On-chain knowledge exhibits that Bitcoin “mid-term” holders have been on the transfer in the course of the previous day, suggesting that they could be dumping presently.

Bitcoin 3-6 Months Age Band Exhibits Giant Spike In Spent Outputs

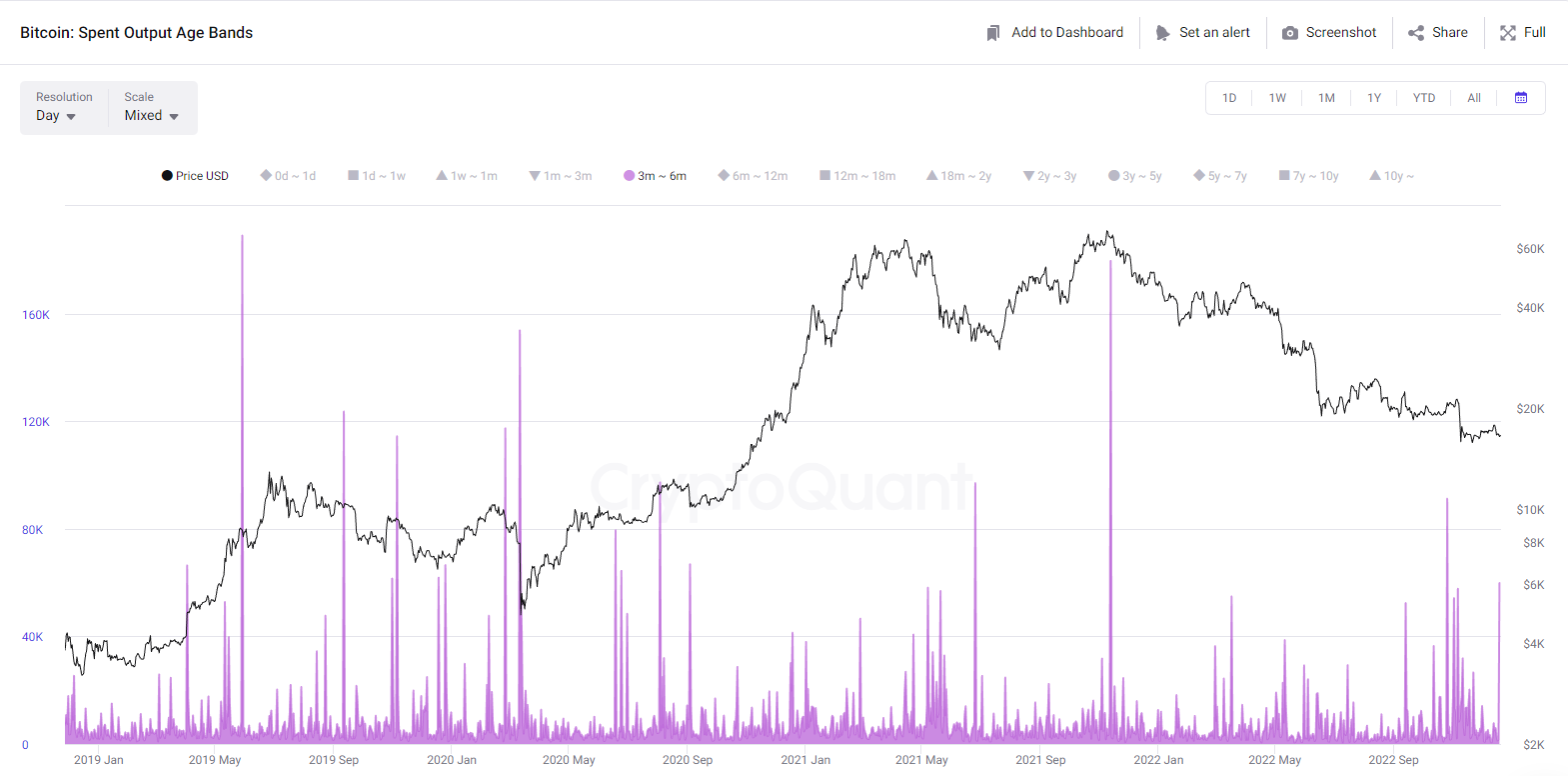

As identified by an analyst in a CryptoQuant post, a rise within the spent outputs for the 3-6 months group has resulted in large strikes for BTC earlier than. The related indicator right here is the “Spent Output Age Bands,” which tells us which age bands within the Bitcoin market are transferring what number of cash proper now.

These “age bands” are teams that outline ranges between which the cash (or holders) falling into mentioned band final confirmed any motion or promoting. As an illustration, the “1m-3m” age band contains all tokens which were sitting dormant since a minimum of 1 month and at most 3 months in the past. If holders belonging to this group shift their cash, then the transfer will present up as a spike on the spent outputs chart for the band.

Within the context of the present matter, the related age band is the “3m-6m” group. Here’s a chart that exhibits the development within the spent output metric for it throughout the previous couple of years:

The worth of the metric appears to have shot up over the past day | Supply: CryptoQuant

Because the above graph shows, the spent output metric has recorded a big worth for the 3m-6m Bitcoin age band lately. The holders belonging to this group are generally known as the “mid-term holders,” due to the truth that their vary covers the boundary between the short-term holder and the long-term holder cohorts.

From the chart, it’s obvious that typically each time this holder group has proven indicators of heavy dumping, the worth of BTC has noticed a steep decline shortly after. The most recent crash following the collapse of FTX, too, was preceded by a big motion from these buyers.

After the present spike, Bitcoin has really already seen a short-term drop, because the beneath chart exhibits. Nonetheless, it’s unclear in the mean time whether or not this decline was all there’s going to be. If previous examples are something to go by, Bitcoin normally observes a big transfer each time this development kinds, which means the actual decline from the most recent spike could also be but to return.

A better have a look at the worth development following the spike within the indicator | Supply: CryptoQuant

BTC Value

On the time of writing, Bitcoin’s value floats round $16.8k, down 3% within the final week.

Appears like the worth of the crypto has been transferring sideways for the reason that plunge a couple of days again | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com