- Lido skilled a drop in TVL in earlier days partly as a consequence of a fall within the worth of LDO.

- LDO rallied by over 9% in current days to assist Lido change into the highest DeFi platform.

Lido just lately disclosed a lower in its Complete Worth Locked (TVL), the potential contributing issue was a decline within the worth of its native token LDO.

Earlier than a modest decline, the staking platform had been the main Decentralized Finance (DeFi) platform. Nonetheless, DefiLlama’s current information hinted at a shift within the staking protocol’s TVL’s fortune. Now, the query is- What could have brought on this most up-to-date growth?

The ups and downs of Lido’s TVL

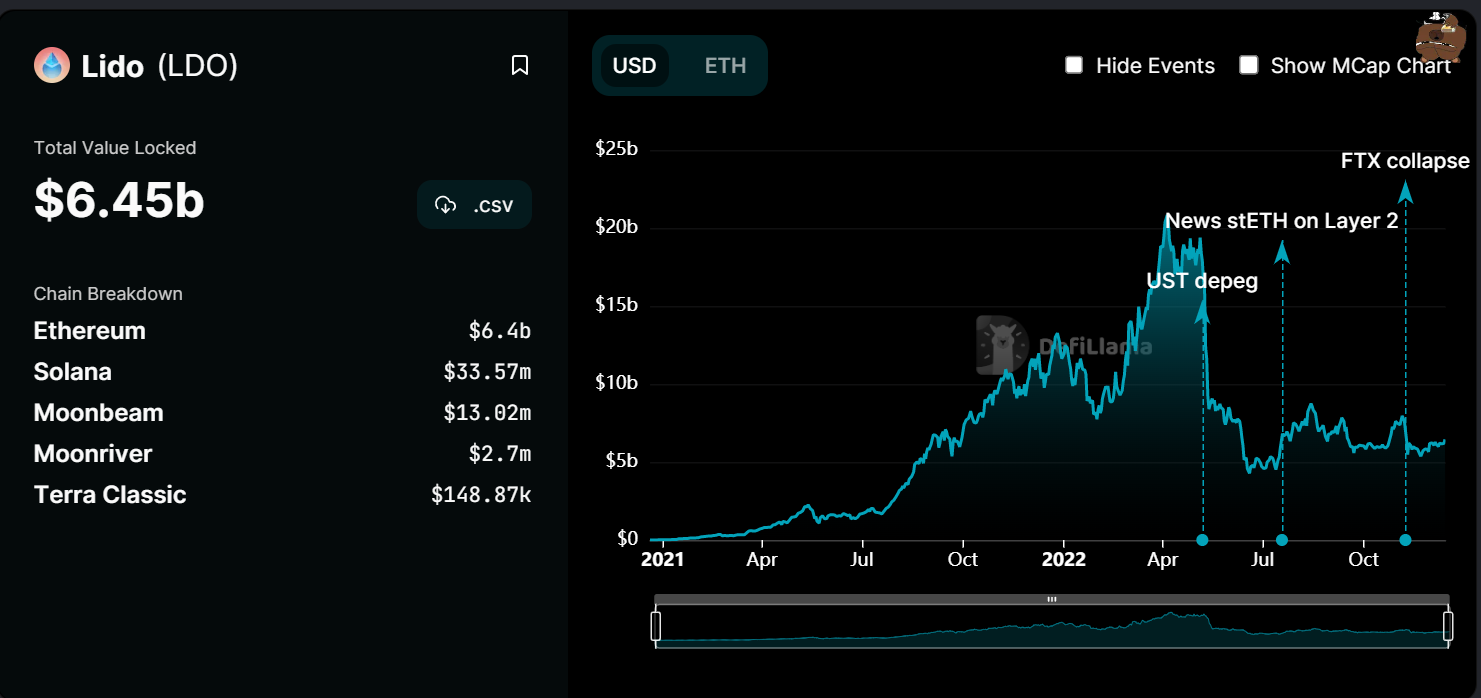

There had been a change within the quantity of Complete Worth Locked of Lido Finance, as per statistics collected from DefiLlama.

Within the final 24 hours, the staking platform’s TVL climbed by greater than 3%, and over the previous 30 days, it elevated by about 8%. With a TVL of $6.45 billion as of this writing, it was successfully the highest DeFi platform.

A second take a look at Lido’s TVL revealed that two vital occasions that shook the crypto world had a detrimental impact on the platform. The platform’s TVL was over $18 billion earlier than Terra’s collapse.

Nonetheless, this worth fell massively because of the collapse. The latest antagonistic impact was the FTX collapse, which additionally brought on the TVL worth to say no from nearly $8 billion to $6.45 billion, at press time.

Supply: DefiLlama

LDO’s worth causes TVL rally

The decline within the worth of LIDO’s native token, LDO, was one of many components Lido recognized for the preliminary decline in TVL.

