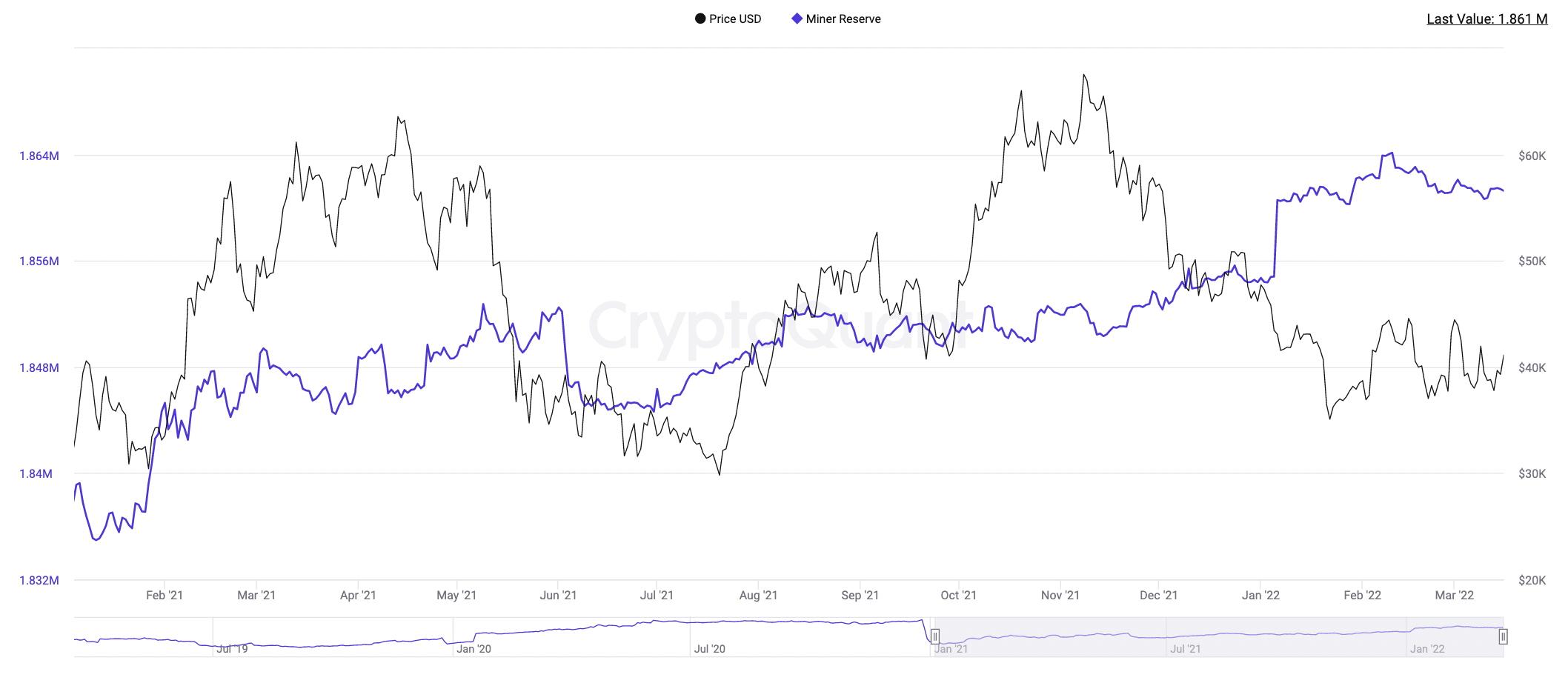

Since January 2021, miners’ reserves have been steadily rising, reflective of their HODL technique. Gibbs means that the publicly traded Bitcoin mining corporations are “taking extra of a bullish method to Bitcoin. “

“The businesses are taking a look at Bitcoin on their steadiness sheet as a method to drive up their market valuations.”

Miners’ reserves in blue are steadily rising. Supply: CryptoQuant

Mellerud additionally understands that Bitcoin mining shares are more and more in style in legacy monetary markets. “The demand for bitcoin funding autos is excessive, significantly within the U.S., because the Bitcoin ETF market is immature.” The Bitcoin exchange-traded fund (ETF) saga is an Achilles heel to the community: successive Bitcoin ETF functions have been rejected.

Associated: Bitcoin mining problem drops for the primary time this yr

Whereas market curiosity for Bitcoin miners swells, Mellerud sums up why the mining enterprise mannequin is engaging and efficient, echoing Gibbs’ feedback:

“Miners are a number of the largest Bitcoin bulls on the market, they usually make the most of the extremely developed fairness and debt markets within the U.S. to boost cash to pay for his or her expansions and working bills, permitting them to maintain the Bitcoin they mine.”

Bitcoin Miner Hut 8, for instance, just lately posted document revenues, with its total BTC holdings surging by 100%. 2022 is probably not the yr of the bull, but it surely’s definitely a very good time to publicly mine the orange coin.