Mining

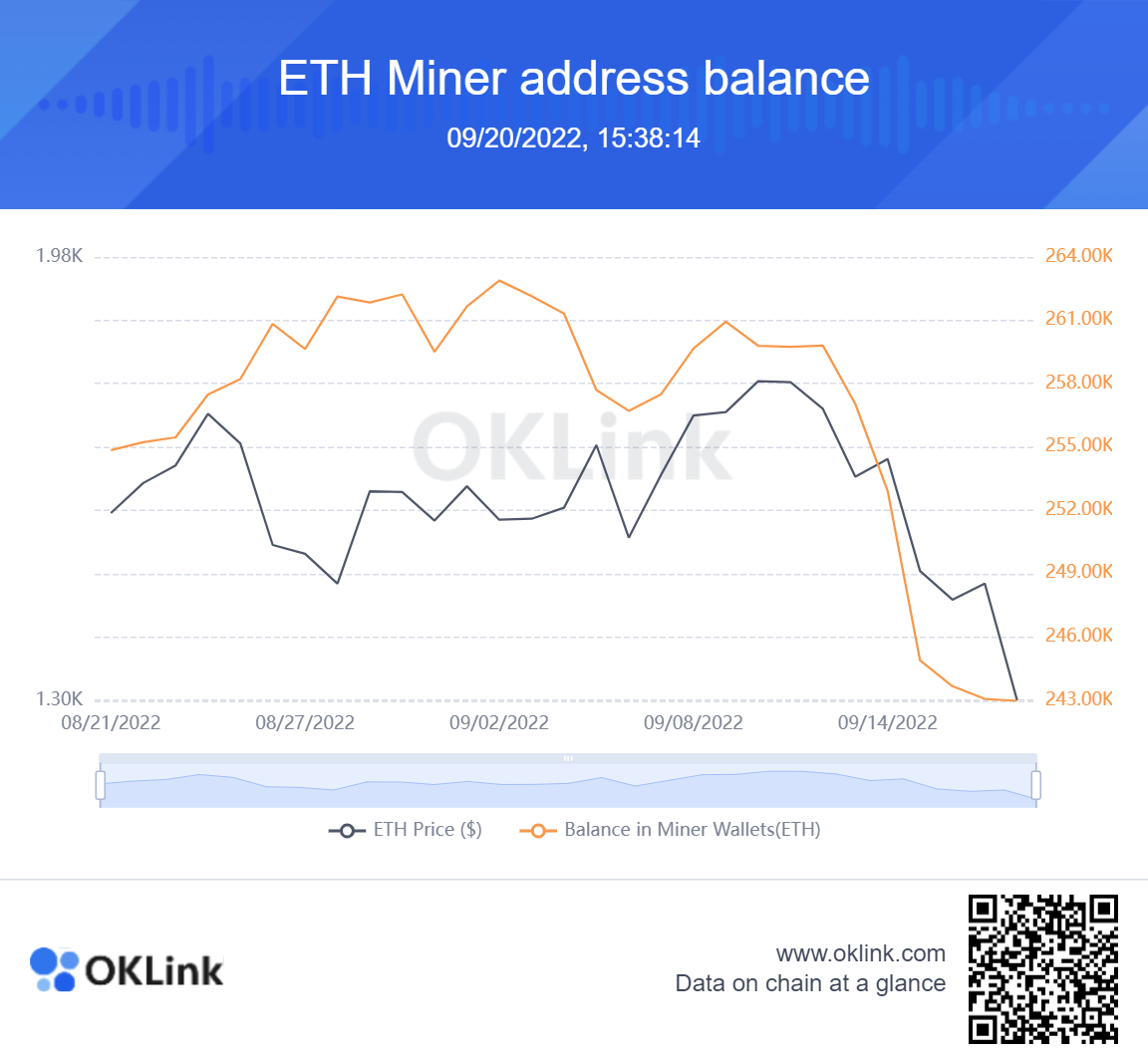

Ethereum miners have bought over 14,785 ETH, totaling $19.73 million as of as we speak’s value, from September 9 as much as the day of the merge, in accordance with information from OKLink.

OKLink pulls mining information throughout a dozen totally different mining swimming pools, together with F2Pool, Binance, and BTC.com

On September 12, the miners decreased their holdings by 2,767 ETH, adopted by one other 4,121 ETH the following day.The biggest sale got here on September 14, the day earlier than the Ethereum merge.

Miners at the moment offloaded practically 8,032 Ethereum, contributing to the asset’s drop from $1,636 to $1,471 in lower than 24 hours.

Chart signifies the drop within the miner’s ETH stability in the course of the merge. Supply: OKLink.

Ethereum’s change inflows additionally hit a excessive earlier than the merge. On September 14, change inflows peaked at 2.4 million ETH, in accordance with information from IntoTheBlock.

Excessive change inflows are sometimes seen as a bearish occasion as merchants transfer funds from chilly wallets to be bought on the open market. Conversely, excessive change outflows point out that customers transfer funds off these platforms to their chilly wallets for long-term holding.

“ETH reserves of miners have decreased dramatically, as much as -22% within the final seven days,” Juan Pellicer, a researcher at IntoTheBlock, instructed Decrypt. “It’s unclear if these outflows had been all despatched to exchanges to promote.”

For the reason that merge on September 15, Ethereum (ETH) has misplaced over 16% of its worth.

As of this writing, ETH modifications fingers at round $1,368 apiece, in accordance with information from CoinGecko.

What was the Ethereum merge?

Following the merge occasion, the Ethereum community shifted from an energy-intensive, proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) mechanism.

This shift additionally ended all mining exercise on the platform, as so-called validators now safe the community quite than miners.

These validators stake 32 Ethereum to validate transactions on the community. For performing this service, they’ll earn a neat yield; in the event that they behave dishonestly, permitting fraudulent transactions to happen, their staked Ethereum could be fined.

Ethereum Basic, Ravencoin, and Ergo Hash Charge Soar Put up-Merge

Mining outfits with heaps of machines had been thus left trying to find new networks as soon as Ethereum executed this alteration.

It additionally seems that a lot of them offboarded a hefty chunk of their ETH holdings when exiting.