A every day timeframe evaluation of the worth of LDO revealed that the asset had elevated. It rose by roughly 10% over the earlier 72 hours. Moreover, it was evident from the buying and selling interval below commentary, on the time of this writing, that it was buying and selling at a revenue of greater than 1%.

Supply: TradingView

The brief Shifting Common’s (yellow line) location indicated that the worth was not in a powerful pattern. The situation of the Relative Power Index (RSI) line indicated that LDO had entered a bullish pattern because of the current spike.

However when the RSI and yellow line have been mixed, it was clear that, whereas bullish, the pattern might have been stronger. The yellow line additionally functioned as a area of resistance for the token at about $1.2. An extra upward pattern is feasible if it breaks by means of this resistance degree.

Complete handle metrics on the rise

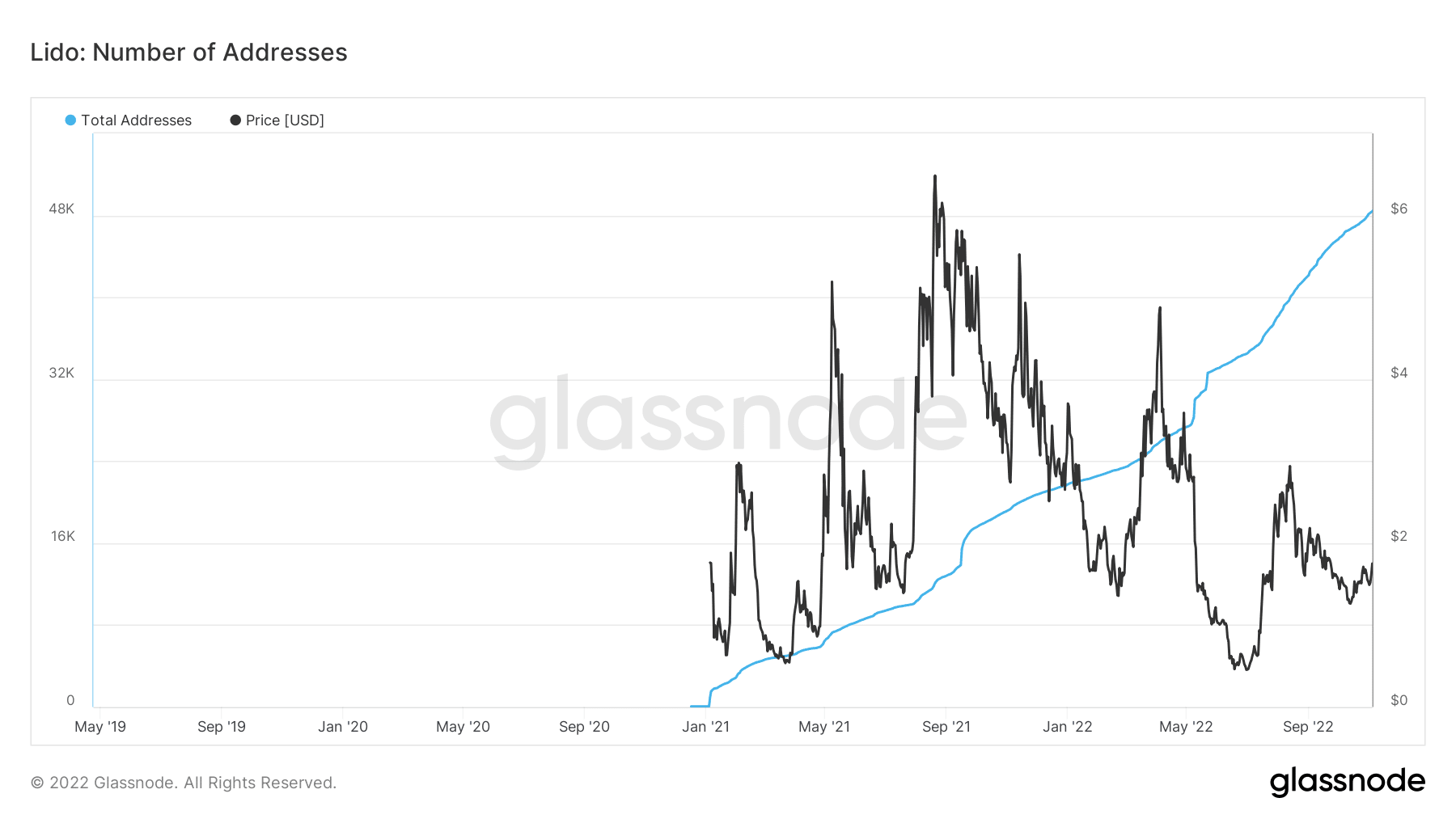

The trajectory of Glassnode’s Complete Tackle metric can be utilized to deduce details about how Lido has developed. The general variety of addresses registered on the community was greater than earlier than, in accordance with the whole handle rely. As of the time of writing, greater than 49,000 addresses might be seen.

Supply: Glassnode