MakerDAO managed to witness some vital enhancements in its efficiency over the previous 30 days. In keeping with information from Messari, the deposit, withdrawal and borrow quantity grew considerably over the previous month.

The deposit quantity grew by 15.35% together with the withdrawal quantity. Moreover, the general borrow quantity grew by 40.36% and 61.70% respectively. This uptick in exercise additionally managed to pique the curiosity of whales.

_____________________________________________________________________________________

Right here’s AMBCrypto’s Worth Prediction for MakerDAO [MKR] for 2022-2023

_____________________________________________________________________________________

‘Whale’iant efforts

In keeping with WhaleStats, a crypto whales monitoring platform, MKR was among the many high 10 bought tokens by Ethereum whales on 6 November. On the time of writing, Ethereum whales have been holding $73 million worth of MKR.

JUST IN: $MKR @MakerDAO now on high 10 bought tokens amongst 100 largest #ETH whales within the final 24hrs ?

We have additionally received $LOOKS, $WBX, $BAT, $AXS & $BOBA on the listing ?

Whale leaderboard: https://t.co/N5qqsCAH8j#MKR #whalestats #babywhale #BBW pic.twitter.com/KqD3aMnS1c

— WhaleStats (monitoring crypto whales) (@WhaleStats) November 5, 2022

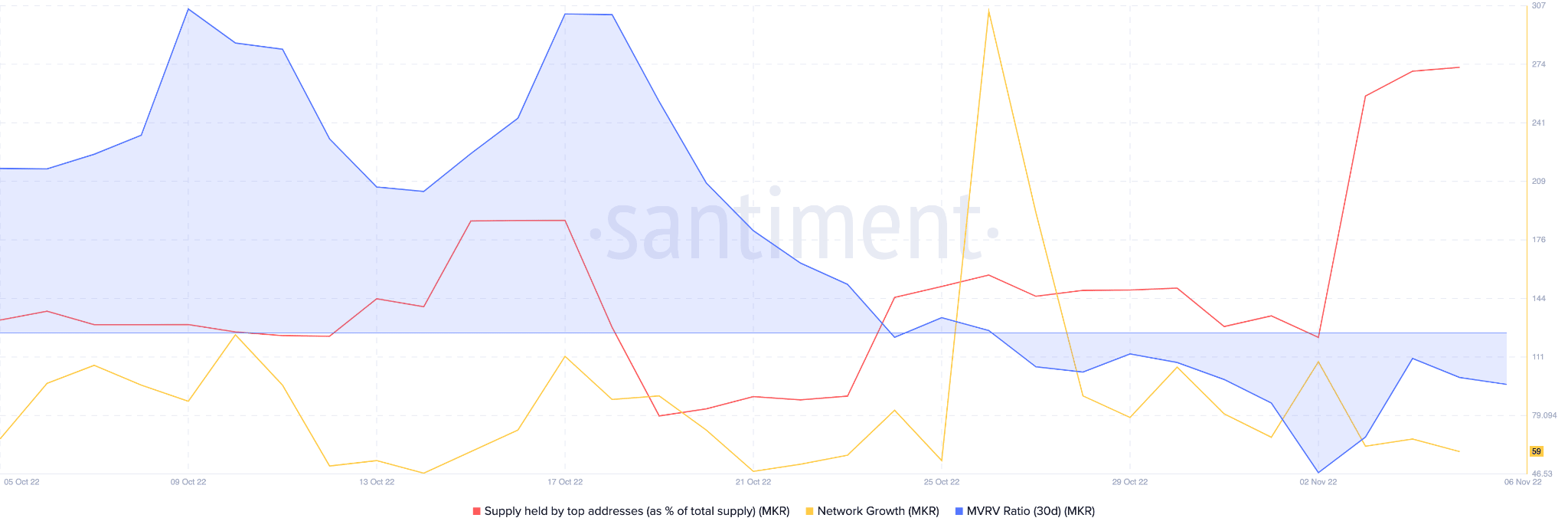

As might be seen from the picture beneath, the provision held by high addresses witnessed an uptick over the previous few days. This developed re-affirmed the notion that MKR was garnering curiosity from massive traders.

Nonetheless, throughout the identical interval, MakerDAO’s community development continued to say no. This indicated that the quantity of recent addresses that transferred MKR for the primary time witnessed a drop. Moreover, the Market Worth to Realized Worth (MVRV) ratio additionally moved in a adverse course throughout this time interval.

Supply: Santiment

MKR out within the open

Though there have been a number of ups and downs when it comes to MakerDAO’s race to the highest, their development when it comes to income was constant. This may very well be as a consequence of the truth that 50% of MakerDAO’s income was being generated from real-world property, primarily MIP65 short-term bonds, ETF, and GUSD rewards.

.@MakerDAO is now producing 50% of it is revenues from real-world property, primarily MIP65 short-term bonds ETF and GUSD rewards.

Doubling revenues over the previous couple of weeks and it is solely the start.

