- Litecoin sees indicators of a slowdown after being within the checklist of high performers final week

- A take a look at what traders ought to count on transferring ahead

Final week we noticed Litecoin obtain an upside as a lot of the high cash failed remained struggled to bounce again. In consequence, Litecoin was receiving a whole lot of consideration, aided by a positive point out by Michael Saylor throughout an interview. However can it maintain its upside now that the market is displaying some indicators of a slight restoration?

Learn Litecoin’s [LTC] value prediction 2023-2024

The Litecoin Journal took word of Saylor’s current statements whereby he described LTC as a retailer of worth. Saylor has been one of many main authorities within the crypto phase, therefore his assertion carried a whole lot of weight.

This isn’t the primary time @saylor has talked about Litecoin in interviews. He has two extra other than the current twitter house. Good to see he’s not bias and understands sound cash. https://t.co/sD0dktSh6d

— Litecoin Journal ŁⓂ️? (@LitecoinMag) November 19, 2022

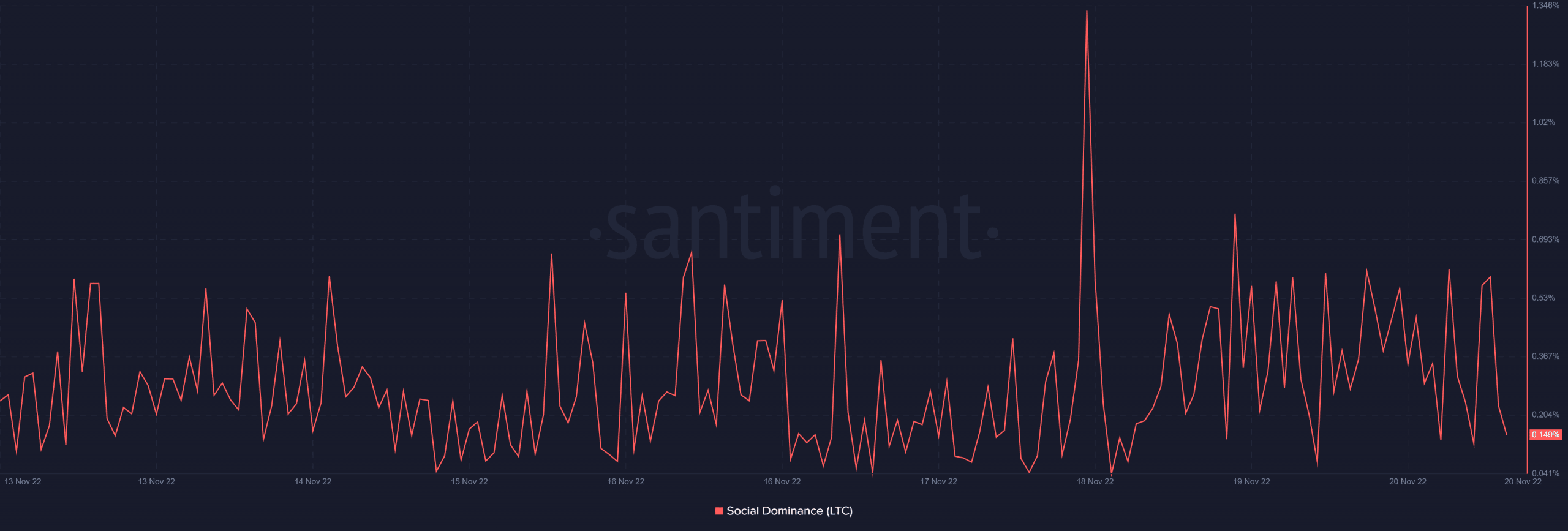

Saylor’s transient point out and categorization of Litecoin alongside Bitcoin was not taken calmly. Hours after his assertion, the cryptocurrency skilled a surge in its social dominance metric. Quick ahead to the current and Litecoin was among the many high trending cryptocurrencies.

Supply: Santiment

The renewed curiosity in Litecoin had a positive end result in LTC’s value motion. Nevertheless, LTC’s momentum has notably slowed down within the final 24 hours, indicating that the bulls is perhaps working out of huff.

