- Lido [LDO] witnesses a large uptick in APR

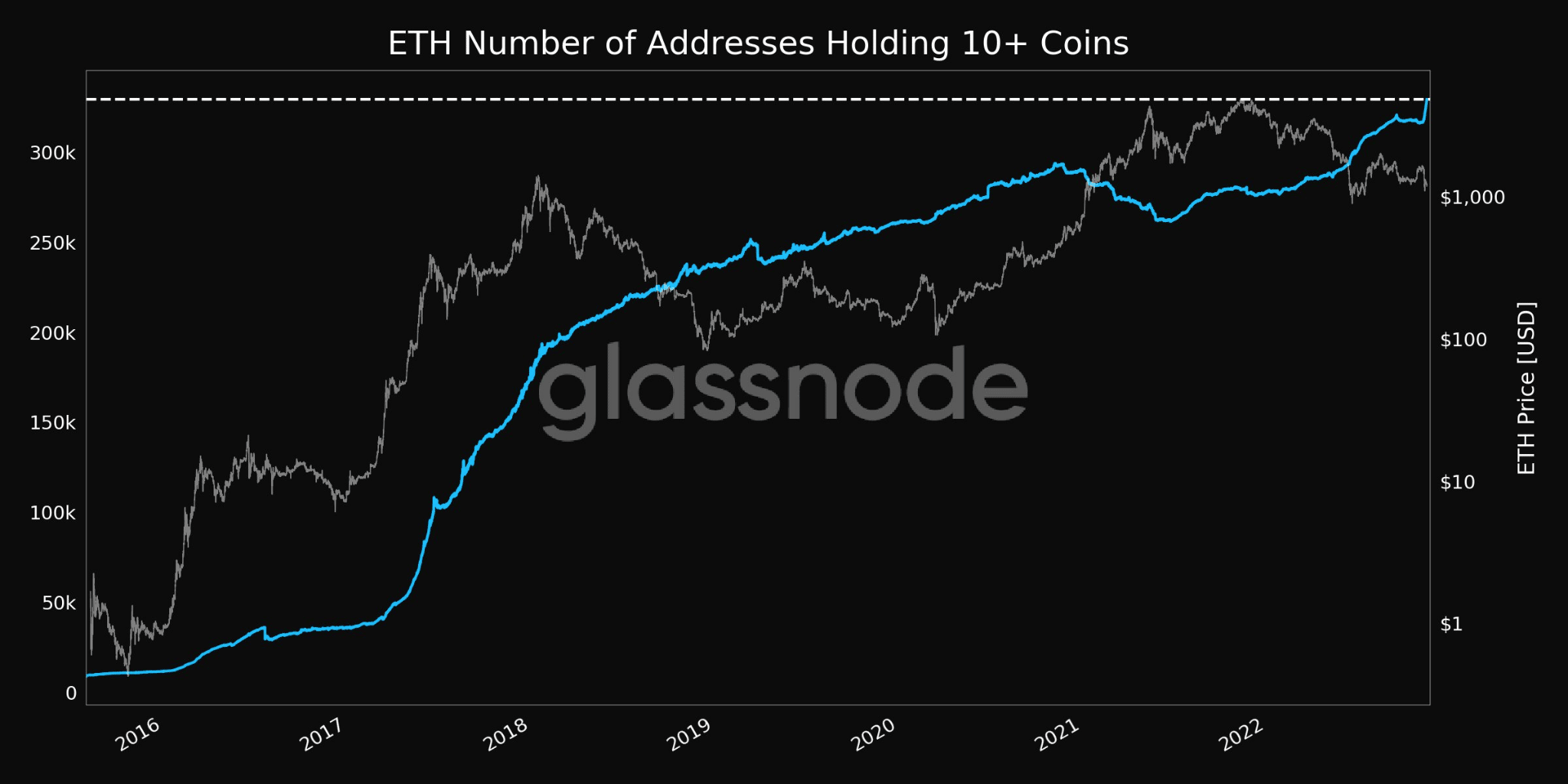

- Validators on Ethereum additionally confirmed curiosity together with massive addresses

