Sure corporations that mined extra bitcoin than rivals final month didn’t essentially beat out their counterparts on the “realized hash price” entrance.

Some corporations working in Texas used demand response packages to generate further income — a method anticipated to proceed because the mining house grows extra aggressive.

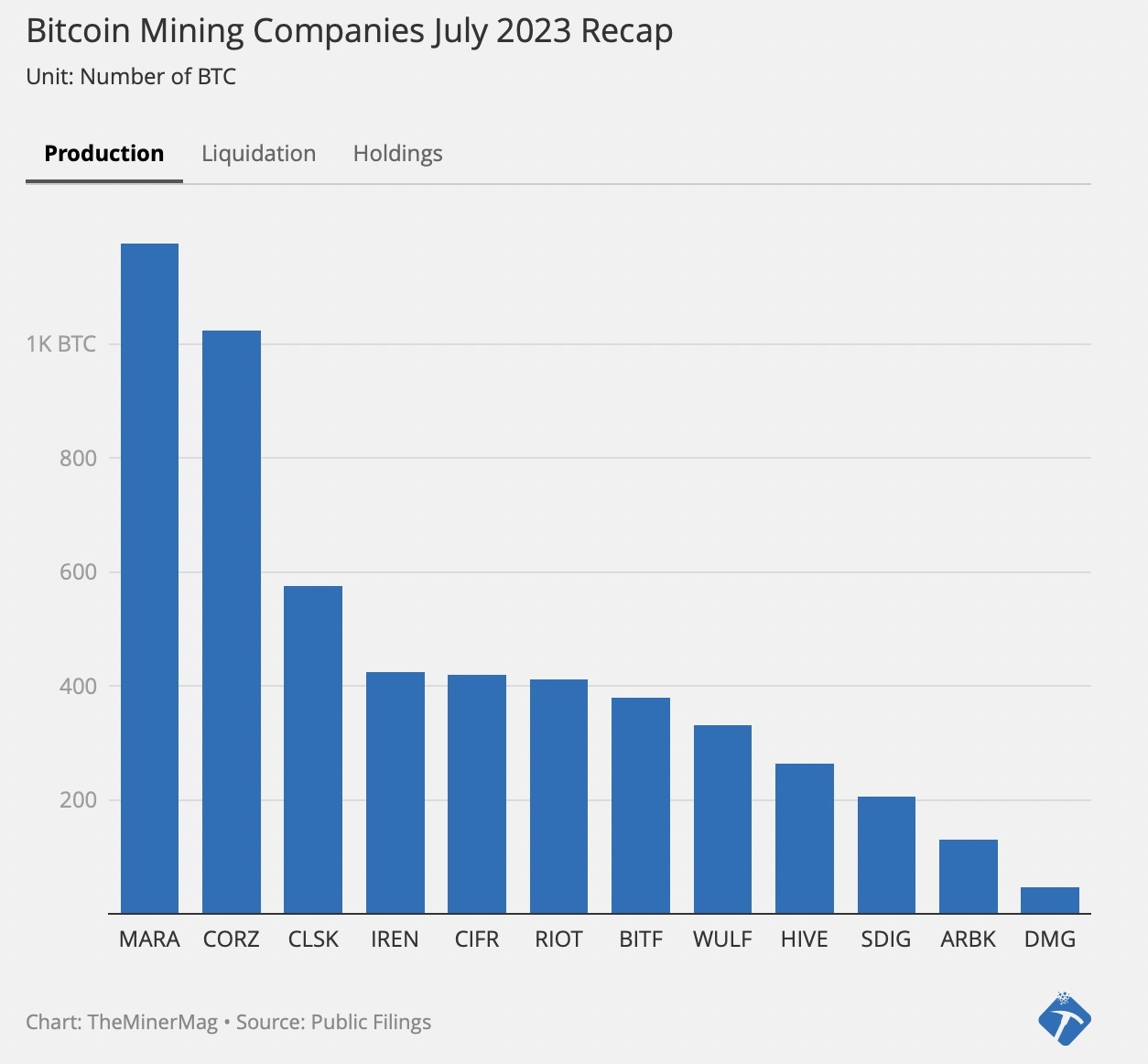

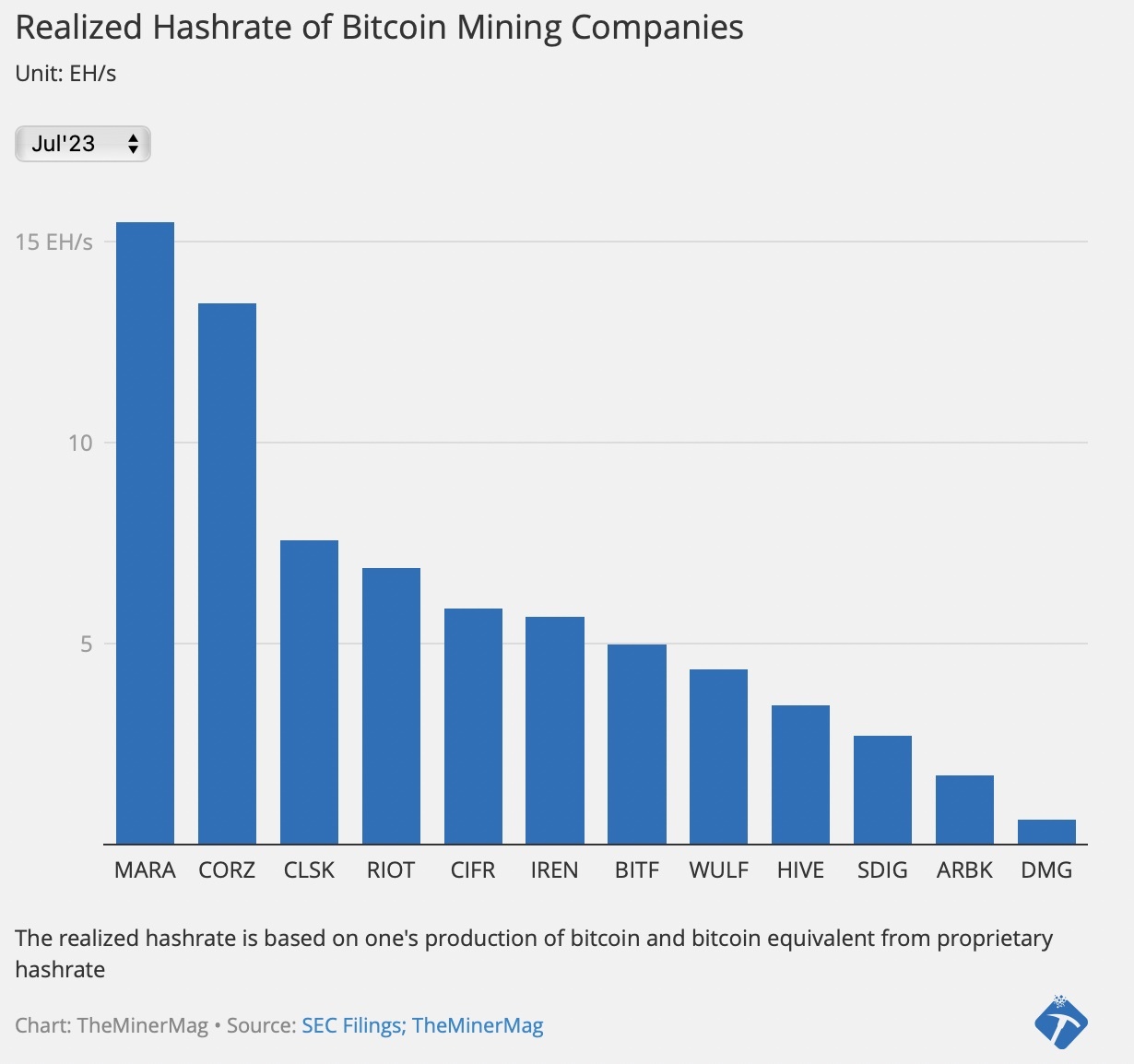

Marathon Digital, Core Scientific and CleanSpark mined probably the most bitcoin in July, respectively, in accordance with knowledge from TheMinerMag. These corporations additionally led all others in realized hash price — a metric based mostly on manufacturing of bitcoin and bitcoin equal from proprietary hash price.

However down the checklist, sure miners that mined much less bitcoin made up for it by curbing their mining operations.

Chart by TheMinerMag

Chart by TheMinerMag

Iris Vitality, for instance, mined 423 bitcoin (BTC) in July, in comparison with Cipher Mining’s 418 BTC. However the latter firm introduced in an equal of 28 BTC in energy gross sales through the month by curbing a few of its proprietary hash price.

Cipher Mining stated in an Aug. 1 assertion that an necessary function of its energy buy settlement in Odessa, Texas is the flexibility “to promote energy again to the grid.”

Miners have the choice to promote their grid-balancing rights to the Electrical Reliability Council of Texas (ERCOT) to steadiness the grid by lowering their power consumption. The corporate started reporting these energy gross sales month-to-month as a bitcoin equal determine.

Riot Platforms mined even lower than Iris Vitality and Cipher Mining — producing 410 BTC in July, an 11% decline from the prior month. However Riot obtained $8.2 million in energy and demand response credit, equal to roughly 280 bitcoins based mostly on the typical BTC value in July.