Why Litecoin’s demand could also be slowing down

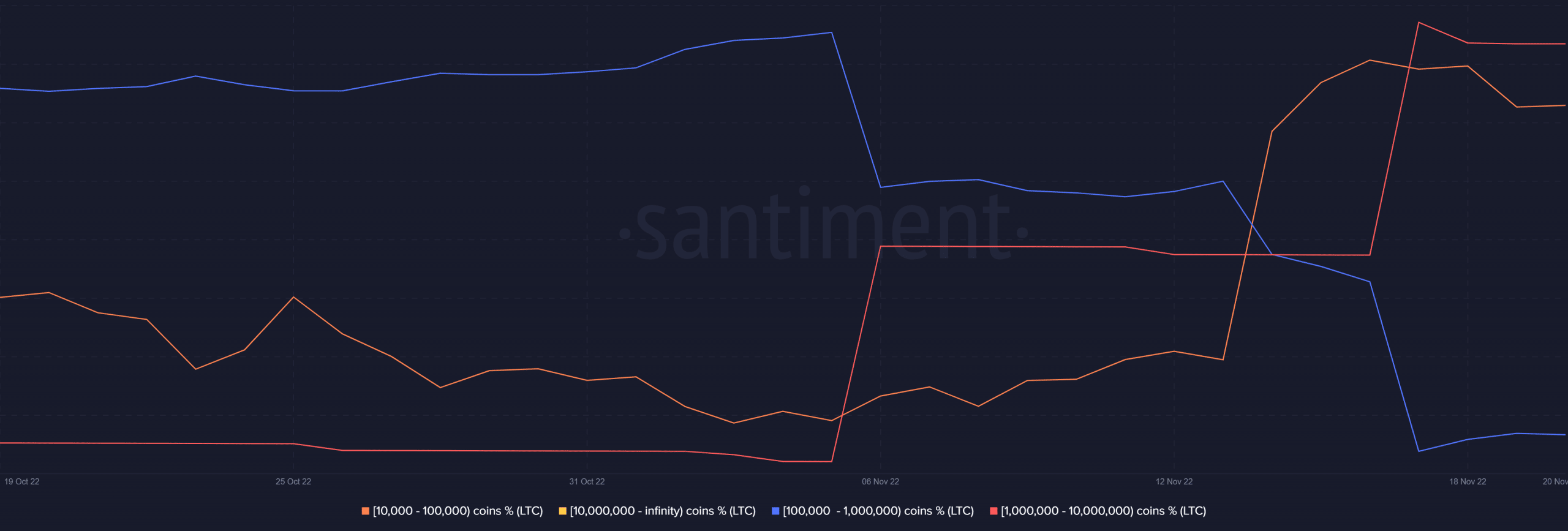

A take a look at Litecoin provide distribution revealed the rationale for LTC to beat the final market path. Addresses within the 10,000 to 100,000 class and people holding greater than 1 million cash have been accumulating for the reason that first week of November. This defined why LTC continued to rally final week.

Supply: Santiment

Nevertheless, shopping for exercise from these addresses witnessed a noticeable slowdown of their accumulation. In the meantime, addresses holding between 100,000 and 1 million cash have been promoting, thus contributing to some promote strain. These high addresses have leveled out their promoting actions within the final two days.