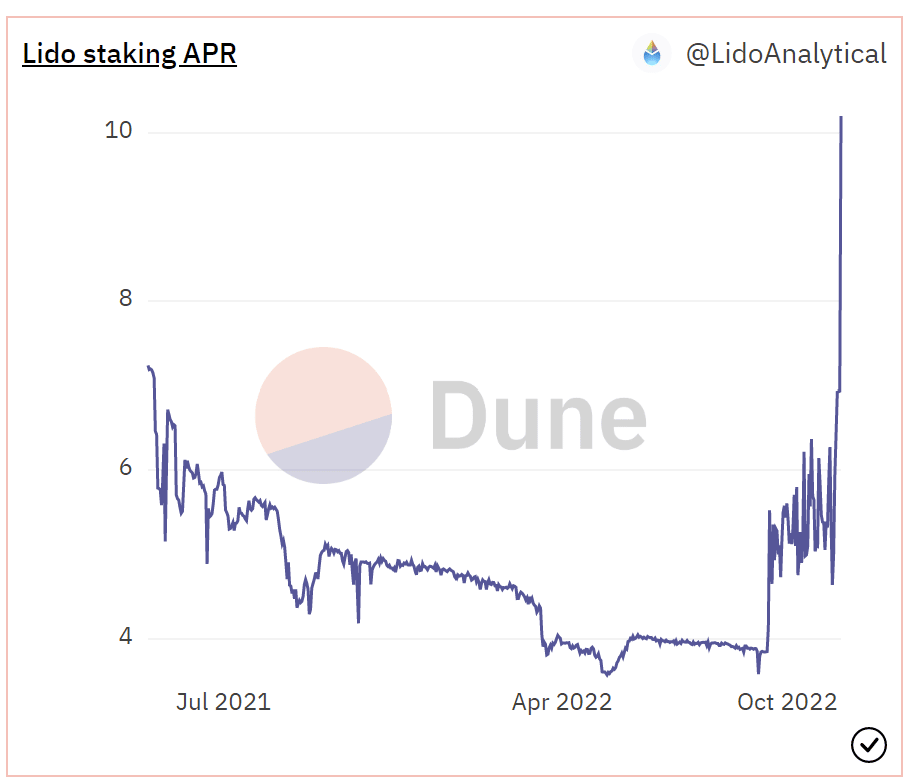

On 13 November, the Lido proposal led to the surge of the allowable APR from 10% to 17.5%. The proposal at hand additionally led to Lido stETH APR touching 10.2%.

Yesterday, the Lido 143 proposal elevated the allowable APR reported by the oracle machine from 10% to 17.5%. It has been voted to go, and the person staking reward replace has resumed. On November 13, Lido stETH staking APR reached 10.2%. https://t.co/0B5tRQiDpG pic.twitter.com/3gOYTVxxGw

— Wu Blockchain (@WuBlockchain) November 14, 2022

The uptick is also a results of the higher-than-expected EL rewards that were given out.

Learn Ethereum’s Worth Prediction for 2022-2023

Some APReciation

This spike in APR may very well be a catalyst that might regenerate folks’s curiosity in ETH and stETH going ahead as customers will stay up for producing extra APR.

Supply: Dune Analytics

Moreover, regardless of turbulent market situations, Lido Finance supplied large APR for folks staking their Ethereum. The identical was confirmed by a Messari Crypto analysis analyst through Twitter.