Temperatures in Texas have soared this summer season, creating “among the most difficult working months of the 12 months,” Riot CEO Jason Les stated in an announcement.

The credit got here as Riot curtailed greater than 90% of its energy utilization on sure dates of peak demand as a manner to assist ERCOT proceed providing energy to customers with out interruptions.

Learn extra: Bitcoin mining load flexibility can ‘considerably mitigate energy shortages’ in Texas

In accordance with Nishant Sharma, founding father of mining consulting agency BlocksBridge, the dad or mum firm of TheMinerMag, miners started reaping the advantages of curbing their mining operations again in 2020. This improvement adopted the entry of the primary large-scale mining operations into Texas, a state famend for its demand response packages.

“Nonetheless, the pattern has elevated now as mining has change into extra aggressive than ever earlier than,” Sharma advised Blockworks.

Final 12 months was powerful for crypto miners as declining crypto costs harm corporations that took on debt to speed up development operations through the bull market. Information heart operator Compute North filed for chapter in September, whereas Core Scientific did the identical just a few months later.

Extra corporations within the house have begun promoting a portion of their bitcoin to cowl sure operational prices. Marathon Digital, for instance, which produced 1,176 BTC final month, opted to promote 750 bitcoins in July.

Miners are taking a look at numerous applied sciences and operational methods to stay leaner and keep forward within the race, Sharma stated.

Hive Blockchain Applied sciences modified its title to Hive Digital Applied sciences as a part of a shift in focus to supporting the expansion of synthetic intelligence.

“As halving attracts nearer, miners will discover extra progressive methods to generate returns for his or her buyers,” Sharma stated. “We’ll see extra miners taking part in power gross sales or completely different demand response packages.”