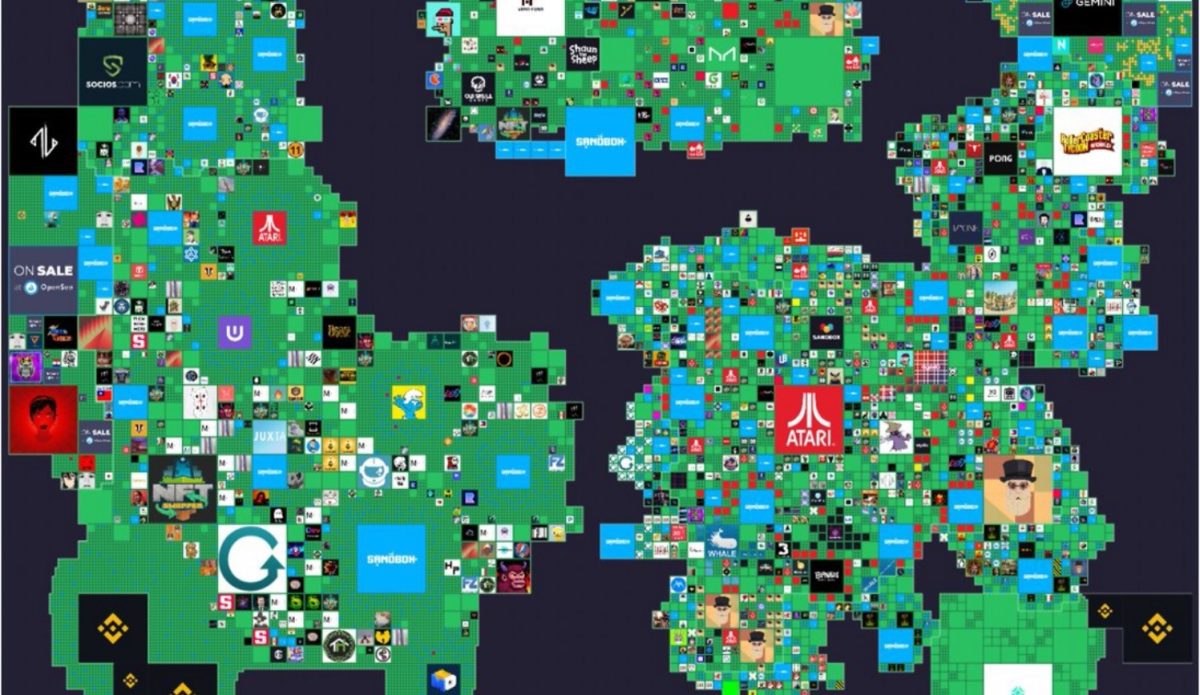

The world of digital actual property is experiencing important turbulence as metaverse land costs plummet over the previous 12 months. This contrasts with the hovering values final seen through the NFT bull market.

Metaverse land costs are experiencing a major decline attributable to a number of components. Firstly, the exuberant costs through the NFT bull market created an unsustainable bubble, resulting in an eventual correction out there. Moreover, the oversaturation of digital actual property tasks has diluted demand, leading to elevated competitors and decrease costs.

Furthermore, the preliminary hype surrounding metaverse land has subsided, inflicting investor curiosity to wane. Lastly, the unstable nature of the cryptocurrency market and the general uncertainty surrounding regulatory frameworks have additionally contributed to the downward stress on metaverse land costs.

TL;DR:

- Metaverse land costs at the moment vary from 0.37 to 1.09 ETH, various throughout completely different tasks.

- Otherdeeds has the highest-priced land at 1.09 ETH, whereas Voxels provides probably the most reasonably priced plots at 0.16 ETH.

- The decline in metaverse land costs contrasts with the height of the NFT bull market when costs reached as excessive as 7.50 ETH. The market has skilled important drops, with Somnium Area and Voxels seeing declines of -93.9% and -93.8% respectively. Buyers have to be cautious of market volatility within the evolving metaverse.

Why is Metaverse Land Failing?

As of this week, the price of proudly owning a plot within the metaverse ranges from 0.37 to 1.09 ETH. That is with variations throughout completely different digital actual property tasks. Apparently, the highest-priced land is discovered within the Yuga Labs’ Otherdeeds realm. A parcel on this digital area at the moment prices 1.09 ETH. In the meantime Decentraland, one other standard metaverse, follows at 0.64 ETH.

Conversely, probably the most reasonably priced properties within the metaverse are located in Voxels, previously generally known as Cryptovoxels, the place a plot may be acquired for simply 0.16 ETH. Somnium Area and The Sandbox additionally supply comparatively economical choices, with costs at 0.37 ETH and 0.43 ETH, respectively.

These current valuations current a stark distinction to the height of the NFT bull market when metaverse lands have been priced as excessive as 7.50 ETH. For example, Otherdeeds reached a staggering ground worth of seven.50 ETH on Could 1, 2022, marking the zenith of the metaverse land frenzy.

What’s Taking place in The Metaverse?

A more in-depth examination reveals that different tasks additionally skilled important declines from their respective peaks. Somnium Space, which commanded a formidable 6.05 ETH per plot at the start of 2022, witnessed a considerable -93.9% drop. Decentraland, however, decreased by -87.8% to five.24 ETH. Furthermore, The Sandbox and Voxels skilled declines of -89.8% and -93.8%, respectively.

This evaluation relies on the research of the highest 5 digital land costs from January 1, 2022, to Could 24, 2023. These are experiences from knowledge sourced from CoinGecko and Dune Analytics.

The sharp decline in metaverse land serves as a reminder that these digital frontiers are additionally inclined to market volatility. This growth prompts an essential query: What is occurring within the digital land market? It emphasizes the necessity for buyers to train warning and be aware of the digital dangers accompanying potential rewards because the metaverse continues to evolve.