I am beginning the dialogue to rewards DAI holders to supercharge development. pic.twitter.com/FqZNjuNXWs— Sébastien Derivaux (@SebVentures) November 4, 2022

With an ever growing income, there additionally stood the chance that DAI holders could be rewarded to speed up MakerDAO’s development. This growth could generate additional curiosity in MakerDAO’s stablecoin, DAI.

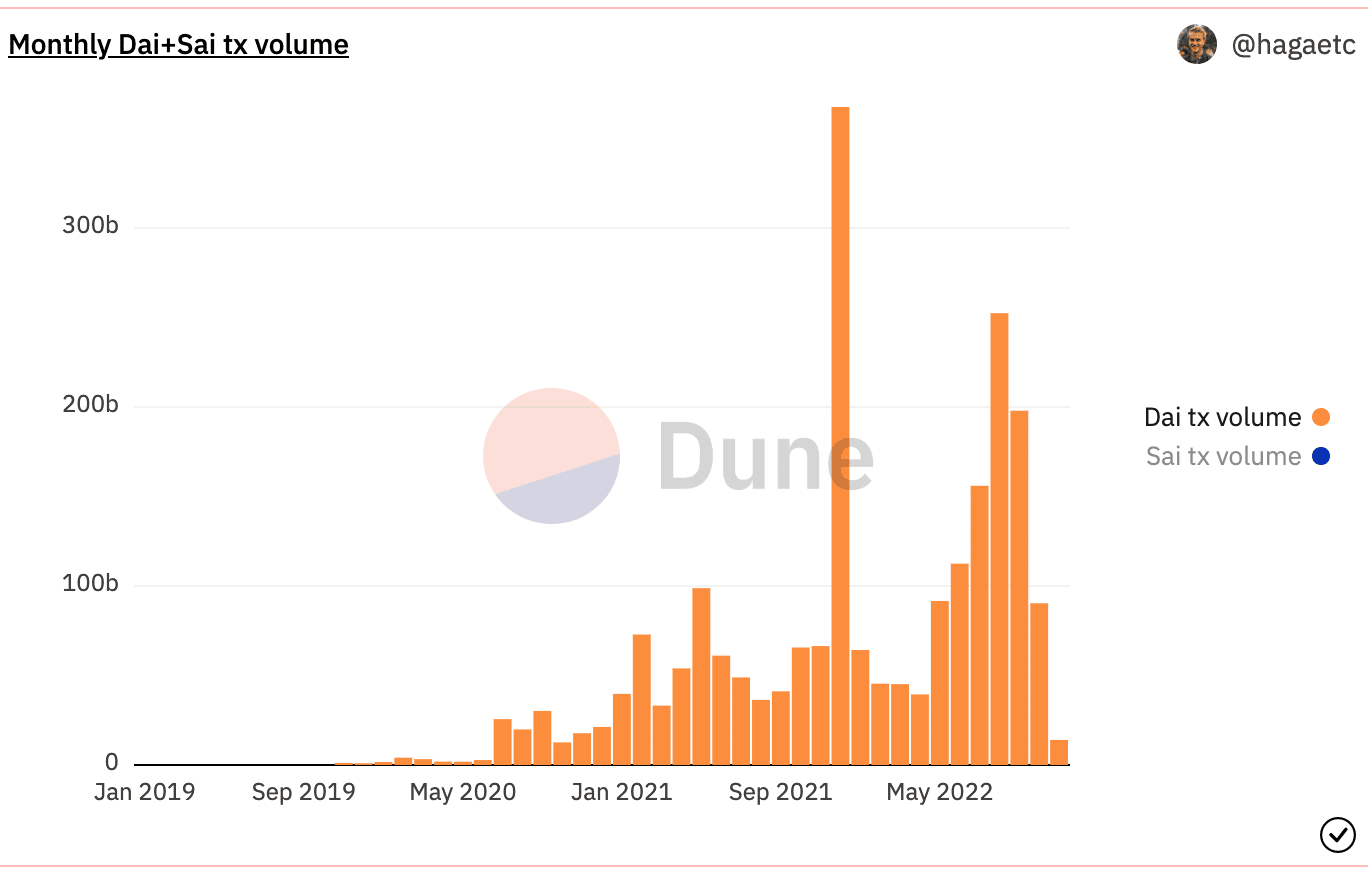

Moreover, as might be seen from the picture beneath, the variety of month-to-month DAI transactions declined over the previous few months. The aforementioned replace may improve curiosity in DAI and have a optimistic impression on the expansion of the stablecoin.

Supply: Dune Analytics

On the time of writing, DAI stood on the #4 rank when it comes to market cap within the stablecoin class in response to CoinMarketCap. Its quantity depreciated by 41% within the final 24 hours together with its market cap, which fell by 0.01%.

Nonetheless, MKR’s value then again appreciated and grew by 4% at press time. It was buying and selling at $895.72 on the time of press and its quantity had depreciated by 24% over the previous 24 hours.