ETH staking yields at >10% pic.twitter.com/8ZvEfG1yHi

— Kunal Goel (@kunalgoel) November 13, 2022

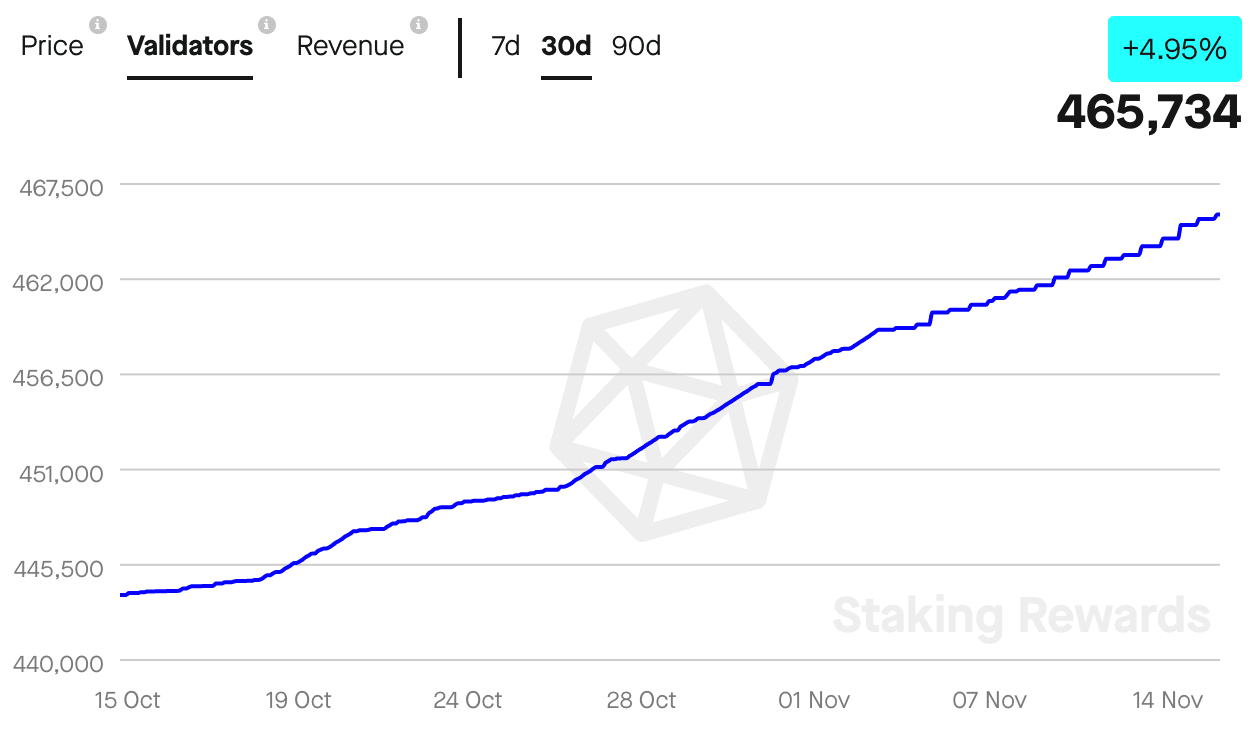

Ethereum’s transaction quantity

As per further knowledge from staking rewards, validators on the Ethereum community grew significantly over the previous 30 days. It may be noticed that the variety of validators on the Ethereum community grew by 4.95%. Moreover, the full income generated by them appreciated by 34.56% during the same time period.

Supply: Staking Rewards

Together with validators, massive traders began taking curiosity in ETH as effectively. As might be witnessed from the picture under, the variety of addresses holding greater than 10 cash witnessed a large improve over the previous 30 days. Moreover, addresses holding greater than 10,000 cash witnessed a similar uptick.

In line with knowledge provided by Glassnode, the imply transaction quantity for Ethereum reached a five-month excessive of $11,970 on 14 November.

Supply: Glassnode

In accordance with its imply transaction quantity, Ethereum’s community progress appreciated as effectively. A spike in community progress would recommend the variety of new addresses that transferred ETH for the primary time had elevated considerably.

Nevertheless, throughout this era, Ethereum’s velocity declined. This indicated that the frequency at which ETH was being exchanged between addresses had decreased. The entire NFT commerce quantity additionally fell, suggesting a reducing degree of curiosity in them.

Supply: Santiment

It stays to be seen whether or not the spike in APR would entice extra folks to purchase ETH for staking functions.

On the time of writing, ETH was buying and selling at $1,229.56 and had depreciated by 1.29% within the final 24 hours. Nevertheless, its quantity had appreciated by 28.68% throughout the identical interval, in line with CoinMarketCap.