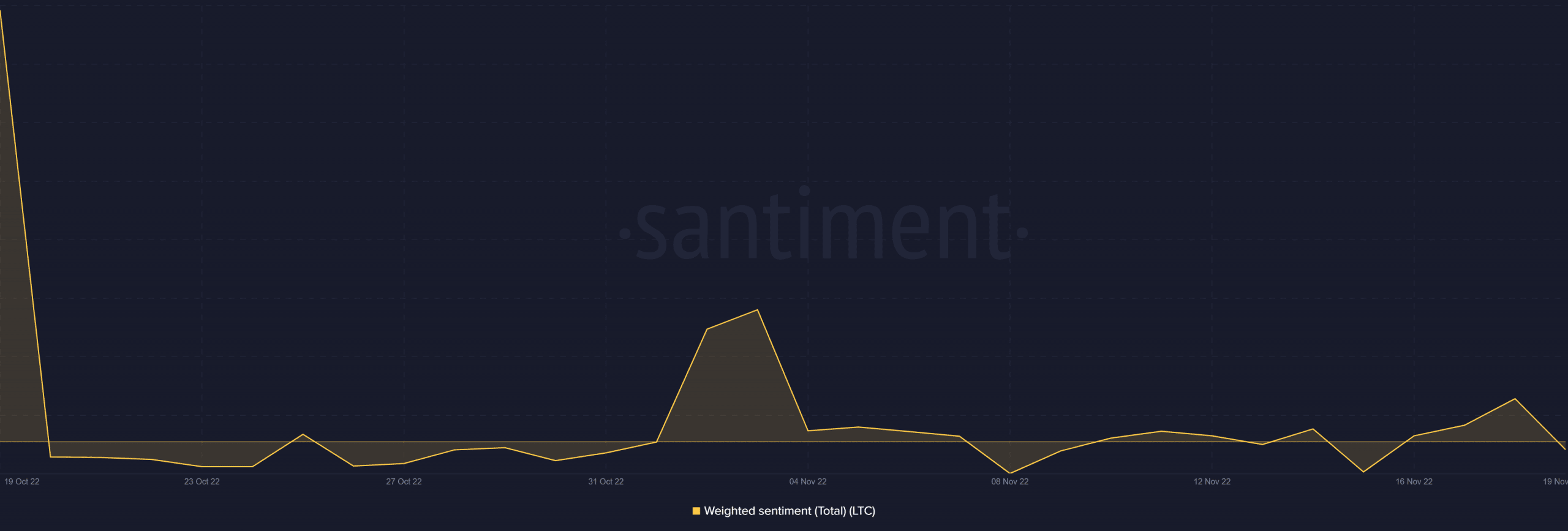

The slowdown in LTC’s upside was accompanied by a shift in sentiment. Its weighted sentiment metric dropped considerably within the final two days. This indicated that traders is perhaps anticipating some draw back.

Supply: Santiment

This commentary additionally confirmed why demand had notably tanked within the final couple of days. Litecoin’s 90-day imply coin age registered an uptick within the final three days. This was an indication that traders have been holding on to their cash through the rally.

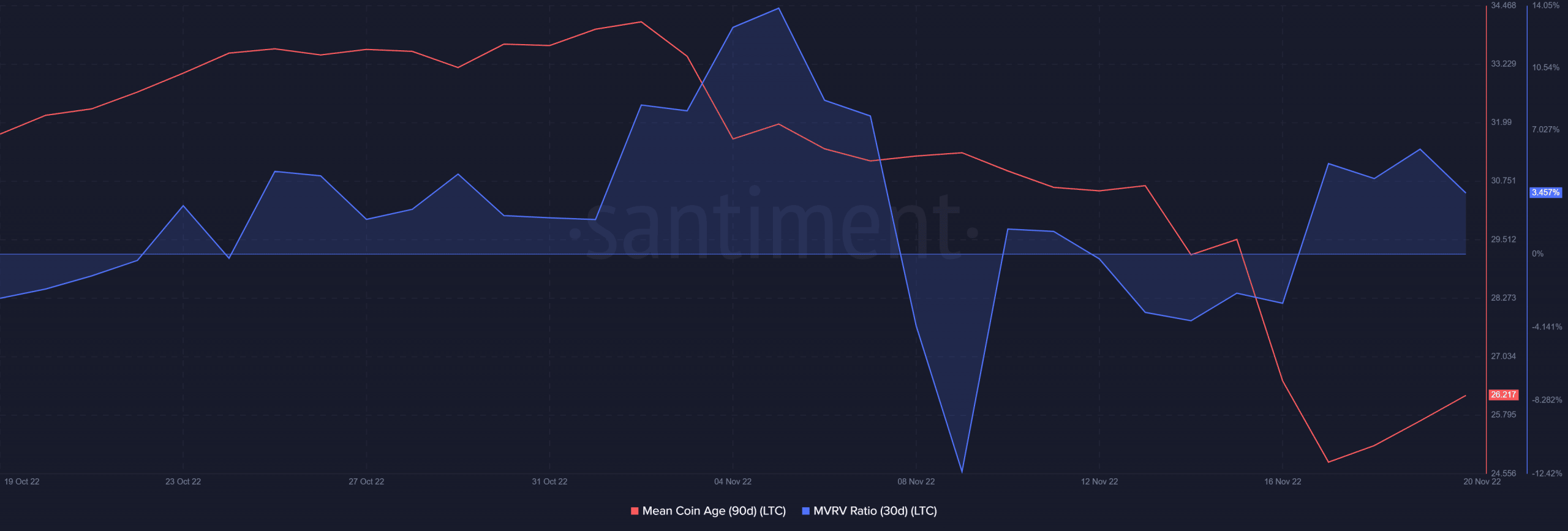

Moreover, its Market Worth to Realized Worth (MVRV) ratio additionally achieved a large uptick within the final three days. This indicated that the merchants that purchased at current November lows stood in worthwhile zones on the time of writing.

Supply: Santiment

Why was this necessary? Nicely, short-term merchants who purchased the current dip is perhaps trying to money out some income. If that was the case, then we must always count on to see a resurgence of promote strain.

Then again, a return of bullish demand could assist domesticate and maintain a bullish sentiment amongst Litecoin traders.