- MakerDAO has liquidated just a few of its vaults to scale back danger and publicity to dangerous debt

- Whales proceed to point out curiosity within the token, regardless of its TVL declining

After the FTX debacle, many within the crypto-community have put their religion in DEXs. It’s in opposition to this background that MakerDAO introduced that it is going to be liquidating a number of vaults to attenuate dangers.

Learn MakerDAO’s [MKR] Value Prediction 2022-2023

No dangerous enterprise

In a tweet, MakerDAO laid out its plan to liquidate USDC-A, USDP-A, and GUSD-A vaults. This will probably be solely carried out to vaults whose collateralization ratio is lower than 101%.

A vault with lower than 101% collateralization ratio can be thought of as “bad debt” for the protocol. Although MakerDAO’s publicity to this sort of dangerous debt is relatively low, the MakerDAO group has determined to scale back its publicity to be secure.

Together with the aforementioned vaults, different vaults with a collateralization ratio of lower than 101% would even be liquidated. In reality, in line with the Twitter thread, MakerDAO will face a 1.5 million DAI loss as a result of liquidation occasion, which accounts for lower than 2% of its current system surplus.

MakerDAO additionally said that this DAI debt won’t pose a serious risk to MakerDAO’s protocol financial health.

MakerDAO’s sustained efforts to scale back danger publicity for his or her customers could also be one of many the reason why massive traders and whales have been noticed to be displaying curiosity in $MKR.

Based on WhaleStats, as an illustration, MKR was one of many most-used good contract tokens among the many top-1000 ETH whales on 24 November.

In reality, on the time of writing, Ethereum whales have been holding $43 million worth of $MKR tokens.

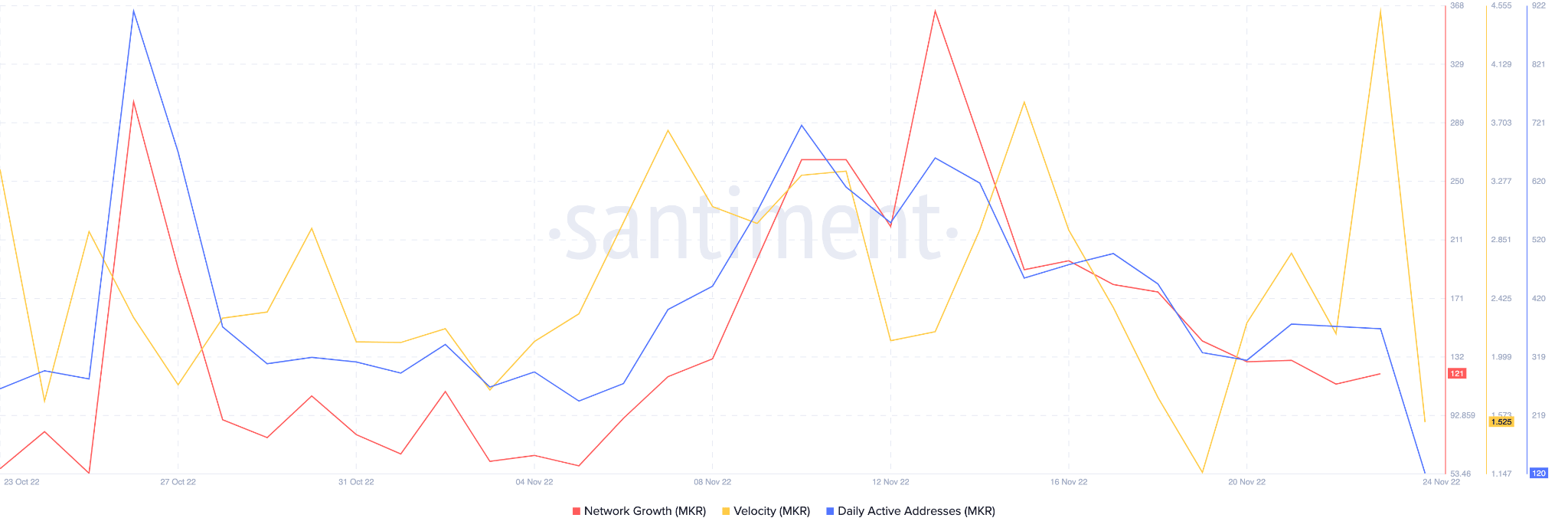

Nonetheless, the exercise on MakerDAO continued to say no. As will be evidenced, the variety of day by day energetic addresses depreciated considerably over the previous few days. One other indicator of lack of exercise is MKR’s declining velocity, which additionally declined throughout the identical interval. A decline in velocity signifies that the variety of occasions MKR was exchanged amongst addresses decreased.

Furthermore, MakerDAO’s community development fell as properly, one thing that implied that the variety of occasions new addresses transferred MKR for the primary time had fallen.

Supply: Santiment

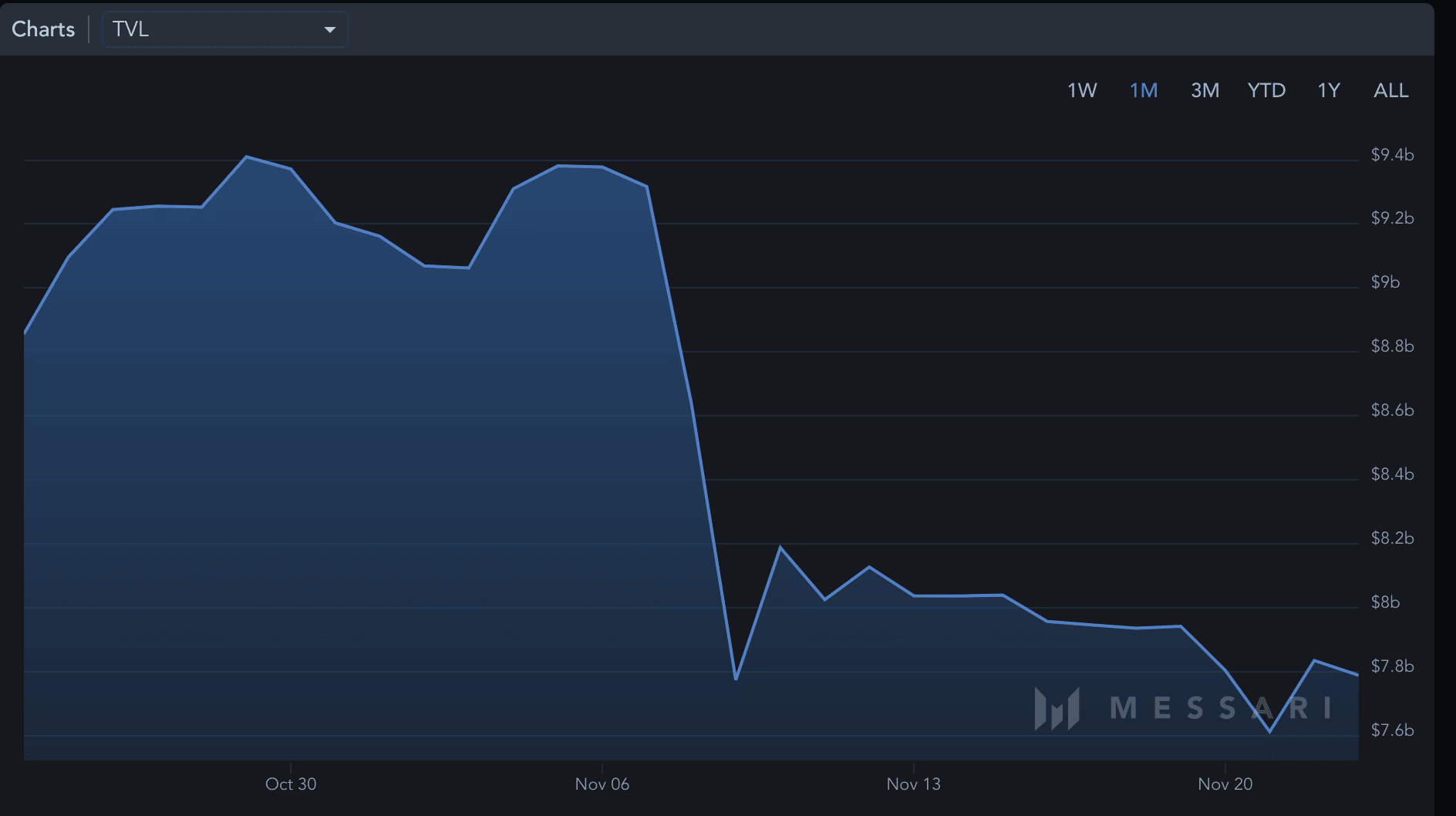

Within the DeFI area, MakerDAO’s TVL fell massively.

Nonetheless, the income generated by MakerDAO appreciated by 23.17% over the past 30 days. Additionally, the variety of transactions elevated by 200% over the identical time interval, in line with knowledge provided by Messari.

Supply: Messari